Weekly Roundup, 17th January 2023

We begin today’s Weekly Roundup with China.

China

The Economist looked at how the reopening of China might disrupt the world economy.

- A second article added more detail.

For three years, China’s “zero-covid” policy has looked the country off from the rest of the world.

Within China, the reopening will be tricky:

Although the zero-covid policy saved many lives when it was introduced (at great cost to individual liberties), the government failed to prepare properly for its relaxation by stockpiling drugs, vaccinating more of the elderly and adopting robust protocols to decide which patients to treat where.

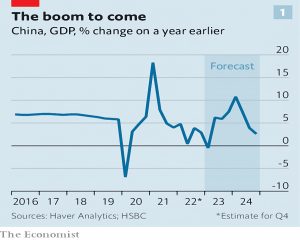

This could hit the Chinese economy, but at some point in 2023 it should rebound.

Some economists reckon that GDP in the first three months of 2024 could be a tenth higher than in the troubled first quarter of 2023. Such a sharp rebound in such a huge economy means that China alone could power much of global growth over the period.

But it’s not all good news:

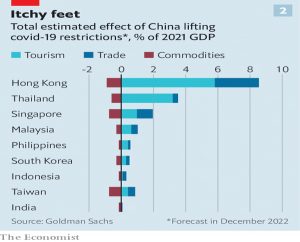

China’s recovery will have painful side-effects. In much of the world it could show up not in higher growth, but in higher inflation or interest rates.

Commodity importers (ie. most of the West) are most at risk.

- Oil might plausibly rise by 25%, to more than $100 per barrel.

Gas will also be in greater demand, which might mean problems for Europe next winter.

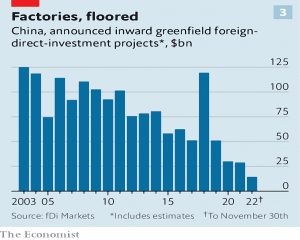

We won’t get back to the pre-covid status quo in manufacturing, either:

Foreign firms are less confident that their operations will not be disrupted. Many are willing to pay higher costs to manufacture elsewhere.

In the FT, Rafe Uddin wrote that shareholder participation is on the rise in the UK.

- Interactive Investor has reported a 30% increase in shareholder voting, with a total of 210K votes cast.

At the same time, since ii moved to an opt-out system for voting, the take-up fell in percentage terms.

- Only 8% of the wider group now seeing the corporate actions voted, compared to 14% of the smaller opt-in audience in 2021.

Richard Wilson, CEO of ii, said:

Private investors can have a powerful collective influence over a company’s conduct and future direction through their vote, should they wish to use it. Sometimes, you just need to remove barriers and red tape.

I must admit to rarely voting since in most cases the votes of private investors won’t matter.

- Perhaps the way ahead is for the big fund managers (who own most of the shares) to poll their investors on how they should vote (using some form of proportional representation, otherwise the same “wasted vote” argument would apply.

But then we might end up with several votes per day.

The dollar

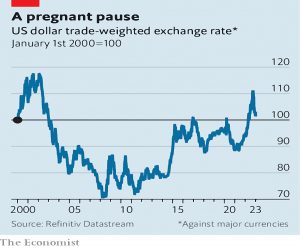

Buttonwood was worried that the dollar could give investors a nasty surprise.

Last September the DXY, a gauge of the dollar’s strength against other currencies, was at its highest in 20 years. Since then, the greenback has weakened: it is now 10% below its recent peak.

This is generally seen to be good news, as a strong dollar can cause problems (outside of the US):

Poorer countries tend to borrow in the currency. When it strengthens, these debts become heftier. Even in rich countries, where governments mostly issue debt in their own currency, a stronger dollar squeezes corporate borrowers.

Commodities are also quoted in dollars, so a strong dollar makes them more expensive for non-Americans.

- And even for Americans, exports become more difficult as US products become more expensive (though imports are cheaper).

Buttonwood doesn’t think the relief will last:

Throughout 2022, America’s Federal Reserve raised rates higher and faster than other central banks. This made the dollar a good target for a “carry trade”: selling a low-yielding currency to buy a high-yielding one and pocketing the difference.

The Russian invasion of Ukraine and China’s zero-covid policy also made the US a safe haven.

- Plus the US economy is in good shape, partly because it’s an energy exporter.

China is opening but the war is not over and the Fed says it will hike further.

- Even a US recession could signal a global one, and enhance the safer haven properties of America.

Yet the best argument that the dollar will strengthen is investors’ conviction that it won’t. In Bank of America’s recent survey of fund managers, a near-record proportion thought that the greenback would weaken. It is difficult to imagine that at least some of these bets have not already been placed.

Which leaves lots of scope for a rise.

- Markets like to go in the direction that will cause the most pain.

CGT

In the FT, ShareSoc director Cliff Weight called for CGT reform.

- This article is strangely-timed, given the recent announcement that the CGT allowance will be cut from £12K this year to £6K next year, and to £3K the year after that.

Private Investors need to come to terms with a lack of support from governments of all flavours and to take advantage of remaining tax shelters while they still can.

Cliff makes a couple of valid points:

- company takeovers lead to forced sales which can trigger CGT liabilities

- CGT calculations can be complex and require good record-keeping

He would like to see rollover relief introduced so that the proceeds from the sale of individual shares could be reinvested without triggering CGT.

- This would put direct share investing on a level footing with collective investing.

He would settle for a reduced rate of GCT on reinvested proceeds.

- Unfortunately, I don’t think he will get either option – people rich enough to invest in shares directly are nobody’s priority for the foreseeable future.

Crypto

The Economist wrote about the hunt for the missing millions of FTX.

- SBF has asked for $500M of frozen assets to be thawed so that he can use them to pay for his legal fees.

The bankruptcy proceedings could take a while.

America’s bankruptcy laws have evolved over centuries to pick apart regular businesses. Now, on the fly, lawyers must work out how to apply them to crypto companies.

A complex but regular bankruptcy might involve 100 creditors and last a year or two.

FTX may have as many as 9m creditors.The firm’s breakdown has left 134 insolvent entities in 27 jurisdictions.

The case may last a decade. To begin with, not all creditors will come forward.

For many, the attraction of storing wealth this way [in crypto] is its facelessness. Lodging a claim requires an id check, so creditors must decide quite how deep their desire for privacy runs.

Investors, who include some of tech’s most illustrious funders, are also reluctant to fess up to their involvement. The court has agreed to keep ftx’s 50 biggest creditors under wraps.

Nor can the assets be easily located:

- record-keeping was terrible

- billions were lost in Alameda’s trading activities

- the Bahamas wouldn’t cooperate for a while

- John Ray, the new CEO wants to sue for donations to politicians and effective altruism charities

And there hasn’t been a big crypto bankruptcy before.

Stocks have certificates of ownership; chairs are sat on by their owners. In contrast, the law does not enforce crypto ledgers and recording something on a blockchain does not conjure a physical coin. Tthe judge in another crypto bankruptcy ruled that some of the customers lack ownership rights over their deposits.

And then there is the matter of paying out what is recovered.

Most of FTZ’s recoverable value will probably be in crypto tokens. [But] the court will have to dish out claims in dollars. FTX holds so many tokens that auctioning them could spark a fire sale.

It might be better to sell the accounts to another exchange, but:

On January 5th American regulators intervened to stall a deal that would have seen Binance, the world’s largest crypto exchange, take on $1bn in assets from Voyager, another bankrupt firm.

This one could run for a while.

State Pension

In the FT, Josephine Cumbo reported that high-earning men face a “state pension shortfall”.

- She meant that this group will likely get less back from the state pension than they have paid in NICs.

It’s surprising to see the FT rushing to the defence of what was once its natural constituency, but one it has in recent years abandoned for less-high-earning non-men.

- It’s less surprising that a pooled insurance system would have winners and losers, and that the losers would be high-earning men.

Of course, it’s not really a pooled system (the contributions don’t fund the benefits) but neither is there a guarantee that everyone will get out more than they paid in.

Men don’t live as long as women, so they don’t get as much back from their pension, and high earners of all genders will of course pay more into the system, but everyone gets the same out per year. (( Everyone with the full 35 years of credits, of course ))

- High earners do tend to live longer than lower earners, so the calculations are closer than you might think.

40-year-old male employees who rank in the top 10 per cent of earners will pay about £250,000 in national insurance contributions during their lifetime, but receive only £248,000 in state pension income back if they live to age 90.

Steve Webb highlighted that the state pension is:

Extremely good value for most people [who] can expect to get more out of the state pension than they pay in.

Further increases to the state pension age, which seem inevitable, could alter this equation. Jason Hollands MD of wealth manager Evelyn Partners said:

The system has a creeping redistributive element to it that is likely to become more pronounced if the state pension age rises further.

Quick Links

I have six for you this week:

- Monevator wrote about the Asset allocation quilt – the winners and losers of the last 10 years

- Joachim Klement wrote About those inflation expectations

- Russel Napier said that The world will experience a capex boom

- Alpha Architect looked at The Value Factor and Deleveraging

- Mauldin Economics said that The Punchbowl Is Gone

- And UK Dividend Stocks gave their FTSE 100 CAPE Valuation and Forecast for 2023

Until next time.