Weekly Roundup, 2nd May 2017

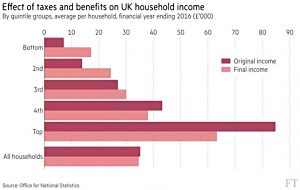

We being today’s Weekly Roundup in the FT, with the Chart That Tells A Story. This week it was about the effect of taxes and benefits on net incomes.

Contents

Taxes and benefits

Vanessa Houlder looked at ONS stats that showed the effects of taxes and benefits on net UK incomes by quintile.

- Pre-tax incomes for the top quintile were £85K, while the bottom quintile earned £7K – a ratio of 12 to 1.

- Net incomes (including benefits in kind like schools and hospitals) were £63K for the top quintile and £17K for the bottom quintile – a ratio of 4 to 1.

The top half of the population pays more in taxes than they receive in benefits, which sounds about right.

- Benefits and tax credits make up more than half of the net income of the poorest quintile.

Benefits have a bigger impact on redistribution than taxes.

- This is mostly because consumption taxes like VAT and fuel duty mean that the poor – who spend a higher proportion of their income than the rich – pay a larger proportion of their income in tax than do the rich (38% vs 35%).

Direct (income) tax was 23% for the rich and 11% for the poor.

- Indirect taxes were 27% for the poor and 14% for the rich.

Indirect tax is flat when households are ranked by spending rather than income.

- Poor people often borrow during hard times, which enables them to spend a larger proportion of their gross income.

Inequality is now at its lowest level since 1986, though looming benefits cuts mean that this will likely change in the future.

Luck vs skill

We look at two articles from Tim Harford this week, as I somehow managed to miss his piece from last week.

This was about the role of statistics in CEO prize-winning.

- The context was the row about the doctor physically dragged from a United Airlines flight.

- United’s CEO Oscar Munoz had just won a prize for Communicator of the Year, but his internal memo criticising Dr. Dao was not well received.

Tim quotes some other ill-timed awards:

- The Kemper Arena in Kansas City won an architecture award, and the American Institute of Architects then held its annual convention there in 1979; hours after they left the roof collapsed.

- Claudio Ranieri won Leicester’s first league title in 100 years of trying, following by the global Manager of the Year award; he was sacked months later.

Tim offers several reasons for these reversals:

- There are lots of awards

- So there are lots of winners famous enough to make the headlines when they screw up.

- Reversion / regression to the mean (in fact, to far below the mean) from outperformance.

- You can think of this as good luck followed by bad luck.

Tim says this is why installing a speed camera usually seems to work

- the accident rate bad enough to provoke the installation will have been partly down to bad luck.

He quotes Kahneman’ findings that instructor’s praise for good performance during training can lead to lower performance in the future.

- Similarly, shouting at a student for bad results can appear to lead to an improvement.

The curse of the magazine cover has been well-known for decades, and the curse of the award falls into the same category.

- I’m also reminded once again of the “great” companies featured in my MBA textbooks of the 1990s that subsequently stumbled.

In financial markets, this means that we need to beware of fund and managers with good recent track records – they may be due a fall.

Woodford

As luck would have it, the FT had an article (by Aime Williams) on the struggles of Neil Woodford.

- After a period of underwhelming performance, his Patient Capital fund has changed its rules to allow more unlisted investments.

- And his new UK equity income fund (he already has one of these) raised only a third of the money that the first one did.

Patient Capital has suffered through the performance of investments like IP group Allied Minds and pharma firm Circassia.

- It’s now almost 14% behind the FTSE All-Share index since its launch in April 2015.

His Equity Income fund has roughly kept pace with the index.

- But January and February 2017 saw the fund’s first ever two month run of net redemptions, with £50M withdrawn from the £10 bn fund.

Some analysts have criticised his large unquoted positions (9% even in the equity income fund for example).

Fundsmith

In Money Observer, Marina Gerner reported on a fund manager who is doing a bit better – Terry Smith of Fundsmith.

- The popular open-ended Fundsmith Equity fund is up 32.7% over one year and 98.4% over three years.

- The Emerging Equities IT (FEET) is up 16.2% over one year, just behind the MSCI EM index (17.2%)

With FEET, he’s tapping into the EM consumer growth story.

- Interestingly, he much prefers India to China.

In the article, Terry explained what he looks for in a company:

- high ROCE

- growth driven by investment of positive cash flows

- competitive advantage (a hard to replicate “moat”)

- lots of small, everyday, repeated, predictable transactions

Sounds good to me.

Bank holidays

Tim Harford’s second article was about bank holidays.

- Labour leader Jeremy Corbyn has proposed four more of them.

The UK currently has eight bank holidays:

- three at Xmas / New Year, two at Easter and three “random” Mondays (two in May, one in August)

- So this is a proposed 50% increase in Bank Holidays.

But since the typical working year is currently 232 days (assuming four weeks of holiday), this only represents a 1.7% decrease in the working year.

- So we would only need a 1.7% increase in productivity in order to cope.

- This is a far cry from the 25% increase needed to deal with the Green’s recent proposal that we should move to a four-day week (with five days’ pay).

I’m confident that UK workers are not so far under the cosh that they couldn’t get their jobs done in 98.3% of the time.

- It won’t be great from freelancers, who would need to raise their rates a little.

Tim notes that the French get more done than us in less time, and also that the working year is inversely correlated with productivity across OECD countries.

He points out that if shorter working weeks were good for companies, their bosses should adopt them voluntarily.

I think this might be ascribing too much intelligence to management, but Tim uses the helmet argument as a possible explanation:

- Ice hockey players wouldn’t voluntarily wear helmets because the reduced visibility would put them at a disadvantage.

- But when helmets are compulsory, safety is increased without disadvantage to anyone.

This ties in with the theory of money as a positional good:

- it’s not how much you have, it’s how much you have relative to everyone else.

I worry most about where the holidays would go.

- Tim points out that the most value would be added by letting us choose when to take our extra days.

- Leisure is cheaper and easier when everyone else is working.

But the Labour proposal is about national unity, so we’ll all be getting the same day off.

We’ve just had another damp squib of a bank holiday, and there’s almost no such thing a reliable UK weather these days.

August and half of July are taken up by the school holidays, so we would ideally have to stuff two into June and two into September.

Of course, Labour has no such plans:

- They want the holidays to be on the Patron Saint’s day for each of the UK’s four constituent nations.

- That gives us 1st and 17th March, 23rd April and 30th November.

These are not vote-winning dates, but since when has that bothered Jeremy.

Bark vs bite

John Authers took a look back at Trump’s first 100 days.

- He decided that while the markets are no longer so optimistic about the President’s plans, they still don’t see him as a obstacle to progress.

John began with three caveats:

- 100 days is too short a time to judge an investment ((The tradition comes from FDR setting this period as a target on which to be judged way back in 1933 ))

- the president has less influence than the chair of the Fed

- opening price is crucial (Obama started at the bottom of a bear market)

Stocks are still beating bonds, so the reflation trade (now known as the “Trump trade”) is still on.

- The S&P beat 10-year Treasuries by 15% between the election and the inauguration.

- The gap has increased by another 3% since then.

But emerging markets (geared plays on global growth) tanked after the election on fears of trade wars.

- This has now reversed, with markets confident that what is good for the US will also be good for EMs.

The outperformance of high-tax S&P 500 firms (which would benefit from corporate tax cuts) has reversed.

- The failure to get changes to healthcare passed by Congress means that investors don’t believe that the tax cuts will be implemented either.

Finance bill

in FTAdviser, Emma Hughes reported on what was removed from the Finance Bill in the light of the general election, and the need to push it quickly through parliament.

- The cut in the money purchase allowance for those already drawing their pensions – from £10K pa to £4K pa – has gone.

- So has the reduction in the dividend allowance (from £5K to £2K)

- The “digital tax” proposal to make people fill in continuous tax returns online was also removed.

- As have the trading and property income allowances (£1K each).

But they will all come back “at the earliest opportunity” if the Tories win the election.

- And they will probably apply retrospectively, if precedent is anything to go by.

Means-tested pensions

In the Guardian, Angela Monaghan looked at a recommendation from the OECD that the UK should axe the state pension for “the rich” and spend the money on more benefits for the poor.

- They would like the richest 5% to 10% to lose the pension.

As we’ve said before, despite the triple lock, the UK pension is one of the lowest amongst the 35 countries of the OECD.

- You’d never think that from reading the headlines in the mainstream media.

The OECD idea is a bad one.

- We have a contributory insurance structure in this country – 30 years of work and NICs means that you get a pension.

If you replace that system with a means-tested one, high earners will want to opt out.

- And political pressure will mount to let inflation wither away the value of the state pension once again.

I think the triple lock will go after the election.

- But if it’s replaced with a double lock of inflation and earnings, that shouldn’t lead to any problems in the next few years.

Capping energy prices

A lot of people see similarities between May and Thatcher, but I don’t.

- Thatcher used her 1980s landslide to pass a genuinely radical agenda.

- May will use hers to steal the centre ground from Labour, and finish them off for good.

She has more in common with Blair than Thatcher.

The latest example came with last week’s announcement that the Tories were nicking a bad idea off Labour (and Ed Miliband, no less) – capping energy prices.

High energy prices are unpopular, but they have more to do with EU rules on contributions from renewables (which we will soon be able to escape), and NIMBY opposition to fracking than they do with price gouging.

- Throw in higher duty levels and you’ve explained why energy in the US is half the price it is in the UK.

The problem with UK energy firms seems to be that lower tariffs are offered to new customers than to loyal ones.

- So you need to switch regularly to get a good price.

This is easy to fix without a price cap.

- Prices should be controlled through regulated competition, not Soviet price-fixing.

The real danger with a price cap is that as underlying prices continue to rise faster than inflation, larger and larger interventions will be needed.

- This will make the industry less profitable and less willing to invest, leading to a vicious circle.

Rather than a cap, what is needed is a credible long-term energy strategy, to avoid reliance on imported supplies at prices driven by fluctuating exchange rates,

Minimum wage

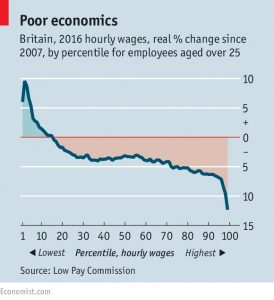

The Economist thinks that a £10 per hour minimum wage is not the best way to help low earners.

- Current plans only stretch to £9 by 2020 (from £7.50 per hour today).

- But Labour is expected to include a £10 per hour commitment in its manifesto.

At some point, rises in the minimum wage should increase unemployment, as they have in the US.

- But the UK hasn’t reached that point yet.

The Economist prefers in-work tax credits to a higher minimum wage.

- But two-thirds of the benefit from these goes to the employer.

- So that looks like corporate welfare to me.

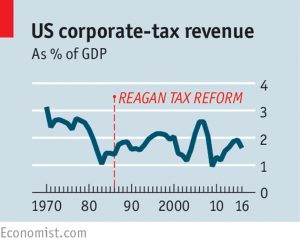

Trump’s tax plan

The Economist also had a couple of articles (1 and 2) on Trump’s tax plans.

They note that the US tax system doesn’t really work:

- Generous allowances undermine high headline rates so that not much money is collected.

- $1 trn is stashed abroad by US firms to avoid taxation.

Reagan managed to cut rates and increase the take back in 1986, but can Trump?

He wants to cut the corporate rate from 35% to 15%.

- Some deductions will be abolished, but funding this depends on a one-off cut of repatriated cash, and then economic growth.

- And extending the 15% rate to small firms will cause high earners to incorporate, hitting income tax.

The alternative minimum tax (which hits rich people) and the estate tax (which kick in at $5.5M in the US, compared to £325K in the UK) would be abolished.

So overall, the cuts will mostly benefit the rich and will largely be paid for by more borrowing (perhaps 1% of GDP per year).

ETFs jump the shark

Buttonwood thinks that ETFs have jumped the shark. (( This is the point in the life of a TV show when it sacrifices plausibility for popularity – the name comes from an episode of Happy Days when the Fonz did a water ski jump over a shark ))

Assets in ETFs passed $3 trn in 2016, up from $715 bn in 2008.

- So their providers ought to have benefited.

But the new ETF is too focused on the financial sectors, and many of the providers have much wider exposures.

- The second-largest provider (Vanguard) is structured as a mutual and owned by its own funds.

And it’s a leveraged bet on the fortunes of ETFs, with echoes of the spit-capital investment trust and sub-prime mortgage crises.

A good current example of feedback effects is the VanEck Junior Gold Miners ETF.

- This is so popular that it now owns close to 20% of many of the small Toronto-listed miners it invests in.

- Toronto rules mean that a 20% holding automatically triggers a bid (it’s 30% in the UK).

- So the ETF has had to increase the size of companies it invests in.

Money in the bank

And finally, a new paper (( Hat-tip to Monevator for bringing this to my attention )) shows that money in the bank is a better predictor of life satisfaction than income.

I think we all knew that, didn’t we?

- So get saving

Until next time.