Weekly Roundup, 9th December 2019

We begin today’s Weekly Roundup in the FT with James Pickford, who was looking at property funds.

Property funds

James Pickford wrote about UK property funds under pressure.

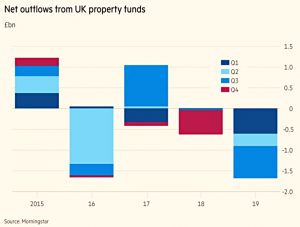

- More than £1.5bn has been withdrawn from open-ended property funds this year.

That’s more than in 2016 when several funds were gated after the Brexit referendum.

- This week M&G Property Portfolio, a £2.5bn fund which closed for four months in 2016, was gated again.

After a terrible year for retailers – Debenhams, Patisserie Valerie, Thomas Cook and Mothercare have all gone into administration – the fund has found it difficult to resell high street and retail park sites (to which it has a 40% exposure).

- M&G has said it will reduce the annual charge on the fund by 30% while it is gated.

Other property funds are now under pressure to freeze withdrawals and sell buildings to raise cash.

- The FCA has promised new rules on funds with illiquid assets from September next year.

After Woodford and the 2016 closures, the message is clear:

- Just say no to open-ended funds, but definitely to those with illiquid underlying assets.

Get your fix through ETFs and ITs, and in the case of property, through REITs.

Vanguard SIPP reaction

The forthcoming Vanguard SIPP – which I wrote about last week (spoiler: I was distinctly underwhelmed) continues to receive generally good press – I wonder why?

- In the FT, Emma Agyemang described it as the UK’s cheapest pension.

For a lot of people, this won’t be true, but in one sense she is correct:

- The average size of a UK pension pot is £41K, and at this level, Vanguard is the cheapest., with an annual platform fee of £62.

But you are restricted to Vanguard funds only, and there is no drawdown facility.

The fact that £41K will give you an annual income of around £1,200 – and so is unworthy of the name pension – was omitted from the article.

- You need to be aiming at upwards of £500K.

The piece also suggested that the new product would disrupt the market.

- I think this is half-true, in that a segment of the market – younger investors who already focus on cost and who already like Vanguard – will love it.

The older crowd who have made HL the market leader despite their excessive fees will probably not notice.

John Redwood

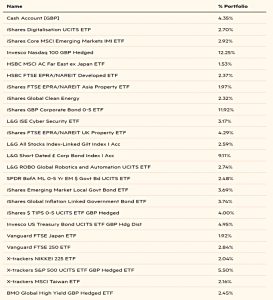

John Redwood provided his regular update on the ETF fund he runs for the FT.

According to John, the portfolio is:

In the middle of its risk bands after a good run, with 50 per cent in shares and 50 per cent in bonds and cash. I may add a bit more to bonds and cash as markets keep hitting new highs.

The most important thing I watch for is the words and actions of the central banks serving the US, China and the euro area.

At the moment, the US is in expansionary mode, whilst China wants to avoid a debt blowout.

- John expects slower growth, but no recession.

John Lee

John Lee was also back with his regular update on his small-cap portfolio.

- His main focus was the takeovers of Charles Taylor and Tarsus, both by private equity.

He owned up to 20 purchases of the latter and 38 of the former.

A key feature of my investment approach has been to build up my holding as I get to know and like a company better.

You can say that again – I can’t remember ever doing more than a couple of top-ups in a single stock (there could be more with ETFs held for the very long term).

So John has to reinvest his cash proceeds, partly by topping other small-cap holdings, but partly through a change of direction:

For the first time in many years I put a fairly large amount into a small number of quality “large-caps” companies where I judged their 7.5 per cent dependable dividend yield to be exceptionally attractive.

Amongst the former were Appreciate (formerly Park Group), Cerillion and Town Centre Securities, Daejan and Hansteen.

- Other holdings include Lok’n’Store, Anpario, Nichols, Treatt, Vitec and PZ Cussons.

The large caps were Legal & General, M&G Investments and Aviva.

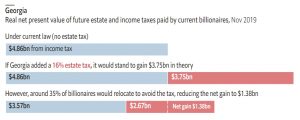

Estate taxes

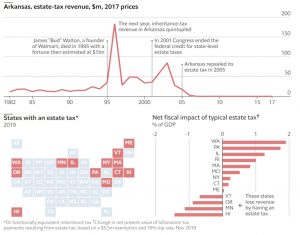

The Economist looked at whether inheritance taxes raise extra revenue.

- Few rich countries use them (the UK is obviously an exception) and neither do all US states.

Yet it seems that most states would benefit from introducing one.

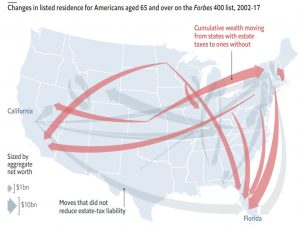

Until 2001, state taxes were refunded against federal ones, so everyone paid a flat rate.

- Now that they aren’t, the rich can pass on more money by moving to a state which lacks the tax.

Starting in 2001, people whose listed state changed were much more likely to switch from states that charged an estate tax to ones that did not than the reverse.

Overall, estate-tax states lost 35% of their listed billionaires, and 50% of those aged over 65.

This means that states lose out not only on estate taxes at death but also income taxes during life.

But most still come out ahead:

Of the 13 states that kept the tax, nine came out ahead. On average, states lose 60-70% of potential estate-tax proceeds as the rich flee.

In The Times, Patrick Hosking wrote about a new asset class – income share agreements (ISAs unfortunately, as they only exist in the US).

- Investors agree to pay university fees in return for a share of future income.

In other words, it’s a capitalist version of the UK student loan system, except that the income share only runs for five or ten years.

- Target returns are between 12% and 17% pa, and investors can diversify across “pools” of students.

Fifty US universities and academies offer these at present., and the number is expected to rise to 100 next year.

I like the sound of this, but I have a few issues:

- I’m not sure I really want only part of the early years’ earnings

- Loans need to be as cheap as federal loans, where these are available (which impacts returns)

- And there are often earnings ceilings so investors miss out on the outliers

Patrick has a different objection – he is uncomfortable with the historical parallels:

The arrangements have uncomfortable echoes of indentured servitude. Between half and two thirds of the (mostly European) immigrants to America between 1630 and 1776 arrived under indentures to pay for their costly passage across the Atlantic.

I can’t see a problem, so long as the arrangement is voluntary.

- A loan is a loan, and needs to be repaid one way or another.

The new approach shifts most of the risk from the student to the investor.

Quick links

I have eight for you this week, the first five from The Economist:

- They looked at Japan’s economic troubles as a glimpse of the future

- And at how P2P lenders are going after the big money

- And at economies in rehab

- And at the retirement of the Google founders

- And at Saudi Aramco, the largest ever IPO

- The FT wrote about DIY stock indices

- UK Value Investor described Marks and Spencer as the destroyer of shareholder value

- And Disciplined Systematic Global Macro Views looked at Momentum plus volatility control.

Until next time.