Weekly Roundup, 27th June 2017

We begin today’s Weekly Roundup in the FT, with the Chart That Tells A Story. This week it was about home sales.

Contents

Homeowners not selling

James Pickford reported that fewer existing homeowners are selling.

- They now account for only 27% of valuations, compared to 45% in May 2010.

- The slack is being taken up by the other market sectors – first-time buyers, buy-to-let investors and in particular, re-mortgagers.

Surveyors Connells put the changes down to political uncertainty and Brexit, as well as higher transaction costs following the stamp duty increases.

- Higher house valuations and lower mortgage rates also mean that re-mortgaging is attractive.

Fighting inflation

With the news that inflation is surging, Lucy Warwick-Ching looked at how to fight back.

She came up with 11 steps to take:

- Buy global equities (with international earnings)

- Sell bonds

- Buy real assets (agriculture, property, gold)

- Tax-shelter your savings in ISAs

- Find the best savings rate (they all look bad to me)

- Pay down your debts (but keep an emergency fund in cash)

- Use an indexed annuity (very bad advice – stick to Drawdown)

- Pay the maximum into your pension

- Join your employer’s SAYE scheme

- Remortgage

- Reduce your spending

Quite an odd list with some good ideas and some bad ones.

- Rather than the focus I expected on which assets perform best under higher inflation, it feels like a consumer approach to cost-saving, which is increasing the case with the Weekend FT.

Pension transfers

Josephine Cumbo had two articles on pension transfers, of which 80,000 have been completed over the past year.

The first reported on the tighter rules announced last week by the FCA.

- these changes could add £1,600 to the cost of a transfer

- the new reforms will apply from next year and will require a “personal recommendation” with “appropriate protections”

- so it’s a bigger, more expensive review than the one currently imposed on all transfers above £30K

The second article reported that the recent cash-ins have knocked £50bn off corporate pension liabilities.

- Note that this is referring to liabilities, not deficits.

- So it’s just the amount of cash they’ve paid out.

- This has been paid to 210,00 people since April 2015.

Combined liabilities for the UK’s 5,800 private sector firms are about £1.7 trn (coincidentally the same amount as the national debt – see below).

Emerging markets indices

Merryn looked at the looming changes to the MSCI Emerging Markets index.

- This currently has a 26% weighting to China, but none of that is from mainland shares. ((The shares currently in the index are quoted in New York and Hong Kong ))

- That’s about to change, with 1% of mainland shares (A-shares) being added to the index.

- This process is likely to continue, with perhaps 40% of the index becoming Chinese over the net decade.

Reaction from both China bulls and bears to such a small change has been out of proportion.

- Bears see this as a top of the market contrarian indicator.

The Chinese market is clearly immature – 80% of trading is done by retail investors – but that need not make it ripe for collapse.

- The economy needs to transition from low-end manufacturing to high-end manufacturing and services, but Korea, Taiwan and Japan managed this well.

Merryn makes the wider point that there is no such thing as passive investing.

- MSCI decides what makes an emerging market, and the relative importance of each of them.

- Effectively, MSCI is your asset manager.

John Authers wrote about the same topic.

- He notes the relative strength of the large-caps amongst A-shares, which mimics the strength of “Big Tech” in the US.

- Earnings expectations are higher for both of these groups.

- As a result, growth is outperforming value.

John references some research to show that governance is another key issue for investors, with state-controlled enterprises underperforming.

- And he notes that as China moves towards 50% of the EM index, we can expect to see “EM ex-China” funds appear (or emerge).

Car financing

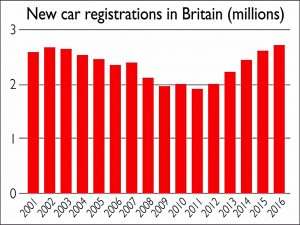

In MoneyWeek, Phil Oakley looked at new car sales, and the PCP contracts that are financing them.

- 2016 saw a record number of new car registrations in the UK

- this is partly because of low interest rates, but also because of PCPs (personal contract purchases)

- 86% of private purchases of new cars in the year to March 2017 used finance, to a total of £41 bn

With a PCP you are in effect renting the car for three years, at which point you have the option to buy the car for a pre-arranged price.

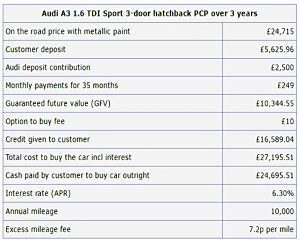

Phil walks through the example of an Audi A3:

- This costs £24,715 to buy

- The customer deposit is £5,625

- The dealer adds a discount (called a deposit contribution) of £2,500

- Next comes the monthly payment of £249, which covers three years of depreciation plus interest at 6.3%

- The “guaranteed future value” of £10,344 is the price at which you can buy the car in three years time

- This means there has been £14, 370 in depreciation

- After taking off the deposits, £6,244 of depreciation is being financed

- If the car was actually worth more after 3 years, this “equity” could be used as a deposit in a rollover PCP deal

- The credit to the customer is the original price less the two deposits, or £16,589

- Note that there is an annual mileage limit, and a fee for using the car more than this

So PCPs make the monthly payment on the car very low, allowing people to “afford” better cars.

- Because they are only renting them (and funding the depreciation).

Note that the “better” cars will hold their value more than a cheaper car, so the cost of a PCP for such cars is lower.

- But buying the 3-year old depreciated car at the end of a PCP deal looks like a much better idea to me.

Phil notes that PCP maths depend on a healthy used car market, but the boom in PCP deals inevitably leads to more second-hand cars (after a 3-year delay).

- Which means that used car prices are likely to fall.

- And some PCP contracts could end up in “negative equity”.

It’s likely that PCP terms will be extended, and borrowers with worse credit will be accepted.

- Some people draw parallels with the sub-prime mortgage scandal from ten years ago, but while there are plenty of superficial similarities, the sums involved are far lower.

But there could be trouble ahead for car dealers and motor finance lenders like S&U (LON:SUS).

Fund managers don’t outperform consistently

In the Economist, Buttonwood confirmed what most people know already – that fund managers rarely outperform the market for long.

- The article notes the recent switch from active funds to passive, which are usually cheaper.

The industry response to this lack of persistence is to kill off underperforming funds.

- 30% of bottom quartile funds in the five years to March 2012 were merged or liquidated in the next five years.

Buttonwood looks at some theories for the lack of consistency:

- successful funds will grow, making the manager’s job harder

- styles (like value or growth) won’t outperform at all times, so managers who stick with a style will have lean times as well as good periods

- one problem with this is that the average tenure of a US fund manager is now less than five years

- or it could just be that returns are down to luck

The article concedes that active management could be more useful in areas where information is harder to come by – emerging markets for example, or bonds.

- I would add areas like the AIM market in the UK.

But for large cap developed equities, passive looks pretty good at the moment.

Queen’s speech

The Queen’s speech finally happened, though as I write this the Tory agreement with the DUP still hasn’t been finalised – so the speech can’t be signed off by parliament.

- I remain confident that the prospect of Jeremy Corbyn in Number 10 will concentrate the minds of everyone involved.

- EDIT: The deal was signed between me drafting and publishing this post.

The speech was shorter than usual, as a lot of the Tory Manifesto plans are no longer implementable:

- grammar schools, the end of free school lunches and a free vote on fox-hunting are out

- so is the energy price cap and the means testing of the winter fuel payment

- the plan to scrap the state pension triple-lock has gone

- and the dementia tax has been replaced with a social care consultation

- also missing are spending commitments on the NHS and new housing

- but electric car charging points and insurance for driverless vehicles survived

What remained was mostly about Brexit and the repeal of EU laws.

- May has turned a once-in-a-generation opportunity to introduce radical policies into a one-trick pony minority government.

The speech has triggered another debate about whether “austerity” is over.

- I dislike the term myself – we can’t have austerity while we run a deficit and the government debt increases – it’s currently at £1.7 trn, or 87% of GDP.

- The Tory commitment to balance the budget has now been pushed back to 2025 – 18 years after the financial crisis!

Ironically, the cost of this debt will fall on the young people who seem unconcerned that it is rising.

- But we do currently have the opportunity to reduce the impact of the debt by refinancing it at low rates for long periods into the future.

- Serial defaulter Argentina just managed to get a 100-year bond away. (( Though they did have to offer 7.9% pa interest – we could probably get away with 1.5% pa ))

And the current burst of inflation will help a little bit.

The mainstream media seems to use austerity to mean any reduction to an existing state benefit.

- So the austerity debate is really about whether the Tories will raise taxes instead.

No doubt they will, but that in turn raises the issue of how much tax you can raise in the UK.

- We’re pretty much at the historical limit as a proportion of GDP, and the rich are paying as much as ever.

- Labour plans to tax them more will mean that many of the richest will leave the UK.

Labour also wants to tax corporations, but:

- it won’t work, since they will both relocate operations and pass on costs to their customers (UK taxpayers)

- the wake of the Brexit negotiations is a bad time to become less friendly to business

Writing in the FT, Jonathan Eley felt that taxes would be increased on wealth rather than income.

There are three key objections to wealth taxes:

- Wealth is accrued from income that has already been taxed, and reflects lifestyle choices (deferred consumption and provision for the future can be seen as “good” behaviour).

- Many asset rich individuals are cash poor, so deferring payment will often be required.

- Taxes that are triggered by optional activity (such as selling your home) will inhibit that activity, leading to non-functioning markets.

Jonathan thinks that they are coming anyway.

- I’m not so sure, but if they are, I will look even harder at going.

Free trading

I’ve mentioned previously that I use the low-cost broker DeGiro for some of my momentum trading.

- DeGiro are regulated abroad (in Holland, I think) so the compensation available is capped at €20K, which means I won’t put more than £15K in the account.

DeGiro charge close to £2 for a trade, but they have been planning to introduce free trading for some time.

- Now another firm has beaten them to it.

The Telegraph wrote about Trading 212, an FX broker which now offers 10 commission-free trades per month (each for £10K or less).

- And despite some links to potentially dodgy Cyprus, the firm is regulated in the UK.

- Which means that it should be safe for up to £50K.

I hope to try it out in the next month or two, and will report back.

Philip Hammond

In the Economist, Bagehot came out in favour of Philip Hammond as the next PM, calling him “the designated adult“:

Mr Hammond is a grown-up in a political playpen that is stuffed with children.

Boris Johnson wants to grab the shiniest prize for himself for no other reason than that it is shiny.

David Davis is a vainglorious contrarian who has spent much of his career on the backbenches and who habitually underestimates the damage a bad Brexit might cause.

Amber Rudd is a neophyte. Ruth Davidson doesn’t have a Westminster seat.

Mr Corbyn is an extreme case of arrested development, a man-child leading an army of disgruntled youths.

He is a professional protester who has reached his late 60s without ever having to make adult decisions about allocating limited resources, let alone creating them in the first place.

Tinder bots

The New York Times had what felt like a spoof article (( No doubt it’s actually true )) by two young women who claimed to have influenced the UK election by using Tinder bots.

People “lent” us their Tinder profiles, and the bot convinced Tinder that their profiles were in geographical locations where the vote was close.

The program would automatically swipe “yes” on every user, and if someone swiped back, the bot would ask about the user’s voting plans.

If the user planned to vote for Labour, the bot sent a message with a link to the nearest polling station.

If the user planned to vote for another progressive party, the bot asked them to consider a tactical vote to beat the Tories.

If the user was voting for a right-wing party, the bot sent a list of Labour policies, or a criticism of Tory policies.

This is what we’re up against now.

Twitter pictures

It was a bumper week for twitter pictures, and I have eight to share with you.

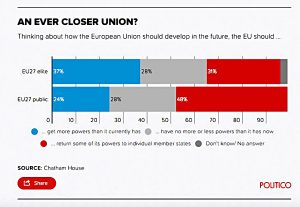

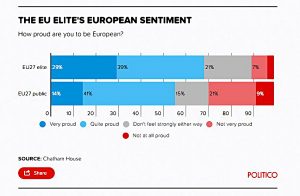

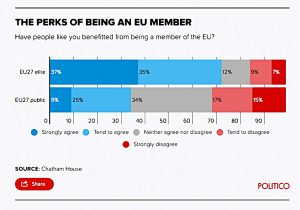

- The first three are about the gulf between ordinary people and the “elites” in the EU.

37% of the elite want the EU to have more power, while 48% of the public want it to have less power.

67% of the elite are proud to be European, but only 55% of the public are.

72% of the elite feel they have benefited from being in the EU, but only 34% of the public do.

This one shows that although London has the second highest average wealth per adult, it has the second lowest mean wealth.

- There’s a lot of variation within the city.

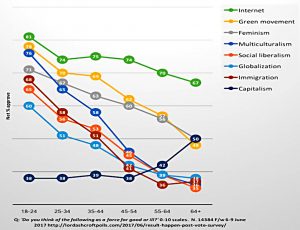

This one looks at attitudes by age.

- The only thing that old people like more than young people do is Capitalism.

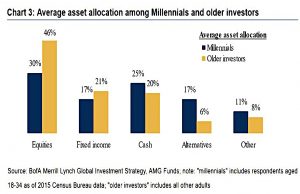

This one looks at asset allocation by age.

- Millennials have too much cash and too few equities.

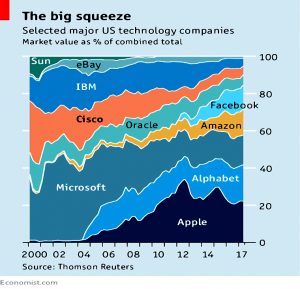

Here’s one from the Economist, showing the changing market capitalisations of US Tech firms.

And finally, here’s the FT’s summary of the week. (( Complete with background image watermark ))

- Inflation is up

- The pound is slowly recovering, but it had a bad week.

- One more BoE committee member voted for a rate hike.

If only I could be that concise.

Until next time.