Weekly Roundup, 17th July 2018

We begin today’s Weekly Roundup in the FT, with the Chart That Tells A Story. This week it was about farmland sales.

Contents

Farmland

James Pickford reported that the proportion of farmland being sold to farmers has fallen in the first half of 2018.

- There has been a corresponding increase in the proportion sold to private investors and lifestyle farmers.

The data comes from Strutt and Parker, who think that farmers are deferring purchases in the run-up to Brexit.

- It’s not yet clear what will replace the generous EU agricultural subsidies regime.

Farmland is also much more expensive than it used to be.

- Prices peaked in 2016 at £10K an acre, after rising for a decade.

Prices recently have varied widely, from £7K to £15, depending largely on the lifestyle attractions.

- Strutt and Parker feel that price pressures are less important to lifestyle investors.

Cereal has been selling better than dairy or mixed, and large farms (> 1,000 acres) have done better than mid-sized (500 to 1,000 acres).

Getting better

After the disappointment of the World Cup, Merryn tried to cheer us up with the news that life is getting better.

- It’s not really news, but she had some ONS stats which show that people get happier once they are past the age of 50.

It’s certainly been my experience that late 40s is the worst age to be.

She recommends some holiday reading to cheer you up:

[amazon template=thumbnail&asin=0241004314]

Stephen Pinker argues that rising moral standards mean that:

We become alert to harms that would have gone unnoticed in the past.

I’m tempted to put quotation marks around the word “harms”, but you get the gist.

[amazon template=thumbnail&asin=1473637465]

The late Hans Rosling has a book on a similar theme.

Merryn has three other recommendations, but these two are my choices.

Patience

John Lee is convinced that patience is the key virtue for a private investor.

- He missed out one a 10-bagger by selling Fenner too early.

- But he has held onto UDG Healthcare for a 16-fold increase over 24 years.

He also held on to Air Partner through an accounting scandal, and has been rewarded.

- And as regular readers of his column will be aware, he has stuck with PZ Cussons through thick and thin, with less reward

He has finally sold his ISA allocation to PZC, and reinvested the money in Air Partner, Charles Taylor and Tarsus.

Of the six stocks John mentions:

- FENR has recently been taken over.

- I have held AIR before, and might do again.

- I have also held UDG, which look less attractive at the moment.

- Tarsus doesn’t look too interesting, but Charles Taylor does.

- PZC looks very unattractive.

Before you retire

Lucy Warwick-Ching had a list of the big questions to ask before you retire.

Here they are:

- When you want to stop working?

- What do you want to do when you retire?

- How much will it cost?

- Where will the money come from?

- What are the tax considerations?

- Where do you want to live?

- What’s on your bucket list?

- Are your plans compatible with your partner’s?

All good stuff.

Platforms

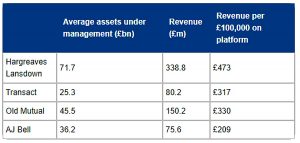

Kate Beioley had a couple of articles on fund platforms.

First, the good news:

- HL and Charles Stanley are looking to set up digital voting for nominee investors, to boost shareholder control.

- ShareSoc will be pleased.

Now, the bad news:

- HL charges more than twice as much on average as AJ Bell (0.47% pa versus 0.21% pa).

The even worse news is that this will never change until investors vote with their feet.

- HL as almost twice the assets under management that AJ Bell does.

Exorbitant privilege

John Authers looked at the “exorbitant privilege” enjoyed by the US, and therefore currently by Trump.

- This is because the dollar is the world’s reserve currency.

Added to that, investment funds tend to flow to the US in times of trouble, even if the source of that trouble is the US.

John cites the example of S&P’s downgrade of US debt from AAA in 2011.

- Money poured into US treasuries,instead of flowing away.

Today’s battle is trade.

- Since Trump has not made it clear what he wants in order to avoid tariffs, his trading partners will retaliate.

- Germany and emerging markets look most at risk.

With trouble ahead (thanks to the US), the investor reaction is to buy the US.

- Bond yields are down globally, an US Treasuries are the best of a bad bunch.

More buying will suppress yields, which reached 3.11% p in May.

- Lower yields support higher stock market valuations.

And there is also inherent demand for US “quality” stocks (those with growth and cashflow).

- Since the end of April, the US market has gained 10% against the rest of the world (which is now declining).

The downside of all this is that money flows to the long end of he yield curve, which flattens it.

- This is a necessary but not sufficient condition for the next recession.

Mean streets

Still in the FT, Nathan Brooker (who looks an unlikely chronicler of mean streets to me) tried to pin the rise in crime (particularly violent crime) on gentrification.

- Yet another spin on the “Society is to blame excuse”.

I obviously disagree with Nathan.

- I currently live in one of the more violent London boroughs

- And I previously lived through two waves of London gentrification (in two separate areas) during the 1980s and 1990s.

Neither were accompanied by a lot of stabbings.

- I’m sure there are much better explanations for the increase in violence.

Let’s be clear – gentrification is a good thing, and violent crime is a bad thing.

- Let’s have more of the former and less of the latter.

The FT continues its journey towards aping the Guardian.

Welfare state

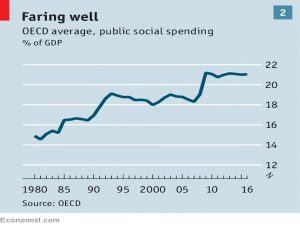

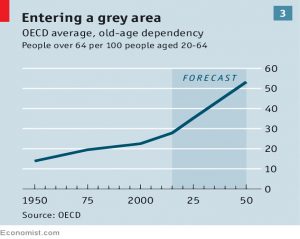

The Economist has two articles (1 and 2) on the welfare state, which they claim needs an overhaul in the face of immigration and ageing populations.

- The newspaper sees welfare as a liberal rather than a socialist invention, and so thinks that liberal principles can renew it.

They are right that the original intention was to give people security to pursue the lives they chose, rather than for the state to take over.

- But the key mechanisms were insurance against unemploment for working men (mostly men at the time), free basic medical care and a better state pension.

It was never the objective that generations should avoid work altogether, or that the cost of providing all these free services might rise to 40% of GDP (half of this goes on health and education, the other half on welfare and pensions).

The idea is that everyone should have enough to live on.

- But what is enough? Indeed, in this context, what is living?

The poorest in society today lead much richer lives than many of those in stable employment as recently as the 1970s.

- There’s not much incentive to take up entry level employment.

The Economist is in favour of a negative income tax (which we in the UK call an earned income tax credit.

- I don’t like this because much of the benefit goes to the employer, who can get away with lower wages (the minimum wage, in fact).

I’d prefer to see something like a job guarantee, where the state provides work in return for an enhanced level of benefits.

- I’ll investigate this in more detail in a future post.

To combat ageing populations, the obvious approach is to raise retirement ages.

- To deal with higher immigration, some benefits should be withheld initially (most likely unemployment pay rather than health or education).

I have no argument against either of those proposals.

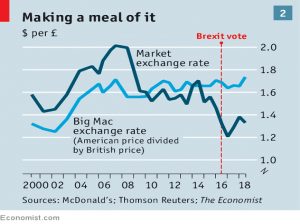

Big Mac index

The Economist has a new format for its Big Mac FX chart.

- The Argentinian peso is the biggest faller since the last visit in January.

Other big movers are Turkey, Brazil and Norway.

The pound is now 23% undervalued, having fallen heavily since the Brexit vote.

Half-year review

Buttonwood looked at index returns for the first half of the year and concluded that even the bulls are starting to become more cautious.

- The funny thing is that both camps prefer US assets- they are either where the growth is, or a safe haven (see John Authers’ article above).

So we could yet see a final flurry.

House price freeze

In the Guardian, Philip Inman reported on a proposal from the Institute for Public Policy Research that the Bank of England should specifically target zero house price inflation alongside 2% CPI.

- The mechanism would be via mortgage restrictions (higher deposits and lower loan to income ratios).

- The house price target would last for five years initially, and would then increase to the general 2% pa target.

This is a pretty direct attack on those who own property, with the ironic aim of making it possible for more people to own property.

- It wouldn’t affect me personally, as I think I have one more upward move in value left in me.

- And the bigger house would lose more in real terms than my current one.

But I do have doubts about how well the restrictions might work.

- What might happen to demand for an asset whose value can’t increase with inflation (at least for five years)?

- Perhaps the controls might trigger a real property price crash.

How would mortgage restrictions affect the top end of the market, where most people don’t have mortgages?

- And what about existing discrepancies between and within regions?

I think building more houses might be a better plan.

Investophobia

Scottish Friendly reported that half of British savers are suffering from “investophobia”. (( Thanks to Monevator for pointing me at this one ))

- They stick with cash despite rock-bottom interest rates – lower than inflation.

Loss aversion remains a powerful force.

Low rates for decades

On to a story that wasn’t widely reported.

- Sir Jon Cunliffe, BoE deputy governor (for financial stability) has admitted that the base rate could remain below 2% pa for decades.

Bank forecasts show little chance of a return to the “old normal”, with rates above 5%.

- But they simply reflect the yield curve, which could of course change.

Quick links

I have just two for you this week:

- Nick Train suggested that the success of value investing might have been a 20th century phenomenon.

- And Newfound Research looked at the magic number for momentum activation and holding periods.

Until next time.