Weekly Roundup, 10th August 2020

We begin today’s Weekly Roundup in the FT with John Lee, who has taken on an investment challenge.

Contents

The Richmond Challenge

In his regular FT column, John Lee wrote about an investment bet he’s made with a friend – with dinner and wine as the prize.

- His friend chose OIECs for one challenge, and stocks for the second – Games Workshop,

Softcat (IT infrastructure), Team 17 (video games), Temenos (banking software – not UK-listed), and Ten Entertainment (ten-pin bowling – a brave choice during Covid).

John chose the stalwarts of his portfolio:

- Anpario (animal feed additives), Cerillion (global telecoms), Concurrent Technologies

(defence-led tech); Lok’nStore (self-storage) and Treatt (flavour and fragrance ingredients).

Other holdings mentioned this month include Air Partner, Aviva, L&G, M&G, Appreciate, Christie, Vitec, Goodwin and Nichols.

Money scripts

Also in the FT, Jason Butler wrote about money scripts, which are usually formed in childhood.

Brad Klontz says there are four core scripts and we each rely mostly on just one of them:

- Those with the “money avoidance” script think money is evil.

- The “money worship” script encourages people to think more money will solve their

problems.- Those under the sway of the “money status” script equate their net worth with their self-worth.

- Under the influence of the “money vigilance” script, people tend to be aware, intentional and diligent about their financial situation.

If you want to find out which type you are, he has a test – but you can [probably figure it out for yourself.

Avoiders think they don’t deserve money and that rich people are evil – this is the left-wing, public-sector take.

- Worshippers are overachievers who find spending and relationships difficult.

Staus types are consumers who are taken by marketing and spin, and who run up debt.

- Vigilant types are intentional, frugal savers, but anxiety can get in the way of them enjoying their eventual wealth.

Jason says he has moved from a status script into vigilance.

- When I was younger I had elements of both worship and status, but I’m definitely using the vigilance script now that I’m older.

Jason also warns against comparing yourself to others:

The majority of people in developed countries have “enough” to meet their essential needs and therefore are generally happy on a day-to-day basis — known as emotional wellbeing. But when they compare themselves to other people — known as life satisfaction — they are less happy.

This is generally good advice – it’s usually much better to compare yourself today with your past self.

- But the pandemic and lockdown response mean that this approach yields disappointing results right now since things were much better last year.

So perhaps a little bit of counting our blessings is in order.

SPACs

Buttonwood wrote about SPACs – the US version of a shell company known as special purpose acquisition companies.

- The idea is that instead of a regular IPO, a business can reverse into this already-[listed shell.

They are in the news because some recent SPACs (Virgin Galactic, Nikola) have risen to astronomic valuations.

Bill Ackman, a shrewd hedge-fund manager, has just raised a $4bn mega-SPAC.

IPOs are not popular in Silicon Valley.

- There are fees (up to 7%) and the valuation has to be low to ensure a share price “pop” on day one of the listing.

And since IPOs are run by bankers, they are run primarily for the benefit of the bank’s repeat customers.

- Successful listings lead to the issue of more shares by the banks (a lucrative feature known as a greenshoe).

The SPAC sidesteps all of this, but at the expense of a whopping 20% stake for the sponsoring firm (Ackman is taking a smaller cut and attaching performance targets).

Barbados

Also in the Economist was the news that Barbados is inviting teleworkers to use the beach as their office, for a year at least.

- Though the island has had few Covid-19 cases, it makes 50% of foreign earnings from tourism.

Now most tourists are banned and unemployment is close to 40%.

- The new “Welcome Stamp” costs $2K per person or $3K per family.

You also need to earn $50K pa, and to take out health insurance.

- But you can carry on paying taxes in your home country.

Vanguard review

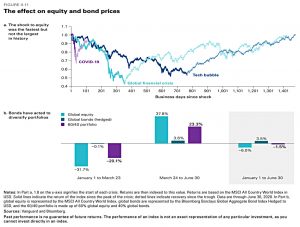

Vanguard’s mid-year review came out in favour of the classic 60-40 stock-bond portfolio.

- It’s true that such a portfolio has done well in 1H20 (stocks were down 6% and bonds up 3.5%, which they somehow turn into a net loss of 1.5%).

But this is something of a “ruler issue”:

- As long as the biggest firms in the biggest market (ie. US tech at the moment) are the best performers, then simple allocations will do well.

But this is not usually the case, and we don’t know how long it will persist for.

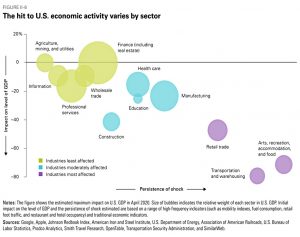

The report also had a nice chart on the US virus impact by sector.

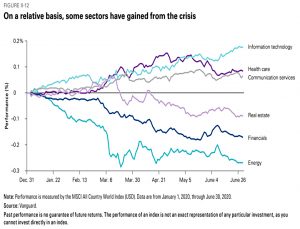

And one showing how this translated into market movements.

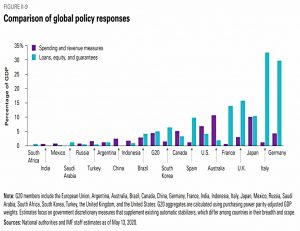

And another comparing global policy responses.

Inheritance tax

In the FT, Delphine Strauss (( I couldn’t find a picture )) reported that IHT receipts have fallen for the first time in a decade.

- This is most likely the impact of the residential nil-rate band, introduced in 2015, which now allows home-owners to pass £500K to their children, rather than the basic £325K.

There is a taper on the relief, which runs back down to zero on estates above £2.7M.

IHT takings for 2019/20 were down 4% to £5.2 bn.

- 20.2K estates used the relief, with 3.9K paying no IHT as a result.

Some £3.1bn was sheltered under the relief.

Intergenerational differences

Interactive Investor used the occasion of the FCA report on intergenerational differences (more on that later this week) to describe the generational differences in the portfolios of their customers.

- Boomers have more home bias, but not much more.

- UK direct stocks are 91% of boomer portfolios (excluding funds), cf. 84% for Gen X and Millenials

- All of these numbers appear shockingly high, but home bias should be expected to show up in the individual stock holdings.

- Investment trusts are more popular with boomers

- They make up 27% of boomer portfolios, cf. 17% for Gen X and 20% for Millenials.

- Stocks are more popular (42%, 43% and 40% respectively).

- ETFs are more popular with Millenials, but still not very popular.

- 12% for Millenials, 11% for Gen X and 5% for boomers

- OIECs are still more popular (27%, 29% and 25% respectively).

DeGiro

Dutch broker Degiro emailed me last week to say they had been taken over by the flatex group.

- I didn’t know who flatex were but apparently they are a German bank.

The potential significance of this is that Degiro would move from the Dutch compensation scheme to the German one.

- The email points out that cash held with Degiro will be insured up to €100K but makes no mention of stock holdings.

Degiro are a creditable alternative to free brokers like Freetrade and Trading 212.

- Degiro commissions usually work out at around £2, and FX charges are lower than normal brokers (though not as low as Trading212).

The stumbling block for me was always the Dutch compensation scheme, which tops out at 90% your holdings, up to a maximum of £18K.

- Unfortunately, it looked like the German scheme ahs exactly the same limits.

If anyone knows different, please let me know.

Quick Links

I have just five for you this week, the first four from the Economist:

- The newspaper reported that Nvidia is trying to buy Arm

- And that Microsoft wants to buy TikTok

- And that the trucking industry is in upheaval, but is also being hyped

- And that Covid-19 could mean the end for some universities.

- Alpha Architect looked at Cross-Asset signals and Time-Series Momentum.

Until next time.