Weekly Roundup, 17th December 2019

We begin today’s Weekly Roundup in the FT, with The Chart That Tells A Story. This week it was about household wealth.

Household wealth

The mainstream press was preoccupied with the UK General Election result.

- The Tory victory is obviously good news for private investors, but I’ll wait until we have some specific proposals to analyse before commenting further.

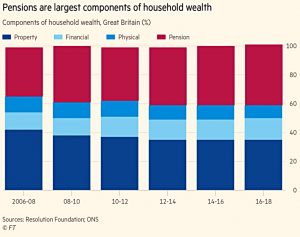

Leke Oso Alabi looked at a report from the Resolution Foundation (using ONS data) which showed that property wealth has been overtaken by pension wealth in the UK.

- Pensions are up to 42%, compared with 35% for property.

Back in 20016, the shares were 34% and 42% in the other direction.

- Note that the numbers don’t include state pensions, but rather DB (80%) and DC (20%) private pensions.

Pension values are up from £3.6 trn to £6.1 trn because of lower interest rates and higher life expectancies.

- Workplace auto-enrollment has also had a small effect.

And there has been a slight cooling of the property market in recent years.

- Financial wealth – held mostly by the richest households – is also up on the back of a 10-year bull market.

Total household wealth is now seven times GDP, the highest multiple in more than a century.

- In the 1970s the ratio was close to three.

Half of the wealth is owned by the richest 10%.

VCTs

Emma Agyemang reported that the number of investors in VCTs is the highest for a decade.

- But it was still only 18,890 for the 2017/187 tax year.

Between them, they invested £716M into the product.

- That’s an average of £38K each, which is a bit more than I put in each year.

I’m a big fan of VCTs and regularly report on my portfolio.

- Returns over the last three years have been excellent.

VCTs have been around since 1995, but they aren’t for everyone.

- They invest in high-risk small companies.

And you have to hold the shares for five years to qualify for the 30% income tax relief.

Fifty Fifty

The Economist looked at why people tend to simplify uncertain possibilities down to 50:50.

Apart from Barack Obama’s famous estimate of the probability that Osama Bin Laden was actually in the compound that he was sending his soldiers to attack:

The bias towards 50:50 has shown up in many contexts. One is decision-making under (known) risks, such as gambling at a (fair) slot machine.

People have a lot of trouble with probabilities – notably working with base rates and conditional probabilities, and ignoring survivorship bias when looking at past performance.

- We have particular problems near 0% and 100% – the change from 0% to 1% seems much larger than that from 43% to 44%, particularly in the context of extreme events like lottery wins.

The same compression effect operates under uncertainty (when the odds are not known), too.

A new paper from Enke and Graeber explains this via “cognitive uncertainty” – a lack of confidence.

If people know that they may not be doing the sums right, or that their memory may be failing them, or that they are not sure what their own preferences are, then their choices depend less on the information they are presented and more on a “mental default” of equal probabilities.

The less certain people are, the more they hedge their bets.

Odds of 50:50 are really code for “I don’t know”.

Inflation

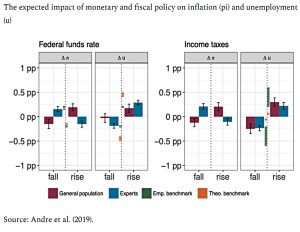

Joachim Klement wrote about the hard time that people have understanding inflation.

Because most normal people do not understand how inflation works, they cannot form a mental link between the central banks promise to keep interest rates low and rising inflation.

And since that mental link breaks down, they don’t change their behaviour.

In contrast, people do understand what causes unemployment:

- rising oil prices

- a reduction in government spending

- a 50 bps increase in the Fed Funds rate

- a 1% increase in income taxes

The problem is that people think that a rise in interest rates will also cause inflation to go up.

- They also think inflation will drop if taxes increase, and vice versa.

This means that monetary and fiscal policy needs to be explained properly by the media.

- If not, it may be ineffective.

P2P

It’s been a busy week in P2P – if we can still call it that.

- The picture is of David Stevenson, who runs AltFI, my primary source of news is this area (though he didn’t write the articles I’ve been reading this week).

New FCA restrictions on the marketing of peer-to-peer investments have arrived.

- Platforms need to apply an “appropriateness test” to check that retail investors understand P2P.

- There’s also a 10% limit on the amount of P2P that “ordinary” investors can hold in their portfolio (there’s a get-out for sophisticated investors, defined as those who have invested in P2P twice or more in the last two years).

- And financial promotions can only be directed at sophisticated investors.

That sounds like a lot of work, and some platforms are abandoning their retail base rather than comply with the new rules.

- Landbay was first, followed by ThinCats.

I was an early adopter of P2P, joining Zopa more than a decade ago.

- But the sector never really developed in the way I imagined – interest rates and credit quality went down as numbers grew – and I quit after a few years.

I could never see the attraction of wasting my ISA allowance on a low return asset, and the lack of easy diversification across platforms was also an issue.

- In fact, I have my doubts that it will survive as a retail product.

What we have instead is “direct lending”, but often to companies with lower credit than regular corporate bonds (which are themselves not the greatest diversifier in an equity crisis).

- Oh for the days when sovereign bonds yielded 4% and upwards.

Quick links

I have six for you this week, the first three from The Economist:

- The newspaper looked at whether anti-competitive firms are killing American innovation

- And at a Nordic pioneer of negative interest rate getting cold feet

- And at why it’s hard for foreign investors to be bullish on South Africa

- Alpha Architect wrote about Fed actions and stock prices

- And about the global impact of home country bias

- The FT looked at the challenge posed by DIY stock indices to the industry heavyweights.

Until next time.