Weekly Roundup, 20th June 2017

We begin today’s Weekly Roundup in the FT, with the Chart That Tells A Story. This week it was about food inflation.

Contents

Food inflation

Gavin Jackson reported that the weekly shop was getting more expensive.

- Inflation is generally up, but food and drink has increased more than the average, after more than three years of declines.

The previous price falls have been attributed to the expansion of Lidl and Aldi across the nation, and the resultant increased competition between supermarkets. (( Amazon’s purchase of Whole Foods last week means that there could be more of that to come in the future ))

- The global downturn in commodities (wheat and corn, as well as oil and metals) has also helped.

But Britain imports a lot of its food, and the Brexit-driven fall in sterling means that it is now more expensive.

- The Brexit negotiations, potential interest rate rises and even another election could exacerbate this, or move sterling in the opposite direction.

Bond market vs the Fed

John Authers made a welcome return to this column in the FT, and wrote about the battle between the deflationists and the reflationists.

- The former group believe that we are stuck with low growth and low inflation, while the latter believe that there is light at the end of the tunnel.

When Trump was elected, the reflationists had the upper hand.

The Fed just raised rates again, and signalled one more rise to come this year.

- But the markets have this as a less than 50% shot.

Two year bond yields indicate that less than one more raise is expected over the next two years.

- This could be in part because the Fed has under-delivered on rate hikes over the past few years.

- But it’s also probably related to the recent fall in US inflation.

So the battle is back on for now – the Fed expects more inflation, but the markets still fear deflation.

Corporate taxes

Before we get to this week’s politics, (( Yes, I’m afraid we’re still in the aftermath of the election )) the Economist had a couple of articles on some of the hot issues that divide the UK parties – corporate tax rates and government ownership.

Buttonwood looked at corporate tax rates, and found that they didn’t matter as much as you might think.

The Labour party wants to increase corporate tax, while the Tories are convinced that cuts will stimulate the economy and promote inward investment in the aftermath of a Brexit deal. (( I’m with the Tories, in you were in any doubt ))

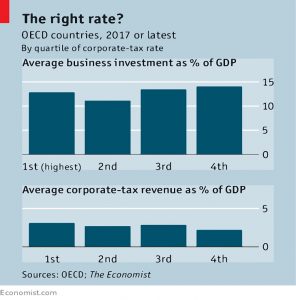

Comparing quartiles of OECD countries, the newspaper found that low rates led to more investment, but raised a bit less tax.

- But both relationships were relatively weak.

The gap between the tax take in the top and bottom quartiles was only 0.9% of GDP.

- The highest tax takes were from countries with lots of natural resources, which are easy to tax.

It’s also worth considering where the extra tax comes from.

- The left thinks that it comes from shareholders (but even if it did, these would largely be the pension funds of citizens).

But a company could also respond by raising prices, holding down wages or moving work to a lower-tax country.

- None of which are good outcomes.

I think corporation tax is misleading, as companies don’t really pay it themselves.

- They key argument for retaining it is to dissuade individuals from incorporating to save tax.

- Which suggests that corporation tax should match basic rate income tax.

But even with no corporation tax, individuals would need to pay tax on any money they withdrew from their companies (as with pension pots today).

- So maybe we should just get rid of it altogether.

State ownership

A second article looked at state ownership, in the context of Corbyn’s pledge to renationalise railways, energy companies and the post office.

- The Economist concluded that state ownership is a poor way to fix economic problems.

The argument for government control is two-fold:

- where there is a natural monopoly

- for example, national security

- where there is a market failure to provide universal access

- schools, hospitals and prisons – where private companies have an incentive to skim off the “best” clients and not serve the “worst” ones

The problem is that without competition, innovation doesn’t lead to greater efficiency.

- Nationalised firms gradually become sclerotic.

- They also run the risk of fostering corruption, and of favouring their workers over their customers.

Yet after the wave of privatisations in the 1980s, more recent dissatisfaction with the performance of private firms means that nationalisation is being looked at once more.

- Nationalisation usually leads to lower growth, but now growth is low in even the most capitalist countries.

- And high corporate profits suggest that competition is not working as it should.

The Economist suggests that the rise of passive ownership of large blocks of companies by asset managers may be to blame, and warns against a Nationalisation 2.0 based around shared ownership.

Inequality

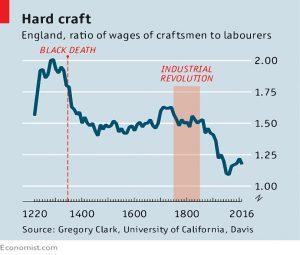

A third Economist article looked at inequality through the ages, comparing skilled wages to those of labourers.

- It turns out that the recent improvement in earnings for craftsmen is unusual.

- The trend over the last seven hundred years has been for wages to converge.

Over the past four decades, wages for graduates have improved relative to non-graduates.

- This has led to fears that looming automation will make the gap even bigger.

But the historical record shows that the skilled to unskilled wage ratio has been relatively stable, apart fom two large declines:

- with short lives and high interest rates (10% pa in 1290), a seven-year apprenticeship was a serious investment that led to premium wages

- when interest rates fell to 5% after the Black Death killed a third of the population, apprenticeships became more attractive, and hence there were more craftsmen

- so the wage gap closed

- during the industrial revolution, machines displaced craftsman, and relative demand for unskilled labour increased

- so the wage gap closed again

So it’s quite likely that as automation starts to displace white-collar, graduate jobs, the wage gap will close again.

- After all, firms have a greater incentive to displace the workers who cost the most.

Tontines

Our final article of the week from the Economist looked at the possibility that death pools might make a comeback.

- Tontines are investments where members pool money and receive dividends from a certain age.

- As members die, the dividends are divided amongst fewer people, and so increase at the individual level.

So they are a form of longevity insurance – protection against living too long.

- The problem is that they provide an incentive for surviving members to kill each other.

For this reason they are illegal, though they feature in a lot of older detective fiction.

- They were banned in the UK from 1774, though they were legal in New York until 1905.

In fact the biggest problem with them was not murder, but fraud, with parents giving new children the name of an older, dead sibling in order to keep the dividends in the family.

But now people are starting to look at them again, as a replacement for the expensive annuities.

- Tontines 2.0 could use crowdfunding to form the pools and blockchain to anonymise the membership and avoid murder plots.

Patents are already being filed.

Election aftermath

And now for some further reflections on the General Election.

- If you don’t want to know the scores, please look away now.

In the FT, Simon Kuper looked at how Facebook is changing democracy.

Let’s say that you wanted to sway forty-something women in Kensington who own homes abroad.

You make a video of Theresa May saying “Brexit means Brexit” and you experiment with formats. One might be a question: “Is hard Brexit risky?” Another is a statement: “Hard Brexit: Insane.”

You vary colours. You see which gets the most clicks. Then you retarget those who clicked it.

Only they, and friends with whom they share it, will see your ad. So you can send an entirely different ad, even a pro-Brexit one, to voters elsewhere.

It’s practically a secret campaign. And it’s cheap.

My operative friend warns: “If politics becomes as good at manipulating as consumer brands are, we’re all screwed.”

Ross Clark in the Spectator had a piece about the new Generation Wars.

Across the developed world there is a growing antipathy towards capitalism among the young.

Among my age group, socialism was associated with the failures of the Soviet bloc: queuing half a day for a cabbage, putting your name down on a long waiting list for a Trabant — and of getting shot if you tried to escape. Capitalism was synonymous with freedom.

This generation see only tax-dodging corporations and bankers who wrecked the economy yet carried on skimming off vast bonuses.

Corbyn’s past support for the IRA means little to them because they don’t recall the Troubles.

Some means needs to be found of allowing the under-35s to acquire a stake in capitalism.

In Master Investor, Victor Hill warned that the millennials are coming after your money.

- Victor is a Tory who campaigned in Scotland.

We completely underestimated the effectiveness of Labour’s use of social media and internet

propaganda channels.Younger voters are much more sceptical towards parliamentary democracy. They want meaning. Economics doesn’t provide it: causes do.

They believe that fairness is more important than freedom. LGBT rights and the rights of

asylum seekers are absolutes which may not be questioned. Intellectuals who deviate from

this view should be “no-platformed” – silenced.Elders, be afraid: the snowflakes are on the march. They are angry. They don’t much care about your so-called freedom. And they want your money.

In the Times, Clare Foges argued that we should stop treating the young as political sages.

Last week’s election revealed the judgment of many young voters to be as we might expect of those with relatively limited experience: hopelessly naive.

They turned out in their droves for a man who promised to lead them out of the badlands of austerity and towards a future where everything is nicer, cheaper, or indeed free.

It has been suggested that the great turnout of the youth vote is an argument for lowering the voting age to 16. Given who they voted for en masse, I would say it’s an argument for raising it to at least 21.

There is no such thing as a free lunch. Socialism is a proven disaster. These might not make for inspiring Facebook posts but they have the virtue of being the truth.

Corbyn watch

After my warning last week that Corbyn is no cuddly geography lecturer, this week provided two pieces of supporting evidence.

First, John McDonald called for a million people to take to the streets to force Theresa May from power.

- This came days after May won an election and received 13.7 million votes.

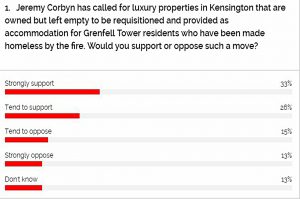

Next, in the wake of the Grenfell tower tragedy, Corbyn called for private property to be requisitioned to re-house the victims.

- He was backed up by Harriet Harman and David Lammy.

And even worse, the public appears to agree with him.

Remember guys, these people are communists, and we know how that story ends.

- First they came for the rich …

Until next time.