Weekly Roundup, 24th July 2018

We begin today’s Weekly Roundup in the FT, with the Chart That Tells A Story. This week it was about inflation-beating savings accounts.

Contents

Inflation-beating savings

Edwin Esosa (an FT intern) reported that there are now 26 savings accounts that offer inflation-beating interest (versus CPI of 2.4% pa).

- From July 2017 to March 2018, there were none.

The increase is largely down to the fall in CPI from 3.1% pa in November 2018.

- But Edwin also credits challenger banks and the end of cheap government borrowing in creating a more competitive market for deposits.

This is obviously good news, but it’s important to remember that cash is a poor long-term home for your savings.

- You would be better of concentrating your efforts on building a globally-diversified multi-asset portfolio than on searching for an extra 0.1% pa on your cash.

Platform review

Merryn looked at the FCA’s review of investment platforms.

- I had intended to write an entire article on this report, but it turned out to be something of a damp squib.

We talked last week about the high margins enjoyed by some of the largest platforms (HL in particular).

Merryn thinks that the key reforms would be to make fee structures more transparent and to make switching between platforms more simple and quicker (say two weeks).

- It’s should also be much cheaper, with only a simple admin fee allowed.

This is all broadly in line with the regulator’s recommendations.

Merryn also recommended comparefundplatforms.com and yourbroker.info for finding the lowest costs platform for your particular level of assets and annual activity.

CDC pensions

Josephine Cumbo reported on the work and pensions parliamentary select committee’s support for CDC pensions (also known as Defined Ambition schemes).

We looked at these schemes back in January and failed to see the attraction.

- They are less flexible than DC schemes.

- Returns are not guaranteed (the key failing of DC schemes).

- The other key problem with existing schemes is that contributions are too low, and CDC wouldn’t address this, either.

- There’s no reason to believe that scale economies would be passed on to scheme members.

I still believe that all we need to do is increase the contribution level to workplace auto-enrolment schemes, and to make these contributions compulsory (as in Australia).

Bad managers

Tim Harford looked at research which shows that the Peter Principle – that people are promoted until they reach a level at which they are incompetent – is true.

- The study looked at 1,500 promotions (of sales staff to management) across 53,000 workers at 214 firms.

It turns out that the best salespeople got promoted and they made terrible managers.

Another paper suggests that a better strategy might be to promote people at random, and then quickly get rid of those people who fail.

- I (and Tim) think you might have to offer staff the option of going back to their original job, or you might get no takers for the manager roles.

Investment consultants

John Authers looked at a study of investment consultants – the people who advise pension fund trustees.

Damningly, the investment products that consultants recommend had exactly the same return and risk profile as products that the consultants had advised against.

The only significant difference is that the products they recommend tend to deviate less from their benchmarks. This implies a “safety in numbers” mindset among consultants that contributes to investment herding.

The other problem was that the consultants mis-represented the performance of their picks.

- They claimed outperformance (versus benchmarks) of 1.73% pa.

- But the study calculated underperformance of 0.3% pa versus the products that were not recommended.

- Even when matching within asset classes, there was underperformance of 0.2% pa.

So that’s an an exaggeration of close to 2% pa.

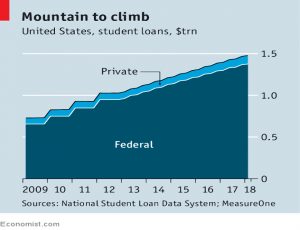

The Economists reported on income share agreements (ISAs, confusingly).

- These are a form of student equity rather than debt, where the college takes a share of future earnings in return for reduced tuition fees.

The share signed over varies from 2% (in STEM subjects or medicine) to 17% (literature and fine art).

- Those involved in the creation of the products anticipate returns in the 4% to 15% pa range.

- They also expect that 70% of US universities offer such poor value for money that they will never be able to offer ISAs.

I’d like to see this idea implemented in the UK, and opened up to the general private investor, rather than just the universities themselves.

- The US universities do raise capital from outside investors, but it’s not clear if any of this is from individuals rather than institutions.

Beating hyperinflation

Buttonwood looked at how Venezuelans cope with hyperinflation.

- Businesses are investing in buildings (for which there is little current demand).

- And individuals are trading eggs and long-life milk.

Since both approaches depend on the local (bolivar) economy, they are only partial solutions.

- A better approach is an offshore stack of hard currency (preferably dollars).

- Failing that, stocks with a lot of foreign earnings can be useful.

So if you really are worried about a no-deal Brexit, you know what to do.

Buttonwood says there have been 57 episodes of hyperinflation, starting with France in the 1790s.

- They often involve a war or revolution.

- Other causes include looting by officials, high welfare spending or reliance on a single source of tax revenue (eg. oil).

The government prints money to pay its bills, causing inflation which further erodes future tax receipts.

Smart people

And finally, DINKs Finance reported that smart people are richer.

- But we all knew that, didn’t we?

Quick links

All my links this week are from FT Advisor:

- Equity release has hit £1 bn per quarter.

- One in 10 people retiring this year expect to withdraw their entire pension savings as one lump sum.

- Most people feel property should not be included in social care entitlement assessments.

- And Seedrs will be using £10m from Neil Woodford to build an automated crowdfunding portfolio product, along the lines of robo-investing.

Until next time.