Weekly Roundup, 6th February 2023

We begin today’s Weekly Roundup with property.

Property

In the FT, James Pickford wondered whether this might be the start of a great buy-to-let sell-off.

- He used as a case study a man with two hundred BTL properties, mostly held through a limited company.

I intend to sell all the properties I own in my own name. Regulation and tax changes have fundamentally changed the economics of investing in the sector.

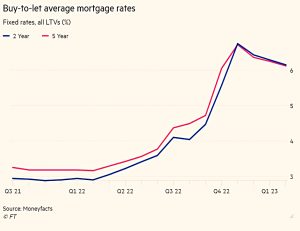

In addition to those two headwinds, 2022 brought more expensive mortgages and a slowdown in house price growth (and possibly a mini-crash to come).

- And there’s more regulation to come, with tighter rental rules and changes in energy efficiency standards in the pipeline.

Lenders restrict the amount of debt buy-to-let borrowers can take out, typically to 75 per cent [of the property value], and insist on a minimum headroom between expected rents and interest payments of 145 per cent. Most landlords take out interest-only loans, which amplify the effect of mortgage rate changes.

Simon Gammon, the managing partner of mortgage broker Knight Frank Finance, says:

The only way they could make it work would be to significantly reduce the loan or put the rent up. People are increasing rent, but not enough to cover the mortgage. So they’re stuck with their existing lender.

James quotes research by Hamptons International on a landlord (owning directly and a higher-rate taxpayer) with a 75% loan expiring on a £200K property with running costs of 31%:

At an average yield in England and Wales of 6 per cent, the landlord would see their mortgage payments rise by 117 per cent, turning a £2,500 annual profit into a £365 loss.

The break-even is now a 7% yield, compared to 3% in 2021.

Lucian Cook at Savills says:

You’ll be left with a core of committed landlords who run it as a professional business. But a lot of people for whom the investment has become more marginal will be taking a second look at it.

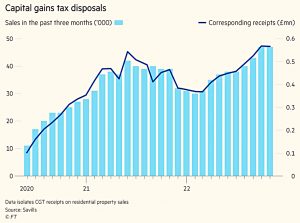

And BTL sales are indeed hotting up.

In the three months to the end of November 2022, the estimated number of buy-to-let or second homes sold hit a record 47,000, an increase of 21 per cent on the same period in 2021.

In a second article, James noted that central London house prices have fallen by 24% (in real terms) over five years to December 2022.

The data comes from Zoopla, whose ED Richard Donnell said:

Higher mortgage rates hit hardest where house prices are highest, so London will suffer to an above average degree.

Zoopla forecasts a further 5% fall nationally in 2023 (and worse in London), and other forecasts are also negative:

Capital Economics forecasts prices will fall across the UK by 8.5 per cent in 2023, with a further drop of 2.5 per cent in 2024. Halifax forecasts a decline of 8 per cent while Nationwide [has] predicted a drop of 5 per cent.

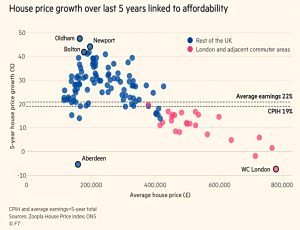

The best price rises in the last five years were in areas with lower prices to begin with, but:

The pandemic-fuelled trend for people to move out of urban areas to coastal or rural homes [has] already “run out of steam”. Coastal locations of east Kent, Torquay and Portsmouth and wider areas of the Lake District and mid-Wales showed a larger than average slowdown in prices over this year.

The price differential between houses and flats also increased during the pandemic, and this is expected to reverse, aided by the resolution of the cladding issue.

Sticking with property in the FT, Michael Taylor from Shifting Shares suggested that people would be better off not overpaying their mortgage.

- To me, this is a simple maths problem – if the expected return on other investments is higher than your interest rate, there’s no need to repay.

Tax considerations might have some effect, but that’s the basic equation.

Over 25 years (the typical mortgage term), the expected return from a diversified portfolio is just over 3% real, or around 6% after inflation is added.

- So you only need to pay down your mortgage when the interest rate is above 6%.

When I first had a mortgage, back in the 1980s, interest rates were around 15%, so we all paid off as much as we could, as fast as we could.

- It’s a difficult habit to break, and I did the same thing when I took out another mortgage on my second property. (( Which is the one I still live in ))

UK mortgage rates didn’t fall below 6% until around 2000, but I was mortgage free by 1999.

- With a small blip around the 2008 crisis, rates have stayed below 6% ever since.

So younger generations will never have developed the overpayment habit.

- Until now – with rates spiking up over 5% and cash savings (everyone’s first port of call for spare money) still paying less than that, some will now be looking at paying down their home loan.

Michael thinks that they shouldn’t, and I tend to agree, though he quotes some more ambitious return targets, like the 9.9% returned by global equities from 1994 to 2021.

- This was a period of declining interest rates, and most people won’t allocate 100% of their savings to equities (or even diversify globally).

But at least he’s putting his money where his mouth is – Michael has extended his mortgage so that he can keep more money invested in the stock market.

Cakeism

Steve Russell from Ruffer warned that we can’t have both a soft landing and a Fed pivot.

- After a grim 2022, markets are off to a decent start in 2023.

Behind this rally is a growing belief that we could have a ‘soft landing’. That the recession so widely predicted for 2023 can be avoided or at least delayed.

This might happen, but what investors want is stronger growth now and interest rate cuts later.

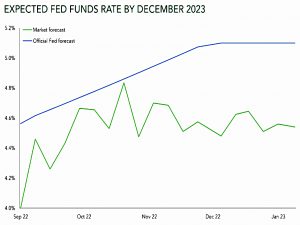

- Markets are now predicting year-end rates to be more than half a per cent below where the Fed is telling us to be.

The Fed appears determined not to repeat the mistakes of the 1970s, and so if a recession is avoided, how can they reverse course and cut interest rates?

You can’t have further corporate earnings strength and 2% inflation, you can’t have China reopening and low energy prices, and most obviously you can’t have a soft landing and a big Fed pivot.

They are talking their book, but Ruffer is happy to stick with its (perennial) capital protection approach in 2023.

Interactive Investor

Interactive Investor has launched a cut-price version of its broking service (which usually costs £10 a month or £120 pa) for those with small pots.

- Investor Essentials costs £5 a month (£60 pa) for those with less than £30K in their pot.

- When you go above £30K, you are automatically switched to the full-price deal.

The new service works out at 0.2% pa for those close to the limit.

- Trades cost £5.99 (for UK and US stocks – funds are free to buy) and obviously, fund fees (from ETFs and ITs) are on top of that.

It seems a reasonable deal on paper, but iWeb has no annual fee and charges £5 per trade.

- And you can stick £1M in an AJ Bell SIPP for £120 pa.

So I can’t see the attraction of the new offer.

M&G

M&G, who lead the recent funding round for the fintech app MoneyFarm, have now launched an investment platform (called &me) aimed at younger investors.

- In a bid to avoid the robo-adviser label, &me employ a few (non-advisor) consultants, so that clients can talk to a human.

M&G Wealth MD David Montgomery said:

[The platform] is designed to help people invest with a long-term view and approach, encouraging them and helping to educate through the app and the dedicated &me consultants.

This is an easy-to-use investment app that guides people through the process of investing, but more importantly, has real people to help answer real questions. Not everyone wants, or can afford, to take full advice and we want to enable more people to save and invest for the financial future they want and dream of.

MoneyFarm will provide six portfolios, divided into “classic” ETF tracker portfolios of stocks and bonds, and “targeted” portfolios that include active funds and alternative assets.

- Fund charges are 0.19% for classic portfolios and 0.42% for targeted portfolios.

The platform charge is tiered:

- Up to £10,000 = 0.75%

- £10,000 to £20,000 = 0.70%

- £20,000 to £50,000 = 0.65%

- £50,000 to £100,000 = 0.60%

- £100,000 to £250,000 = 0.45%

- £250,000 to £500,000 = 0.40%

- £500,000+ 0.35%

Combine the two charges and the service is not cheap.

Small pots

The Department for Work and Pensions (DWP) has issued some proposals on what should be done with small DC pension pots.

- With the end of jobs for life, many people end up with a small pot from each of their employers.

- Auto-enrolment has made this even more likely.

The DWP has two options in mind:

- All deferred pots are transferred to a consolidator (not the original pension manager)

- “Pot follows member” where deferred pots are added to your pension at the new employer

Both sound like an improvement on the current situation, but there are a couple of problems:

- Some old plans will have advantageous conditions that employees may not want to give up (eg. guaranteed annuity rates)

- Small pots (usually under £10K) themselves have advantages (they don’t trigger the reduction in the annual allowance to £4K and they don’t count towards the LTA) which people might want to hang on to

Quick Links

I have just two for you this week:

- The Economist said that Things are looking up for Meta

- And the FT asked How can investors ride the EV boom?

Until next time.