Weekly Roundup, 16th February 2015

We begin today’s Weekly Roundup with the FT’s “Chart that tells a story”.

Income gap narrows

The chart below shows how the after-tax income of the richest, poorest and average households in the UK changed between 1980 and 2013. The median income rose 81% to £23.3K, though this was flat from 2002-03 through 2012-13.

Income inequality has grown since 1980, with the top quintile increasing income by 119% and the bottom quintile by 74%. More interestingly, the peak gap was in 1990, when top earners received 6.4 times more than bottom earners, up from 4.2 times in 1989.

This ratio is now down to 5.3. The change in the 1980s was driven by high-rate tax cuts, that of recent years by the minimum wage rising faster than median pay, and by increases to the tax-free personal allowance. High earners have been hit by the increase in capital gains tax to 28% from 18%, and the introduction of the 50% (now 45%) band.

Pensions

Josephine Cumbo wrote about the high expectations that some pension savers have for the new regime which comes into force in April. Many people are convinced that their pension will operate like a bank account, with easy cash withdrawals.

Michelle Cracknell, chief executive of The Pensions Advisory Service (TPAS) sais that most people weren’t aware that they might “need to exit one product, take some guidance and advice in the middle, and then probably take out another product, just to access their money.”

Merryn’s column was also about the pension reforms. For the past couple of decades, expensive public-sector DB pensions have been seen as superior to cheap private-sector DC schemes.

But now the DC schemes have advantages: early access (age 55), flexibility and inheritability. Transfer values are also good (around £25 per £1 of guaranteed pension), as low interest rates mean that the present value of future payments is higher.

Merryn still thinks that a transfer is a bad idea. Apart from the risk of inexperienced investors blowing up their account, or rougues fleecing the over-55s of their cash, there is also political risk. A DB pension is a promise, and unlikely to be tampered with. A DC pension is a pile of cash (and stocks) which a Labour government might be interested in.

Still on pensions, the Telegraph reported on a proposal from (Liberal) pensions minister Steve Webb to offer all pension savers £1 from the government for every £2 they put in themselves.

This is just a nicer way of saying that he plans to scrap 40% relief for higher-rate taxpayers and replace it with a flat 33%. This is a small change from a previous idea to have a 30% flat rate – 33% would be easier to explain to public.

So if the Liberals do form part of the next government, we have that to look forward to. On the plus side he also wants to remove the £1.25M lifetime allowance on pensions.

Actuaries

In the FT letters section there was a reply to an article we mentioned last week – by Neil Collins on the maths of the BT pension fund deficit. Mark Tennant pointed out that real problem with pension fund deficits is that the valuation model no longer matches reality.

Since the yield on AA bonds will no longer satisfy the pension fund requirement of an inflation-linked income stream, we need to look at returning to the dividend discount model used before 1986. This would in turn lead to a shift towards the use of income equities to meet pension liabilities rather than low-yield bonds.

There is some merit in such a change, though it would need to be introduced gradually (perhaps over five or ten years) to avoid unneccessary market turmoil.

Carney hints at more QE

Investment Week (amongst others) reported on Mark Carney’s statement that the Bank of England is prepared to cut interest rates further and expand QE if deflation appears. The monetary policy committee still expects inflation to return to target (2% pa) within two years.

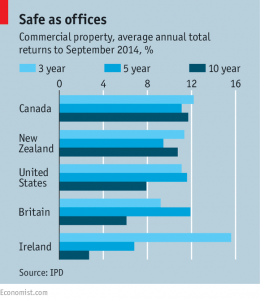

Commercial Property

In the Economist, Buttonwood looked at the recent excellent returns from commercial property. Low interest rate have historically led to a property boom and the current regime is no exception.

Looking forward, the three risks to property are rising interest rates, an economic downturn that hits demand and oversupply through rapid building. The first two issues are absent and the third exists only in hotspots like London. So the good returns might continue for a while yet.

The Zero Bound

Finally, over on the M&G Bond Vigilantes blog, Richard Woolnough looked at the implications of ever-more negative yields. In theory investors should prefer “cash in a box” to bonds paying less than zero.

The main problem here is risk of loss – paper money can be stolen or destroyed (eg. in a fire). You can put the money in a fire-proof box, but ideally you need to use a wide selection of boxes in a wide range of secure locations. Doing this is neither cheap nor easy.

A bank could create this custodian network, but would charge something for its use. Nonetheless, the fungibility of cash and government debt means that no matter how negative interest rates became in theory, in practice they will be close to zero because of this custodian network.

A second issue is that the demand for the cash in a box would reduce the money supply in the normal economy, with deflationary effects. Richard prefers QE as a policy since it is inflationary instead.

Until next time.

1 Response

[…] pass on negative rates to customers, then investment and consumption should rise. Economists predict that in practice zero is the minimum rate, since people can switch to […]