Weekly Roundup, 11th May 2020

We begin today’s Weekly Roundup in the FT with Merryn Somerset Webb, who was talking about Warren Buffett.

Buffett

Merryn reported on the downbeat Berkshire Hathaway shareholder meeting from last week, which was forced online by the virus.

- Warren admitted that he went into the crisis (which Merryn is now calling the GVC – Great Virus Crisis) with the wrong stocks, and has been selling his holdings in four US airlines.

Merryn notes that BRK still holds too many value stocks and has underperformed the S&P 500 over the last decade (up 126% versus 140% for the index).

- Of course, not only Warren had the wrong stuff going into the GVC – this was a rapid crash with distinct sector impacts.

Merryn plugs the usual suspects in terms of funds to buy and also mentions two fund launches from Downing.

- Good luck to them, but I wouldn’t start from here.

Sovereign Wealth Fund

In her MoneyWeek column, Merryn suggested turning the Covid-10 bailout into a Sovereign wealth fund.

Shareholder capitalism must find a way to be more inclusive.

I’ve nothing against the government taking (temporary) equity stakes in firms (it can work out to be profitable if managed correctly), but how is this more inclusive.

- The government already owns tons of stuff, but I don’t think of it as mine, as I have no control over it (or agency, as the cool kids like to say).

That is unless the stakes are sold on to the public.

- In which case the problem becomes persuading the smart money want to buy them.

Market vs Economy

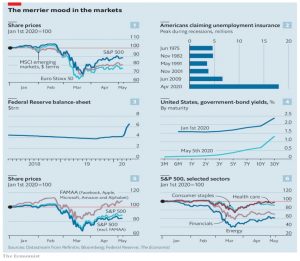

The Economist looked at what it called a dangerous gap between the financial markets and the real economy.

A one-month bear market scarcely seems enough time to absorb all the possible bad news from the pandemic and the huge uncertainty it has created.

The Fed is largely responsible:

The catalyst [for the market recovery] was news that the Federal Reserve would buy corporate bonds, helping big firms finance their debts. The Fed has little choice—a run on the corporate-bond market would worsen a deep recession.

The other factor is that there is nowhere – other than shares – for investors to put their cash.

Government-bond yields are barely positive in America. They are negative in Japan and much of Europe. You are guaranteed to lose money by holding them to maturity, and if inflation rises the losses would be painful.

But the recovery has been selective, and much better in the US.

Investors have put even more faith in a tiny group of tech darlings—Alphabet, Amazon, Apple, Facebook and Microsoft—which now make up a fifth of the S&P 500 index. There is little euphoria.

The newspaper notes four threats to dreams of a smooth recovery to business as usual:

- A second wave of infections

- A “90% economy”, with demand suppressed for a long time

- Fraud, which is often exposed after prolonged booms, and which would damage market confidence, and

- A political backlash, since the slump will hurt smaller firms and further entrench existing winners, leading to high taxes and “one-off” surcharges

Long-term skew

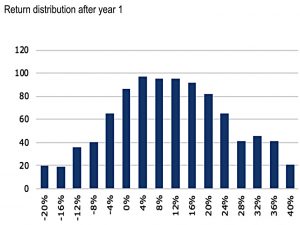

Joachim Klement looked at the long-term skew in markets.

- He examined returns from a hypothetical market with annual returns of 10% and volatility of 15% pa.

He used random draws from a lognormal distribution for annual returns, and simulated 1000 runs of 25 years of returns (so, a Monte Carlo simulation).

The year 1 distribution is symmetrical around 10%.

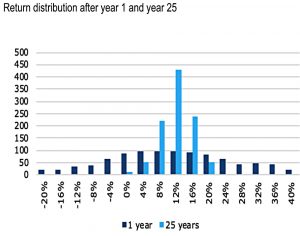

By comparison, the return after 25 years is much more concentrated around the mean.

This is simply due to the fact that by pure chance positive years follow negative years and vice versa.

So there is an emergent mean reversion.

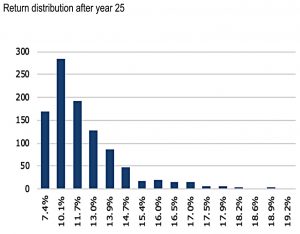

Further, the 25-year returns are not symmetrical.

- The distribution is lumped towards the left. but from a starting point only slightly below the overall average.

In contrast, the right-hand tail stretches out a long way.

The distribution has positive skewness (even though the original annual return distribution did not).

So for long-term investors, downside risks are reduced, and although the chances of extremely high returns are also lower, they are not lower to the same extent.

- Joachim puts this down to how many bear markets you invest through – dodge a few and your long-term returns will be great.

The longer you invest, the greater the positive skew, and the better your chances of achieving a better than average result.

Hedge funds

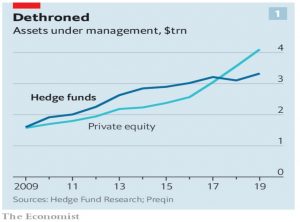

The Economist looked at hedge funds, which have had a rotten decade since the 2008 crash (as evidenced by Buffett’s winning bet against a hedgie).

- PE now has more capital than hedge funds, and almost have of the $30 trn in US equities is now passively managed.

The hedge fund industry has hopes that the present slump will make them relevant again.

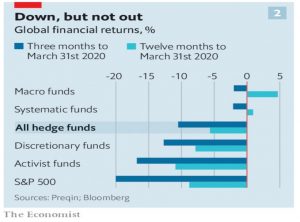

If you think their purpose is to make steady returns, regardless of how markets fare, then most have failed.

They have lost less than the market, though this hasn’t prevented further outflows.

But the goal for most institutional investors is to generate good returns that are steady and low-risk. If hedge funds beat the market during times of stress, they become a source of diversification.

The newspaper notes that “systematic” (algorithmic, machine-led) funds have done best.

The Medallion fund, the flagship fund run by Renaissance Technologies and set up by Jim Simons in 1988, was up by 24% in March. By contrast, discretionary funds, which are run by human managers picking and choosing trades, are down by 12.7%.

Macro funds have also done well, but activist funds have suffered.

John Authers also looked at hedge funds in his Bloomberg newsletter.

- He notes that this is a terrible time to try to beat the market.

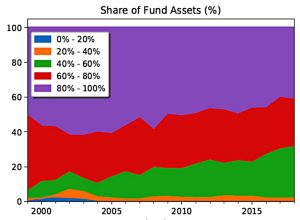

The S&P 500 is doing better than the average stock (or an equal-weight strategy), as the large-cap (tech) stocks continue to dominate.

- This is also why value and other factor-strategies have underperformed in recent years.

And it explains why BRK and Buffett (who started out running a hedge fund) has also underperformed.

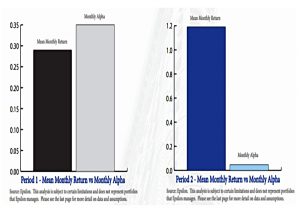

Since 2008, Hedge fund alpha has disappeared (John’s chart comes from a recent report by Epsilon Asset Management, and shows returns before fees).

The average active share of hedge funds has also dropped off a lot.

As the markets are driven by the largest stocks, the same thing is happening to hedge funds as to stockpickers.

- Usually the smaller, nimbler ones do a bit better. At present, the big ones are outperforming (although they are still failing to beat the S&P 500).

The only recipe for success over the past decade has to be overweight the FAANGs.

David Kostin of Goldman Sachs has a warning:

Narrow market breadth is always resolved the same way. Often, narrow rallies lead to large drawdowns as the handful of market leaders fail to generate enough earnings strength to justify elevated valuations and investor crowding. In these cases – such as 2000 – the market leaders “catch down” to weaker peers.

The alternative resolution is that laggards “catch up” with the leaders – but that doesn’t look likely at present.

Quick Links

I have eight for you this week, the first four of which are from The Economist:

- The newspaper looked at what might happen to Disney

- And at the impact of the pandemic on the American health-care complex

- And at how pubs, cinemas and shops might reopen in the UK

- And at the new normal for offices

- Alpha Architect looked at the size effect in multi-factor portfolios

- And clarified the difference between Absolute Value and Relative Value

- Enterprising Investor reminded us that some investment strategies are too good to be true

- And Flirting with Models looked at Straddles and Trend Following.

Until next time.