Weekly Roundup, 4th May 2020

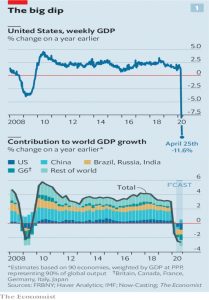

We begin today’s Weekly Roundup with The Economist, which is predicting a post-Covid 90% economy.

Contents

90% Economy

The Economist warned that life after lockdown will be hard.

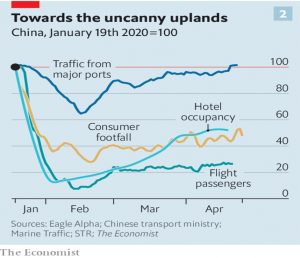

- China started to move back towards normal at the end of February and has got about 90% of the way there.

Rides on the metro and on domestic flights are down by a third. Discretionary consumer spending, on such things as restaurants, has fallen by 40% and hotel stays are a third of normal. Unemployment is at around 20%.

Unlocking is a drawn-out process, with many unknowns.

- Even if governments relax restrictions, consumers may stay away.

Aggregate-spending patterns in Sweden and Denmark over the past months look similarly reduced, even though Denmark has had a pretty strict lockdown while official Swedish provisions have been exceptionally relaxed.

And many businesses will have strained balance sheets and weak demand for their goods and services.

Government schemes will save businesses in the short term, which is welcome. But those designed to preserve jobs risk eventually creating zombie firms that neither thrive nor go bankrupt, slowing the recycling of labour and capital.

Muddy Waters

Buttonwood looked at the work of the famous activist short-seller Muddy Waters, run by Carson Block.

The stock of covert embezzlement – “the bezzle” – grows during booms [and] peaks just as boom turns to bust. For short-sellers, these are the good times.

The firm’s name comes from a Chinese proverb – muddy waters make it easy to catch fish – and initially, the company specialised in Chinese scams.

There are common elements to frauds:

One is a breach between earnings as defined by Generally Accepted Accounting Principles (GAAP) and non-GAAP measures. Another is an increase in “days payable outstanding”. Firms with dressed-up earnings also tend to pile on debt because they lack strong underlying cashflow.

Acquisitions are also an issue:

Aligning the accounts of acquirer and acquired gives ample scope for fiddling.

Melissa Dell

Melissa Dell has been awarded the John Bates Clark Medal.

- This is given each year by the American Economic Association to the best economist under 40.

Dell studied the “mita” system in Peru and Bolivia, which co-opted indigenous men to work in silver and mercury mines.

- It operated between 1573 and 1812.

Centuries on, families living just inside mita areas consume 25% less than those just outside them, are less educated and rely more on subsistence farming.

Outside of the mita areas, men worked on haciendas (privately-owned agricultural estates.

- These areas had more investment in public infrastructure and offered protection from bandits to the poor.

Yet more evidence that state control is not a good idea.

Dell has also looked at the positive effects of colonialism:

Indonesian villages closer to Dutch sugar factories are today richer than those further away.

Inflation

The Economist also looked at the impossibility of measuring inflation in a pandemic.

- The ONS uses a basket of items designed to reflect the spending of a “typical consumer”, and measures the price of a significant minority of these by physically visiting shops.

A bigger problem is that 30% of spending is on services that are no longer available (restaurants, hotels, culture and holidays).

- And when these services return, many of them will have significantly different prices.

The disappearance of multi-buy offers (eg. BOGOF – claimed to encourage hoarding) will also be missed since they were never included (their use was thought to be constant).

- So inflation – particularly for poor people, who use these offers more – will be understated.

Which in turn means that index-linked raises to thresholds and benefits in April 2021 will be too small.

Echo chamber

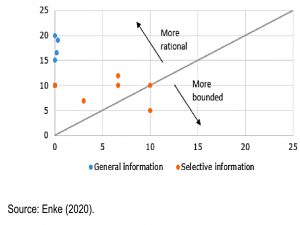

Joachim Klement looked at the dangers of being stuck in an echo chamber.

- It’s easy on social media to hear only views which confirm your own (admittedly, this is easier if your views are left-wing).

We know that there is other information out there that may explain market moves better than our dominant market narrative, but these competing narratives are increasingly shut out of sight, because they are not reported in the media and not discussed amongst investors.

Joachim quotes an experiment where subjects were shown random numbers around 100 (50, 70, 90, 110, 130, 150).

- They were asked to guess whether the average value was above or below 100.

Some were shown confirmatory sets (all numbers above or below 100) whilst controls were also shown some contradictory information.

Participants who were caught in the echo chamber believed reality to be similar to the numbers they saw. Meanwhile, the control group that saw a little bit of neutral information was much more accurate in guessing the true average and behaved much more rationally.

So make sure that you consume media from both ends of the political spectrum.

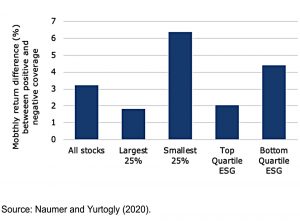

Media impact

In a second article, Joachim looked at the impact of media on share prices.

- He quoted a study which looked at 105K news reports on S&P-500 companies from 2006 to 2016.

The quartile with the most positive media coverage outperformed the most negative quartile by 3.2% per month.

Unfortunately, the performance difference only exists as long as one uses contemporary media coverage. Using past media coverage makes the performance difference disappear. Hence, this is not a strategy to outperform markets because nobody can predict media coverage.

But larger stocks – with index membership and broad shareholder bases – and also ESG stocks seem to have greater insurance against negative coverage.

- Conversely, positive coverage of a small stock can produce a large rise in the price.

As for ESG, Joachim speculates:

If a company takes ESG risks seriously, it inadvertently reduces the risk of negative media coverage for bribery, excessive compensation, environmental damages or other issues.

GDP bonds

In the Times, David Smith argued the case for GDP-linked bonds.

- He quotes an article by Costas Milas, from the University of Liverpool.

The interest due on GDP-linked bonds would go up or down with the issuing country’s economic performance. When GDP growth is weak, its debt servicing costs would decline. The ratio of its debt to GDP would therefore rise less sharply during a downturn, thus reducing the need for austerity to reduce the debt pile later.

I can see how this helps the government, but I’m less clear how investors would be persuaded to buy the bonds.

- Who needs more stuff that goes down (or in this case, drops income) when times are bad?

There are easier (and more lucrative) ways to bet on recovery, and the mapping of returns to the economic cycle means that the bonds offer no real diversification.

Second homes

Second homeowners have had it tough over the past few weeks.

- First, the locals kicked off when city folk attempted to shelter (in homes they own) in the country or by the seaside.

Now, as George Hammond reported in the FT, local councillors want commercial holiday lets to be excluded from the £10K coronavirus small business grants.

- They are also lobbying for the council tax “loophole” on commercial holiday lets to be closed.

Businesses with rateable values below £15K / properties that receive income of less than £12K pay nothing.

- The government has said that second homes can be re-classified as domestic properties while they are occupied by owners during the crisis.

It’s all enough to put me off my plan to buy a seaside cottage, and indeed to even spend my holiday money in one of these towns.

- It shouldn’t pay to bite the hand that feeds you (or to kill the goose that lays the golden egg).

Quick links

I have seven for you this week:

- The Adventurous Investor reported on the Dividends Bloodbath

- Terry Smith advised dividend investors to never let a crisis go to waste

- Alpha Architect looked at how to measure Extreme Downside Risk

- Pragmatic Capitalism asked What the Hell is the Stock Market Doing?

- The Economist wondered what is weighing on Samsung

- And questioned why some countries want central databases for Covid contact-tracing databases

- And forecast a lost decade for the unemployed in the US.

Until next time.

Re inflation, as you may imagine ONS are well aware of these issues and below is extracted from the latest inflation report (for March):

“There will inevitably be challenges around some of our collection activities, as approximately 45% of the CPIH basket is physically collected in stores across 140 locations in the UK. The remainder is collected by ONS staff from online sources and administrative data provided by external suppliers.

The price collection for this publication, reflecting March prices, was largely unaffected by recent developments. However, in a small number of detailed categories, the number of price quotes used in constructing the indices is less than half the number used in February. These sections are identified in relevant tables in the accompanying dataset, for example in table 7.

The collection issues increase in subsequent months and we have been planning for these. Before we release the April figures on 20 May, we will publish an article which will describe both the changes we have made to our data collection procedures and the methodological changes needed to adjust for missing prices where products are not available and services stopped during the lockdown period.”

No sign yet of the promised article – but it could make interesting reading.

Some clues might be given by the online price change for high-demand products (HDP) that the ONS are currently publishing weekly at Section 6 of: “Coronavirus, the UK economy and society, faster indicators”, see

https://www.ons.gov.uk/peoplepopulationandcommunity/healthandsocialcare/conditionsanddiseases/bulletins/coronavirustheukeconomyandsocietyfasterindicators/latest

Just found this – which was published yesterday. I have not yet had a chance to read it in any detail, but the salient points I have gleaned include:

a) For items/services no longer available:

“For unavailable items, where consumers can no longer access the market because it has effectively been shut down under current movement restrictions, we aim to make an imputation that has no impact on the all-items index, so that the calculation reflects only the price movements of those goods and services that consumers can purchase.”

“There are 92 items in our basket of goods and services that we have identified as unavailable for the April 2020 index (see Annex B), which accounts for 16.3% of the CPIH basket by weight. The list of unavailable items will be reviewed on a monthly basis.”

b) An extended form of web scraping will be used in lieu of shopping visits to collect prices for available items;

c) For under-sampled available items:

“For available items that we have not been able to collect, we aim to make an imputation that reflects the price movement that we have missed by not being able to collect the data. Where a sample is less than 20% of its usual size, we will review on a case-by-case basis. In extreme cases, we may consider replacing the data with an imputation. An imputation will also be made for categories in which it has not been possible to collect any price quotes at all. The imputation will be based on the most appropriate choice of:

– imputing from the index immediately above it in the classification structure

– imputing based on the price movement of a similar item

– carrying forward prices”

Full report is available at:

https://www.ons.gov.uk/economy/inflationandpriceindices/articles/coronavirusandtheeffectsonukprices/2020-05-06

April inflation figures release today.

In summary:

a) inflation numbers have dropped quite significantly versus a year ago;

b) the impact of the unavailable items whilst not trivial is not huge and the official way they have been accounted for may over-estimate inflation;

c) revised spending patterns for available items could have at least as significant an impact as missing items and this is not accounted for in any way (positive or negative) in the official figures

For monthly report see:

https://www.ons.gov.uk/economy/inflationandpriceindices/bulletins/consumerpriceinflation/april2020

Things that I noted are:

“For April 2020, in addition to the 90 items, we identified a further 15 items where the proportion of price quotes collected were below 20%. For most of these items, we based the price movement on the collected prices. However, for a small number, we made the decision to impute their price movement as the collected prices were uncharacteristic for those items.”

and also

“Overall, the 90 imputed items in the CPIH had a downward contribution of 0.17 percentage points to the change in the CPIH 12-month inflation rate.”

Another thing I noted from this report was that

“the Bank of England must make a determination on any changes to the coverage or basic calculation of the RPI that we propose, to establish whether such a change “constitutes a fundamental change in the index which would be materially detrimental to the interests of the holders of relevant index-linked gilts”. We have shared our plan with the Bank of England, and they have determined that none of the planned temporary changes outlined “were both fundamental changes to the coverage or basic

calculation of the RPI, and also materially detrimental to the holders of relevant index-linked gilts”

And, for an alternative approach (ie different to the official agreed method), where the weights are adjusted to remove unavailable items and/or updated to account for some revised expenditure patterns (just fuels and lubricants) in the overall inflation calculation, see:

https://www.ons.gov.uk/economy/inflationandpriceindices/articles/priceseconomicanalysisquarterly/may2020

And the key things I noted from this report are:

“Compared with the official CPIH series, an experimental series that updates the CPIH basket to remove unavailable items leads to an annual growth rate 0.1 percentage points lower than the official rate, at 0.8%.

Compared with the official CPI series, an experimental series that updates the basket to remove unavailable items leads to an annual growth rate 0.2 percentage points lower than the official rate, at 0.6%.”

and

“Modifying the CPIH and CPI baskets further to account for changes in fuel consumption results in an annual rate in line with the official rates, at 0.9% and 0.8% respectively.”