Idle Investor 3 – Trends, Maxims and Strategy 3

Today’s post is our third and final visit to Edmund Shing’s book The Idle Investor.

Contents

Mechanical Investing

Before explaining how Strategy 3 works, Ed takes a chapter to review the academic studies to find a system that delivers good performance with low risk (volatility).

He starts by describing the ideal system:

- Needs input only once per month, and doesn’t take much time.

- Does not require any special knowledge – uses only information from the internet.

- Relatively consistent returns, with no large drawdowns.

- Deals well with bear markets in stocks.

- Diversification across asset classes and geography.

- Uses low-cost funds (ETFs).

After looking at the studies, Ed concludes that trend-following is best, because it avoids heavy losses during crashes.

- At the same time, it produces high returns by exploiting momentum.

- And it has low volatility (because it avoids large drawdowns).

Such systems can underperform buy-and-hold during long uptrends (2003 to 2007, 2009 to now) but will outperform in the long run.

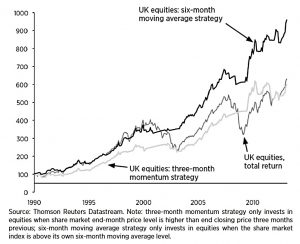

A six-month moving average strategy works better than a 3-month momentum strategy (buy / hold when the price is higher than it was three months ago) in the UK.

- Even the 3-month strategy performs as well as buy-and-hold, but with lower volatility.

The 6-month strategy returned 9.9% pa compared with 8.0% for the index, and fell only 135 in 2008, compared to 43% for the index.

- The 3-month strategy held equities for 62% of the time and the six-month strategy for 67% of the time.

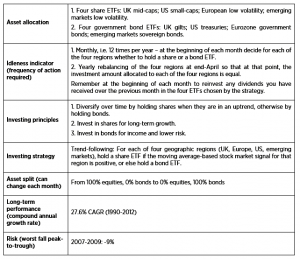

Strategy 3: Multi-Asset Trend following

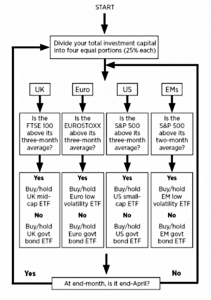

Ed’s third strategy checks once a month to see whether it should hold a variety of equity ETFs, or bonds instead.

- The portfolio is always 100% invested in something.

The system uses four stock-bond pairs:

- the UK

- Europe

- the US

- Emerging Markets

Here are the ETFs Ed uses:

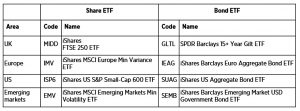

- UK mid-cap equities versus UK government bonds.

- European low volatility equities versus European government bonds.

- US small-cap equities versus US government bonds

- Emerging market equities versus emerging market government bonds

The decision on which fund to choose is based on the most popular indices for each region:

- The FTSE-100 for the UK

- The Euro Stocxx 50 for Europe

- The S&P 500 for the US

Interestingly, Ed also uses the S&P 500 to test emerging markets.

- I would be more inclined to use the index that each equity ETF tracks, or even the ETFs own price action.

Ed uses the 3-month moving average in each region apart from emerging markets, where he uses 2 months.

Dividends are held within the sub-fund and invested on the next sale and purchase.

Once a year (at the end of April), Ed rebalances the four sub-funds back to an equal amount in each.

- Ed chose April because it is the last month where equities outperform on average.

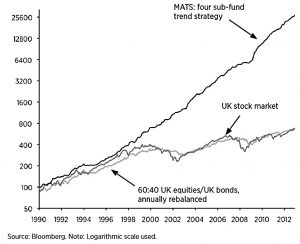

Over 23 years (1990 to 2012), Ed says that this MATS system (Moving Average Trend-following Strategy) would have returned 27% pa, with no down years after 1995.

- The main advantage was avoiding the 2000-03 and 2007-09 bear markets.

The worst falls were in 1994, the only year when equities and government bonds fell at the same time.

- But the drawdown was only 8%.

Ed expects future performance to be worse, as the long bull market in bonds comes to an end.

- But he expects emerging market currency gains to continue.

Future investment trends

That’s it for the systems.

- The last two chapters in the book are about investment trends and investing maxims.

Ed has six investment trends to look out for:

- Inflation and interest rates to remain low.

- Bond returns to be low (since yields are at record lows).

- More government encouragement to save via ISAs and pensions.

- The raised ISA limit and workplace auto-enrolment are evidence of this.

- But the cuts to the LTA and annual pension allowance show that there is a limit to the government’s generosity.

- Property investments (buy-to-let) to be taxed more heavily

- This is already happening.

- Ed sees this as an easy way to raise more tax to pay down government debt, since property taxes are hard to avoid.

- By this logic, tax on primary residences can also be expected to increase in due course.

- “The hunt for yield will underline how important reinvested dividends are in driving total return from shares.”

- I think this is misleading – reinvesting dividends is important so that we can make use of compounding, but dividends themselves are not the driver – high yield is imply a proxy for value investing.

- It’s also the case that the hunt for yield can drive high-yielding assets to high prices which negate their advantages and increase their riskiness.

- ETFs will become more popular.

- This is definitely happening, particularly amongst younger investors who are big fans of Vanguard.

Not much to argue with there.

Maxims

Ed ends his book with 18 “key principles for Idle Investors.”

They are a decent bunch, but we’ve already come across most of them earlier in the book:

- Buyer beware.

- Financial experts do not always have your best interests at heart.

- Knowledge is not enough.

- Ed doesn’t spell out what else is needed.

- Patience and inaction are vastly underrated behaviours.

- Fund managers underperform.

- Fund managers are generally not worth the money.

- Passive investing via index funds and ETFS is cheaper (Costs Matter)

- Because a few super-investors (buffet et al) have outperformed does not mean that many can do the same.

- Don’t screen watch (also known as Cut Out The Noise).

- Saving money is as important as making it.

- The explanation to this one is “Low volatility investments will typically give superior profits over time”, which is a bit of a non sequitur for me.

- I guess Ed means protecting money rather than saving it.

- Know your own risk comfort level and capacity for loss.

- Avoid the fast buck mentality.

- The tortoise won the race, not the hare.

- Don’t keep all your cash eggs in one basket.

- In the UK, this means no more than £85K per bank/building society.

- Diversify across asset classes, but don’t over diversify (Asset Allocation matters).

- Longer holding period = lower risk of loss.

- Only invest in risky assets for a minimum of five years.

- Preserve capital.

- This feels like a repeat of “protect your money”.

- Beware of debt.

- Financial gearing magnifies both gains and losses.

- Near-zero interest rates to persist.

- This is a prediction rather than a maxim.

- Use tax-efficient investments (ISAs and SIPPs) – Taxes matter.

Conclusions

I really like Ed’s third strategy, and plan to implement a version of it for myself.

- Of course, my version will have to be more complicated, with many more asset classes.

I took my first steps in this direction back in 2016, when I looked at markets for spread betting.

- You can see the eighteen indices, FX pairs and commodities that I chose back then in this post.

- In the follow-up post I added UK and US long-bonds to the list.

Events got in the way and I only began to spread-bet in earnest in November 2017.

- But this list will be my starting point.

I’ll return to the implementation of this modified strategy in a later post.

Until next time.