Weekly Roundup, 27th July 2020

We begin today’s Weekly Roundup with a look at capital gains tax.

Contents

Wealth tax

In the FT, Merryn Somerset Webb argued that CGT is a stealth wealth tax.

- As we noted a few weeks ago, a real wealth tax is hard to calculate and hard to collect.

They end up based around property and the UK already has the second-highest property taxes in the OECD.

- But the government needs to raise more money, and we are close to the historical limit on raising taxes (around 35% of GDP).

Both CGT and IHT are wealth taxes – one on gains (no longer index-linked) and the other on transfers.

- The missing type of wealth tax is the existential one – if someone has something (even if they don’t do anything with it), tax it anyway.

It’s the lack of CGT indexation that leads Merryn to use the “stealth” prefix.

- If your assets only grow with inflation, CGT can mean that you end up with lower purchasing power than you started out with.

She expects the recently commissioned review of CGT to raise rates and hopes that IHT will be converted into a gift tax, with recipients charged at their marginal income tax rate.

- She also discussing limits on the primary residence exemption but I can’t see that happening.

It would lock up the property market as people sitting on large gains would never move again.

Merryn also thinks (like me) that simply trying to squeeze more out of “the rich” is futile:

The UK’s well off are already highly taxed [and] the rich are both mobile and good at avoidance. If we really want to dent our debt via the tax system, it isn’t just the rich that will have to pay more. Everyone will.

Consumption tax

In the Times, Ed Conway suggested we might do away with all our taxes and replace them with just a progressive consumption tax – a kind of souped-up VAT.

The overarching principle is that rather than taxing people on what they earn, you tax them on what they spend. Any money they want to save or invest remains tax-free.

I’m not so sure – I have no moral objection, but whatever you tax, you get less of.

- I think that the last thing the economy needs at the moment is less consumption.

I would go for income tax, VAT, sin taxes (booze, fags, petrol/carbon, sugar, fast fashion), insurance contributions (NICs and a social care fund) and some form of gift tax with an annual allowance.

Endowments

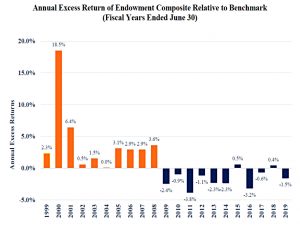

John Authers looked at recent lacklustre returns from US university endowments, and in particular at a new paper from Richard Ennis (available from SSRN).

- Endowments did well before 2008 (and their investing style became famous) but have underperformed since then.

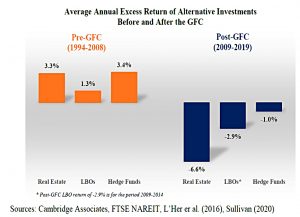

It’s down to asset classes – real estate, private equity and hedge funds beat the stock index before 2008, and have done worse since.

So far, this is a ruler problem – when stock markets (dominated by US tech) are booming, then everything else looks bad in comparison.

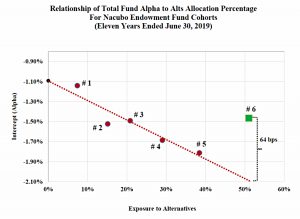

There’s one other interesting result – as endowments increase in size (cohorts #1 to #6 in the chart), their exposure to alternatives increases, and their performance goes down.

- Except for the very largest, who despite the biggest exposure to the worst assets still do better than all but the smallest cohort.

This could be down to skill, or to first-mover advantage in being an early adopter of alternative assets.

- John hypotheses that the pandemic could throw up new opportunities, and we could do worse than watch the big endowments to see where they are.

Redwood

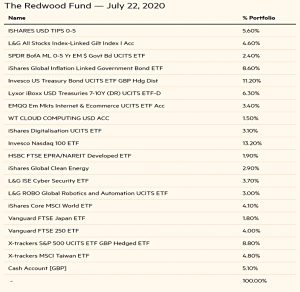

In his regular update on the ETF portfolio that he manages for the FT, John Redwood warned of a wave of capital destruction caused by a top-down green revolution.

It means faster closures of aircraft and car factories and the writing down and write-off of more coal oil and gas investments. It requires the accelerated retirement of a whole generation of heating systems and family cars, less air travel and big changes to cities and their property estates.

On the other hand:

There will be investment opportunities in the new batteries, renewable energy, electric heating and new travel options, and personal housing and transport assets.

And the continuing digital revolution means more demand for software, laptops, smartphones, tablets, broadband and cybersecurity.

But John is worried about the growing gap between market valuations and company earnings.

- Without a vaccine, and possibly with a second winter wave of the virus, things look expensive.

He is long on digital tech and green energy and sold down property some time ago.

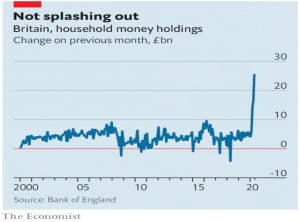

Household savings

The Economist reports that household savings are up in Britain.

- This is not a big shock, given the government’s furlough support and the lack of things to spend money on.

Money held went up by £26 bn in May, to £55 bn (2.7% of “old” GDP).

- The savings ratio increased from 5% in February to 30% during lockdown.

The OBR’s central scenario predicts that the household savings ratio will remain above 10% in the next few years. That’s bad news for the economic outlook.

Natural capital

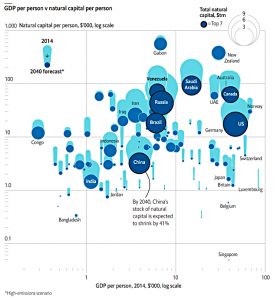

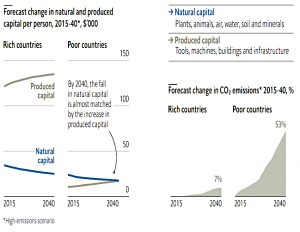

The Economist looked at the future of natural capital (the value of the world’s land, forests, fisheries, minerals and fossil fuels) and concluded that as natural wealth is used up, economies will rely more on human capital.

- Sounds a bit Ministry of the Bleeding Obvious to me – lots of resources are non-renewable and the world’s population has to date continued to increase through time.

Natural capital was $13K per person in 2014, for a total of $911 trn. (( For some reason, the figures from Inclusive Wealth use 2005 FX rates and prices ))

- New Zealand has $380K per person, but Gabon has even more.

Of course, a lot of natural resources can be a curse, bringing corruption, rules by despotic elites and a loss of international competitiveness.

- Congo has not fared as well as Singapore, for example.

But in general, more natural capital means higher GDP.

Some economists argue that natural bounty raises the level of gdp but slows its growth rate: it provides an additional, steady stream of income that grows less quickly than the rest of the economy.

For one thing, resources become progressively harder (more expensive) to extract and exploit.

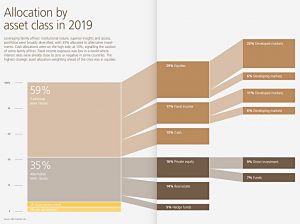

Family Offices

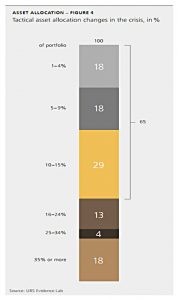

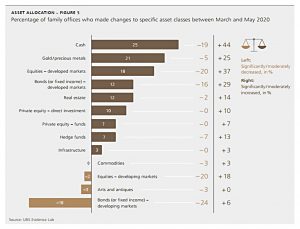

In the Times, Patrick Hosking looked at a report from UBS on family offices.

Most have made money or are flat across the pandemic.

The 120 offices that UBS look after have between them assets of $142 bn (so $1.2 each on average).

Robinhood

Zero-fee broker Robinhood has decided to postpone its UK launch “indefinitely”.

- It’s closing its UK website and throwing away the 250K email addresses on its waiting list. (( I put in a fair amount of effort to get to close to the top of this list ))

In the US they have 13M clients, up by 2M in 1Q20 alone.

The company statement blamed Covid-19 and hinted at operational problems:

The world has changed a lot over the past several months and we’re adapting with it.

We’ve come to recognise that our efforts are currently best spent on strengthening our core business in the US and making further investments in our foundational systems.

But besides the service’s crashes in March, many commentators felt that the bad publicity around the suicide of one of the company’s inexperienced young options traders had something to do with it.

- This probably isn’t the best time to launch a zero-free trading service.

We look at the proposed offer back in February – a cut-down version of the US service.

- It did not include leverage (options), but I’m not sure whether the gamification touches from the US (confetti bursts on trades and use of emojis) were included.

It was more like the Trading 212 offer for US stocks. (( Other zero-fee brokers are available in the UK – most notably Freetrade – but the Robinhood plan was US stocks-only, and Trading 212 are better for that ))

- So I won’t exactly miss it, but I was looking forward to the competition and I would have opened a small account.

Greece

Greece has become the latest country to offer rich ex-pats a tax deal.

- You get a 7% rate for 10 years – assuming that the draft law passes, and that you don’t live in Greece already.

This is the same rate as the southernmost regions of Italy (with the added restriction there that you must live in a town with a population of less than 20K) and 3% lower than the rate in Portugal.

- Of course, the EU (and the UK tax-man) won’t be too keen on such schemes.

Finland has cancelled it’s tax treaty with Portugal, which means that Finish tax rates still apply.

Cash

AJ Bell is planning to join Hargreaves Lansdowne in offering an integrated platform for cash savings.

According to the firm:

[Customers] will be able to apply for multiple accounts quickly and easily, with no

paperwork, and manage their cash savings via one online account that sits alongside their existing AJ Bell Youinvest accounts.

Which sounds fine, especially if you are an existing AJ Bell customer.

- But the obsession with getting the best deal on cash puzzles me.

Cash is a safety and liquidity asset, not a return asset, and would usually make up less than 10% of your portfolio.

- In these currently times of historically low interest rates, obsessing about getting another 0.25% pa on your 5% in cash seems odd.

It would be much better to save 0.5% pa in running costs on the 60% to 80% of your portfolio which is in stocks.

Burrito Bonds

The Mexican restaurant chain Chilango has gone into administration.

- The firm sold £3.7M of “Burrito Bonds” – paying a whopping 8% pa in interest – to retail investors in 2019 and 2019.

Lending to small companies is risky, and so is P2P.

- Equity crowdfunding of startups is even riskier.

The next step for those who have outgrown cash savings accounts should be boring old stock market index funds.

Quick Links

I have six for you this week, the first three of which are from the Economist:

- The newspaper explained why real-time economic data needs to be treated with caution

- And reported that the copper and gold prices are usually rising together

- And told us about a new material that will help to make transistors vanishingly small

- Alpha Architect looked at fundamental momentum, the carry trade and currency returns

- Musing on Markets wrote about the resilience of private risk capital

- And UK Value Investor provided his mid-year updates on the FTSE and S&P CAPE ratios.

Until next time.