Weekly Roundup, 16th August 2021

We begin today’s Weekly Roundup with a look at AIM.

AIM

In the FT, Claer Barrett looked at AIM, and its use in avoiding IHT.

- I’ve been running a portfolio like this for the last four years, and I’ve just begun selling it off to pay for care home fees.

The tax exemption came in a while back, but the approach became popular eight years ago when it became possible to hold AIM shares within an ISA. (( My own AIM IHT portfolio is not in an ISA ))

- Shares not listed on another recognised exchange, and held for two years or more, do not attract IHT.

It’s the same Business Property Relief (BPR) aimed (( No pun intended )) at family businesses and farms.

Today, up to half a billion pounds a year is flowing into “IHT Isas” offered by specialist investment management companies such as Octopus, Unicorn and RC Brown.

Despite its (deserved) high-risk reputation, AIM has performed well through Covid.

- I should point out that the AIM-100 index is not representative of the overall AIM market – even more so than the FTSE-100.

AIM is a stock-picker’s market, with only;y around 25% of its firms worth investing in.

Alex Davies from Wealth Club commented:

The FTSE 100 is full of yesterday’s companies, but if you invest in Aim you can get exposure to tomorrow’s winners. It’s the nearest thing we have to a British Nasdaq.

I’m a big fan of Wealth Club and buy most of my VCTs through them, but AIM is nothing like Nasdaq.

Simon Thompson from Investors Chronicle said:

The outperformance of small-caps reflects the higher weighting in Aim indices to fast-growing sectors (technology, ecommerce and healthcare) that are beneficiaries of benign monetary and fiscal tailwinds.

That sounds more like it to me.

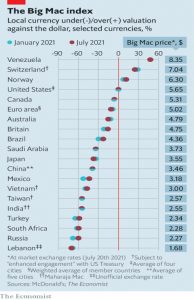

Big Mac index

The Economist had its regular report on what burger prices can tell us about FX rates.

A Big Mac in Vietnam works out to be 47% cheaper than in America. [This] suggests the dong is undervalued. America’s Treasury certainly thinks so.

Twice a year it reports to Congress on countries that might be keeping their currencies artificially cheap to boost exports and steal a competitive edge. In April it confirmed that Vietnam was one of a trio of trading partners, alongside Switzerland and Taiwan, pursuing “potentially unfair” currency practices.

Vietnam has now agreed to let the currency fluctuate more freely.

It is common for poor countries to seem cheap relative to rich ones. The price of a burger [in Vietnam] is about what you would expect given the country’s GDP per person. Taiwan remains surprisingly cheap, given how prosperous it has become. And Switzerland seems expensive by any measure.

At the bottom of the table is Lebanon:

The Big Mac costs the equivalent of only $1.68. One reason may be that Lebanese importers can purchase some of the ingredients at a more favourable, subsidised exchange rate. Lebanon’s currency chaos is both a reflection of its economic disaster and a contributor to it.

HL

Hargreaves Lansdown reported on a switch in the demographics of their users.

- 50% of their new clients were in the 30-54 age group and 83% were under 55.

The median client is now aged 46, down from 58 in 2007 and 54 in 2014.

- HL now has 1.65M clients.

CEO Chris Hill said:

The pandemic has accelerated two trends that were already evident to us: a permanent shift to digital [98% of trades are now online]; and a change in the demographic mix.

We are seeing younger clients show an interest in investing. They are starting to benefit from the transition of wealth from older generations. Getting clients onto the platform earlier means that we can support them for longer as they grow their wealth.

AUM was up 30% to June 30 2021 to £136 bn, though a fair bit of that will have been from the growth in stock markets.

- New business was up 13% to £8.7bn and revenues were up 15% to £631M, tough profits were down 3% to £366M.

HL remains amazingly resilient, given that it’s the most expensive of the well-known trading platforms.

Crypto

The Economist had three articles on crypto.

When Gary Gensler was appointed the head of the SEC in April, it was seen as “good for crypto” – like so many news items.

- He used to teach a course on crypto at MIT and had described bitcoin as a “catalyst for change”.

But now he has signalled that he wants tougher regulation, describing crypto as “rife with fraud, scams and abuse”.

- He said that crypto tokens were not a means of exchange but rather “highly speculative stores of value”, and that investors could not access “rigorous, balanced and complete information”.

Strictly, the SEC has no jurisdiction over bitcoin and ether, since they are not securities:

The “Howey Test”asks whether investors have a stake in a common enterprise and are led to expect profits from the efforts of a third party.

Stablecoins are more likely to pass this test as they often represent a stake in a particular crypto platform.

Jerome Powell has hinted that these should be regulated as money-market funds or even banks.

The SEC does control ETFs and to date, applications to launch bitcoin ETFs have gone nowhere.

- Bizarrely, Gensler suggested that bitcoin mutual funds and ETFS based on the CME’s bitcoin futures might be more acceptable.

Gensler also suggested that he might request extra powers to deal with DeFi, smart contracts and crypto trading platforms.

The second article looked at stablecoins in more detail.

Because banks offer deposits that are redeemable on demand and superficially riskless, but which are backed by longer-term, less liquid and riskier assets, they are vulnerable to runs. Stablecoins are similar.

Tether is the obvious example – it has $62 bn of tokens which in March 2021 were only 5% backed by cash and Treasury bills.

- Tether’s self-reporting would also imply that it is the world’s seventh-largest investor in commercial paper, close to Vanguard and BlackRock.

Tether’s leverage is estimated at 383, providing a safety buffer of just 0.26%.

The Economist compares stablecoins to money market funds:

[They] were created in the 1970s to circumvent rules limiting the interest banks could pay depositors. After promising to maintain the value of their shares at a dollar, money-market funds blew up in 2008 in the global financial crisis.

American taxpayers stepped in to forestall a fire sale of their assets and a crash in the market for commercial paper, on which the real economy depends.

A taxpayer bailout of Tether seems unlikely to me. The article concludes that stable coins should be regulated like banks:

Subject stablecoins to bank-like rules for transparency, liquidity and capital. Those failing to comply should be cut off from the financial system.

Which sounds reasonable to me, but then I am a stablecoin sceptic.

- I can’t see the point of private stablecoins from unknown sources, and I expect them to be driven out by central bank coins, and those issued by trusted private companies.

Apple, Google and Amazon would be my choices.

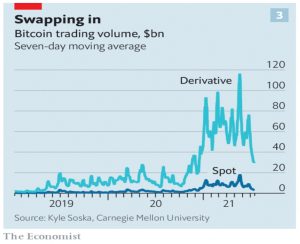

The third article was a stress test of the crypto space which asked “What if bitcoin went to zero?”

- There were 11,145 crypto-currencies listed on CoinMarketCap at the time the article was written, compared to “only” 6,000 a year before.

The total market cap is up from $330 bn to $1.6 trn (the GDP of Canada).

- And there are 100M digital wallets, triple the 2018 figure.

“Institutional” trading (trades of more than $1M) is now 63% of the total, up from 10% in 2017.

- Despite this, price volatility remains high.

What would happen if the price fell to zero?

A rout could be triggered either by shocks originating within the system, say through a technical failure, or a serious hack of a big cryptocurrency exchange. Or they could come from outside: a clampdown by regulators, for instance, or an abrupt end to the “everything rally” in markets, say in response to central banks raising interest rates.

Mohamed El-Erian described three kinds of crypto-investor: fundamentalists, tacticians and speculators.

- Speculators will sell and fundamentalists won’t so the behaviour of tacticians – who think crypto will rise in value as more people adopt it – in the rout will be crucial.

Bitcoin miners—who compete to validate transactions and are rewarded with new coins—would have less incentive to carry on, bringing the verification process, and the supply of bitcoin, to a halt.

Long-term holders have low entry prices and massive unrealised gains.

- Buyers in the last year – including most of the institutional buyers – would face the worst “real” losses.

As well as the $1.7 trn of crypto market cap, there is another $90 bn of listed crypto firms and $37 bn of investment in unlisted crypto firms at stake.

- Payments companies (PayPal, Visa and Revolut) would also be hit, and even mining hardware firms (like Nvidia) would suffer.

A total of $2 bn could be lost, though margin calls on derivatives could inflate this further, perhaps by an order of magnitude.

- And then there are the stablecoins (as discussed above).

The Economist worries about contagion to other assets:

A sell-off would begin with the most leveraged punters in high-risk areas: meme stocks, junk bonds, special-purpose acquisition vehicles. Investors exposed to these, facing questions from their investment committees, would follow in turn, making risky assets less liquid, and perhaps provoking a general slump.

The newspaper notes that the Gamestop shenanigans led to a 2.5% daily fall in the S&P 500.

- I don’t expect to see a total collapse in crypto, but the risk of something like Tether blowing up, and triggering an 80% drop in price is the main thing holding me back from investing at the moment.

Quick Links

I have just three for you this week, the first two from The Economist:

- The newspaper said that American biotechnology is booming

- And wondered how the delisting of Chinese firms on American exchanges might play out.

- Alpha Architect looked at the role of intangibles in value investing.

Until next time.