Weekly Roundup, 4th May 2021

We begin today’s Weekly Roundup with Nutmeg.

Nutmeg

Nutmeg now has more than £3bn in assets under management.

- Clients are up 53% YoY to 1Q21, to 130K – I make that an average balance of £23K.

- Net inflows are up 230%

According to Alt-Fi, this makes Nutmeg the UK’s fourth-largest wealth manager overall.

But it’s still losing money – £21M in 29198, up from £18M in 2018.

- Nutmeg says losses in 2020 were 30% smaller, implying a £15M loss.

CEO Neil Alexander said:

While the last year has been financially difficult for many people, we have also seen many new and existing clients who have been fortunate enough to have more disposable income as a result of reduced expenditure on leisure, hospitality, commuting and holidays.

Nutmeg has been a beneficiary of this shift, welcoming tens of thousands of seasoned investors wanting to take advantage of a digital-first wealth management service.

They are still too expensive for me, however, charging 0.68% for a basic ETF portfolio.

- The managed service comes in at 0.99% pa.

You can do something similar for yourself for less than 0.4% pa.

Crypto news

On Citywire, Gavin Lumsden reported that Scottish Mortgage (SMT) has invested £72M in Blockchain.com, which is apparently the UK’s biggest cryptocurrency company and was founded by an ex-Coinbase employee.

- Blockchain raised $300M in March and Baillie Gifford is now its largest external shareholder.

- The firm has raised a total of $490M in six rounds since August 2014.

SMT now has £3.3 bn (17%) in 45 unlisted companies, of which just 0.4% is in Blockchain.com.

Gavin also said that Brevan Howard (who manage the BH Macro and BH Global funds) was planning to follow Ruffer into bitcoin.

John Authers wondered whether Coinbase’s listing might pop this year’s crypto bubble.

- It certainly looked that way last week, with BTC and ETH down 20%, but they have both come back this week (to new highs in the case of ETH).

Coinbase is a big moment for the emerging crypto world. Many of those sinking money into the stock are the same people holding (or hodling) bitcoin.

Commentary surrounding Coinbase has been almost all about legitimacy and the notion that the crypto world has received an endorsement, rather than about growth, or fears of overheating.

Why should this be a problem? Because when the most exciting thing to be said about an investment is that it has matured, the chances are that the excitement is over.

John draws an analogy between the crypto exchanges and the picks and shovels suppliers to the gold rush.

In a second article, John looked at whether bitcoin might displace gold as an inflation hedge.

- I think this is largely a generational issue, and not always about inflation.

Old guys like me, who remember inflation, are still biased to gold.

- Young people prefer bitcoin, but they see the attraction (1) in terms of price appreciation and (2) in terms of protection from currency devaluation (specifically in the dollar) – they don’t think too much about inflation (yet?)

Like gold, [the] value [of bitcoin] is in the eye of the beholder. It has no intrinsic value, and while the same is true of banknotes, it has no government standing behind it.

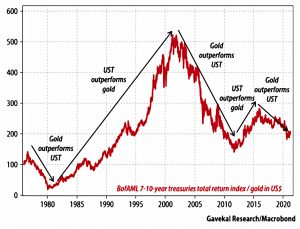

John provided a chart of gold versus Treasury bonds.

Treasuries beat gold when people aren’t too worried about inflation, while gold wins when there are inflationary concerns. Except at present, both are falling.

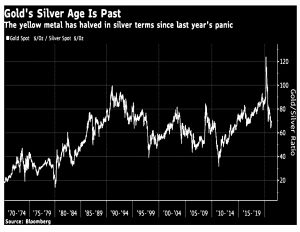

John also compares gold to silver.

Gold is generally thought of as an inflationary hedge, but if we judge it instead in terms of silver, we see that its price has roughly halved since the Covid panic last year.

Gold has grown steadily more expensive relative to silver since the bizarre year of 1980 when prices of both precious metals went bonkers. The last year has seen a spike and then a reversal for the ages.

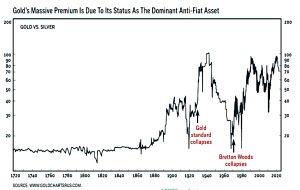

Long-term, demand for gold over silver seems to be driven by its “anti-fiat” properties.

- So one explanation for the sudden fall over the last year is the rise of bitcoin as an alternative.

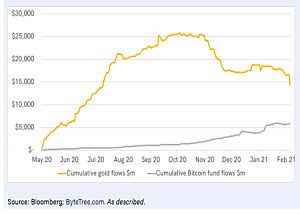

Flows in and out of the two assets offer some support for this idea.

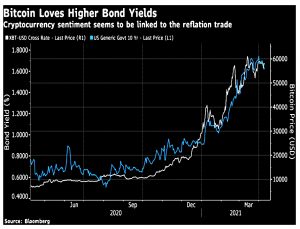

The bitcoin price has also been closely correlated with the rise in bond yields (with, as John points out, massively different levels of volatility).

This implies that the digital currency benefits directly from the “reflation trade” — or the belief that inflation is coming.

John reaches the same conclusion as me:

The current drive in bitcoin looks like a bid to protect against currency debasement, by means of a measured transfer from gold, which is deemed the weaker anti-fiat asset for the moment.

But an anti-fiat asset should generally avoid big losses, whereas these happen regularly with bitcoin, and less frequently and severely with gold.

As bitcoin’s declines tend to be three times bigger, risk can be equalized by holding three times as much gold as bitcoin — which implies buying more bitcoin from here.

That sounds reasonable to me – if you have 3% in gold and precious metals, perhaps you should be thinking about added 1% of bitcoin. (( Strictly, you should sell 0.75% of gold into probably a mix of 80% BTC and 20% ETH ))

More fintech

I came across a new robo-advisor last week – ikigai (Japanese for “a reason for being” – quite a lofty ambition for a robo).

- They offer ETF portfolios (from 19 somewhat overlapping asset classes, and apparently from BlackRock) and to be extra confusing, quote their charges by the month.

The five portfolios are called Walk, Run, Rise, Fly and Soar.

- Equity allocations range from 12% to 72%.

- The only non-stock/bond/cash investment is gold, to a maximum of 6%.

The portfolios include features like automatic rebalancing, dividend reinvestment and fractional shares.

ETFs average 0.025% per month, or 0.3% pa.

- Custody (effectively the platform fee) is 0.01% per month, or 0.12% pa.

The total of 0.42% pa sounds good, but there’s also a £10 a month account fee.

- So on an ISA level account of £20k, fees would be £204 or 1.02% pa. (( Note that they don’t seem to offer an ISA at present ))

At the £85K UK compensation limit, this falls to 0.56%.

- Which is still too expensive for me.

In the Alt-Fi newsletter, Daniel Lanyon claimed that we were in the midst of the neo-broker wars.

- Bitpanda, an Austrian crypto unicorn is apparently now offering a stock and ETF service.

I’ve looked at Bitpanda for buying crypto, and they were the third-cheapest of 24 brokers, at 0.15% per transaction.

- The stock app is in beta at the moment, but it seems to offer commission-free fractions of stocks via derivatives (from BNP Paribas).

- They claim “tight spreads”, but also state that these can be varied according to “market conditions and trading amount” – the maximum spread increase is apparently 0.5%.

On the surface, this sounds like CFDs – but BitPanda says they will buy the underlying stocks and store them with bank custodians.

- It’s a very short list of stocks and ETFs at the moment, as per the Freetrade free tier but with the addition of a lot of crypto assets.

Here’s the tax statement:

Since it’s possible that your investments can generate income and capital gains, there might be tax implications that you should be aware of. These implications depend on the tax rules of the country in which you are considered a resident for tax purposes. It is your responsibility to understand how to declare and pay taxes.

It seems safest to assume we’re dealing with a taxable account (GIA).

The other neo-broker mentioned by Daniel was Bux, who I hadn’t come across before.

- Bux seems to focus on US and EU stocks, with free trading in the US and €1 commissions on Euro stocks.

FX charges on US stocks are 0.25%, which puts them behind Stake and Trading 212.

- T212 charges 0.15% per trade, and Stake charges 0.5% only on cash in and out of a dollar account.

At the moment this is academic, as the app doesn’t seem to have arrived in the UK yet.

A Boring Money survey of 65,00 investors has found that newbies (who started less than a year ago) prefer Trading 212 to Hargreaves Lansdown.

- T212 has 25% of this market, with Moneybox at 10% and HL third.

HL remained the favourite with investors who had between 1 and 10 years of experience.

Holly Mackay from Boring Money thought that these new investors were being too risky by just investing in stocks.

- T212 doesn’t offer OEICs, though it does trade in ETFs.

CFDs are also available (though not spread bets nor actual crypto, as the original article claimed).

Yale endowment model

In the FT, Aziza Kasumov said that the architect of the Yale endowment model has called time on it.

- Hunter Lewis – who I hadn’t heard of (( He should perhaps have a word with David Swensen about sharing the glory )) – says that the model ios “backwards-looking, outdated and worn out”.

Lewis is co-founder of Cambridge Associates, who advise on half a trillion dollars of institutional assets.

The model is defined by a heavy equities weighting and chunky allocations to private equity, venture capital and hedge funds. It was widely adopted, including by pensions funds, private foundations and family offices.

Lewis thinks that PE and VC are too crowded and that fees have swallowed up the “illiquidity premiums”. PE returns have converged with those from listed equities:

For the period ending June 2019, the S&P 500’s 10-year annualised performance beat buyout funds for the first time in a decade.

I feel I have to point out here that excess returns are not the only attraction – uncorrelated returns can help even if they are slightly lower.

Lewis said:

It doesn’t mean that individual private equity deals don’t make sense because they

can. But as an area . . . the fees are too high. The competition is too great.

He points out that Yale (which made the model famous) can access the very best deals, which the rest of us can’t.

- He also said that investors will need better inflation hedges in the future.

Quick Links

I have seven for you this week, the first five from The Economist:

- The newspaper asked why American workers are becoming harder to find

- And reported that developers are struggling to meet the demand for e-commerce storage space

- And described how TSMC has mastered the geopolitics of chipmaking.

- The Economist also said that it was time to bet on microchips

- And explained the magic realism of Tesla.

- Alpha Architect looked at market timing using aggregate equity allocation signals

- And Disciplined Systematic Global Macro Views wrote about what break-evens and real rate changes tell us about market regimes.

Until next time.