Weekly Roundup, 26th April 2021

We begin today’s Weekly Roundup with a look at Bernie Madoff.

Madoff

Bernie Madoff, the perpetrator of a Ponzi scheme larger and more famous than Charles Ponzi’s original, died in prison earlier this month, aged 82.

- Like so many financial fraudsters, Madoff started out as a relatively good and successful guy. (( I read somewhere that Michael Milken made a legitimate $500M in the year before he decided to start using Ivan Boesky’s inside information ))

He started a brokerage with his brother and his father-in-law in the 1960s and was a big player in the creation of the pioneering electronic exchange NASDAQ (which he chaired).

- In the 1980s he switched to investment management, peddling a long/short options strategy designed to provide stock-market returns but with lower volatility (Madoff never provided the real details of how the scheme worked).

This result is in many ways the Holy Grail of investment (it’s certainly what I’m trying to do with my portfolio) so unsurprisingly it was quite popular.

Like all Ponzi schemes, it needed new investors to keep going, since it paid returns to the existing investors from the cash paid in by new ones.

- Madoff wasn’t really trading the options at all.

Ponzi’s original scheme (which used airmail stamps) lasted only a few months in the 1920s. Madoff’s scheme lasted for decades, for several reasons:

- Madoff didn’t actively promote the fund, or claim outsized return – he claimed a consistent 10% pa.

- Instead, he relied on exclusivity, and on referrals to friends of existing investors – including a lot of charities and a number of showbiz figures.

- He kept trading and custody operations within his firm and used tiny accounting and legal firms that he could rely on.

- He provided detailed, regular and professional-looking statements, and dealt quickly with withdrawals.

- Most people find the lack of empathy required to operate Ponzi hard to believe in, especially at the scale Bernie was operating at, and from someone posing as a philanthropist.

Madoff came a cropper in the 2008 financial crisis when investors needed to withdraw money to cover losses in more volatile instruments.

- Madoff confessed to his sons, who turned him in and he got 150 years in jail.

His request for compassionate release in 2020 – when terminal kidney disease was diagnosed – was refused.

- At least two of his investors committed suicide, and both of his sons pre-deceased him (one from suicide, one from cancer).

At the time he was caught, Madoff’s fund had $200M in cash, representing $64 bn of hypothetical account balances.

- Since then around $12 bn has been paid out, with $5 bn still to payout.

Total losses are around $17 – $25 bn (since the $64 bn included mythical profits).

- Some who cashed out early have been made to surrender their “profits”.

Madoff’s firm was investigated eight times by the SEC without More than a couple of people spotted that something was up, including Harry Markopolos and Erni Arvedlund, each of who wrote books about it.

Richard Butler of ING said:

For years we looked at Madoff’s record and marveled at his low vol strategy.

Great Sharpe and Sortino Ratios using liquid stocks easy to margin.We had always insisted on requiring the assets and record keeping to be at a third party custodian – pretty normal stuff. He always was very polite in throwing us out of his office when we wouldn’t budge from that.

John Authers quotes a reader’s response to his “appreciation” of Madoff:

Our compliance group asked him 3 questions: 1. Who is your law firm (2 man

shop)? 2. Who is your accounting firm (2 man shop)? 3. Where are the assets

held (“we hold them”)?In 5 minutes they figured him out … and the U.S. Government could not.

Ed Thorp, who amongst other things beat the casinos at blackjack, noticed that many of the trades Madoff claimed were in instruments with zero volume that day. Thorp said:

I waited year after year after year for it all to blow up. One reason it didn’t was that he was a pillar of the establishment. And he had all these people steering money to him, charging fees. He wasn’t charging fees himself, which was another big red flag.

Remember folks, if it looks too good to be true, it is.

Vanguard advice

Vanguard has launched what they are describing as a financial advice service with an all-in fee of 0.79%.

- That breaks down as 0.15% for their platform, 0.14% for their funds and 0.50% for the advice.

- That’s a discount on the regular fund fee (or a lower advice fee, whichever you prefer).

You need a £50K portfolio to access Vanguard Personal Financial Planning, which gets you an annual review of an online plan.

- At £100K, you get the phone and video support and at £750K you get face-to-face advice.

Advice fees are expected to fall as the service grows (the similar service in the US has tiered fees).

But since you are locked into the Vanguard platform (and the service only looks at retirement savings), it’s not comparable to using an IFA.

- It’s more like the bancassurance days of the 1980s and 1990s when the high street banks would make appointments with in-house advisors to ensure that their current account holders took out ISAs (or PEPs in those days) using the bank’s own managed funds.

The present-day equivalent is something like a robo-advisor, where you take a risk questionnaire in order to be pointed at the appropriate ready-made portfolio.

- In Vanguard’s case, you might speak to a real human (though reports suggest that a lot of the service will be moved online) but you’ll still be pointed at a subset of the firm’s funds.

This looks like the process used by an IFA, but with IFAs the fees are much higher and there is the illusion that you are receiving a bespoke solution.

- Usually, you aren’t – most IFAs use ready-made portfolios on a single platform, and many outsource the investment process entirely.

IFAs don’t focus on investment, they focus on regulation and psychological hand-holding for clients.

- This is why almost nobody needs to use an IFA – you should become a DIY investor instead.

Sean Hagerty, Vanguard’s head of business in Europe said:

For some investors, the cost of advice is a barrier. Annual fees for retirement savers north of 2% are not uncommon in the UK. With people living and working longer, these costs can make a considerable dent in their hard-earned retirement savings.

This is true enough, except that you probably don’t need the advice, and you definitely don’t need to pay those fees.

- Most people can learn to manage their own portfolio at a cost of between 0.3% to 0.4% pa.

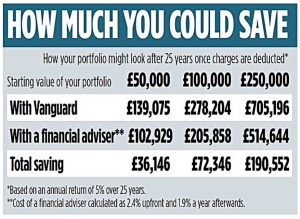

This is money put together a table (above) showing how much Vanguard might save you – when compared to an expensive provider like St James’ Place.

- What’s missing from the table is the column for a DIY investor at 0.35% pa in fees.

Hagerty said that Vanguard will be clear about when extra advice is needed:

[If a potential client needs advice we cannot offer] we might say our advised proposition is not for you. We will be very clear about that. For example if someone asks us about a defined benefit transfer, we will say we just can’t serve you.

Interestingly, Vanguard doesn’t seem to be setting itself up in opposition to IFAs. Hagerty said:

[We are] 100 per cent committed to working with advisers, not against them. What I would say to advisers is that we are here to work with you to expand the market, to give great advice to a lot more people.

We would be foolish to think we can go out and think we can take share away from our adviser clients. We will work with [those] clients who are a little bit worried about it to find out how we can decrease overall cost.

The smaller advice firms are more our collaborators. They are very alive to Vanguard’s value proposition. They believe what we believe. We want to be able to serve clients and have a high satisfaction level. Growth takes care of itself then.

I would rather be top rated than biggest. Size isn’t that important to us. We really want this to be something that helps the entire market. We believe there is an opportunity for the entire UK advice market to be bigger and better.

If it helps UK savers it will expand the entire market. The industry wins when savers

win.

Industry commentators seem to think that Vanguard’s entry into this market is a big deal, but DIY investors can safely ignore it.

- With a bit of luck, the hoo-hah will make more people realise how expensive financial advice is, and convert more people to the DIY cause.

ETFs in IA sectors

From last week, more than 530 ETFs are being included in the Investment Association’s (IA’s) sector lists of investment funds.

- Only physical replication ETFs – those who actually own the underlying assets they are

tracking – are eligible for inclusion in the IA sectors; synthetic ETFs are not eligible.

At the same time, the global bond sector has been split into 14 sections, based on the type of bond, credit type and currency.

- It has been planned to include ETFS from last year, but so many bonds funds applied that the new sectors were needed.

The new list has 52 sectors and more than 4000 funds.

- Eleven providers have submitted funds: Amundi, BlackRock, Fidelity, First Trust, Franklin Templeton, HSBC, J.P. Morgan, Legal & Genera, Lyxor, Vanguard and XTrackers.

The Specialist and Global sectors host the most ETFs, with 79 and 71 respectively.

Jonathan Lipkin, IA Director for Policy, Strategy and Research, said:

We continually monitor the fund market to ensure all IA sectors reflect the wide range of products the investment management industry has to offer UK savers.

ETFs are a rapidly growing part of the UK fund market. Their inclusion in the IA sector framework recognises this, helping savers and their advisers to make comparisons and choose funds to meet their long-term financial goals.

Laith Khalaf, formerly of HL and now with AJ Bell, said:

[This is] another step into the mainstream for ETF investing in the UK. It will bump up the visibility and comparability of ETFs, and provide a further competitive challenge to active funds and index trackers.

ETFs can be useful to give investors more specialised exposure to particular themes

in the market, which active and index funds don’t tend to cover in such a focused way. As ETFs rise in profile, more investors will likely join the growing throng of converts, and their inclusion will only serve to accelerate that trend.

Drawdown charges

Regular readers will know that I have a lot of problems with getting money out of my pensions.

- UFPLS withdrawals usually require multiple paper forms to be returned, and then HMRC takes a punitive tax cut upfront.

One problem that I haven’t had is extra charges for withdrawals.

- The two platforms I’ve used to date treat decumulation in the same way as accumulation, as I would expect.

But Dominic Lindley of think tank New City Agenda has called for the FCA to extend the 0.75% cap on auto-enrolment workplace pensions into drawdown:

Most people without access to advice take the path of least resistance, and there

is very limited shopping around and switching. The Financial Conduct Authority has a lot of faith in disclosure [of fees].We need to help as many people shop around as possible but also protect those who don’t or can’t shop around. Regulators need to set clearer standards for drawdown products including default investment, communication and withdrawal pathways and a charge cap.

According to Josephine Cumbo in the FT:

Analysis of 28 drawdown providers last year by Which?, the consumer campaign

group, found DIY investors could, in total, expect to pay between 0.5 per cent and

1.25 per cent in annual charges (including fund fees) for pension drawdown.

That’s higher than the typical 0.48% pa in a workplace pension, but about average for DC pensions in general.

- DIY investors should do much better, including in drawdown.

Quick Links

I have six for you this week, the first four from The Economist:

- The newspaper tried to make sense of the SPAC spectacle

- And warned that Darktrace’s float will test London’s market

- The Economist also wrote about the oil supermajors’ mega-bet on natural gas

- And reported that UiPath is Europe’s most successful tech export since Spotify.

- Musings on Markets wrote about Fact and Fiction in the Corporate Tax burden

- And Alpha Architect explained how to build a better q-Factor Asset Pricing Model.

Until next time.