Stanley Gibbons — Stamps and Coins

Following on from last week’s Alternative Investing Show, today we’re going to look at stamps and coins as an asset class. Are they a practical option for the UK retail private investor?

Contents

Stamps and Coins as an asset class

There are three points to make in favour of stamps and coins as an alternative asset class:

- they offer strong returns

- they are not correlated to mainstream financial markets, and so offer good diversification

- this lack of correlation has been persistent during financial crises (eg. 2008) when other “uncorrelated” assets suddenly tended to flock together

The case for strong returns is built on rarity – they aren’t making any more old coins and stamps. So that’s supply sorted. The other question is demand.

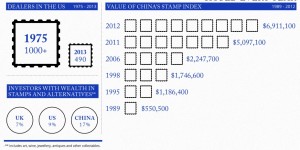

Here in the UK, collecting stamps and coins – which is quite different to investing in them – is seen as a dying hobby for the over 50s. But there is evidence of growing interest from (younger) collectors in India and China.

The disadvantages include:

- a lack of fungibility – each item is unique

- liquidity is not great, as there are no publicly traded markets – although there are auctions, some sales are private, which impacts price transparency

- there is no revenue stream (such as dividends or rental income) – this also complicates valuations

- there are costs associated with insurance and storage

- there are fakes and forgeries

Investments of Passion

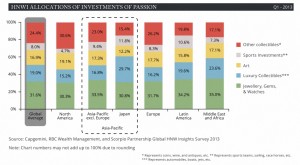

Cap Gemini’s World Wealth Report tracks investments by high net worth individuals (HNWIs) in Investments of Passion (IoPs). It seems that the financial crisis of 2008 had a significant impact on spending on art, antiques, cars, stamps and coins, but this effect was short lived.

Demand has now recovered, and a trend towards “investor-collectors” – rather than just collectors – has been detected. Jewellery, gems and watches remain more popular than stamps and coins.

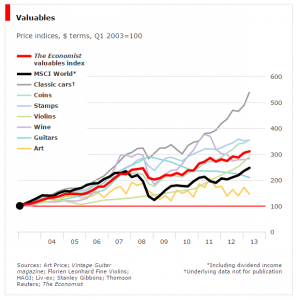

The Economist Valuables Index is weighted according to Barclays wealth management clients’ portfolios: 17% hold coins and only 6% stamps.

They have at least performed well: over 10 years to 2013, stamps and coins each returned 250% profit, compared to 150% for the MSCI World Index of stocks (dividends included).

The Stamp Market

As you might expect, the stamp collecting market is shrinking in the West and growing in the East.

Investment grade stamps

The Alternative Investment Report: Rare Stamps and Coins 2015 lists four factors affecting value:

- Rarity

- small number of surviving examples – some countries issue too many stamps or too many of a single issue for them to become rare

- printing mistakes / wartime stamps / stamps from a short-lived monarch are all in demand

- more accurately, this is supply versus demand; rarity alone may be insufficient as collectors usually look for items of significance

- Condition

- the best quality examples are the most sought after

- margins, gum and colour are important factors

- production method – older stamps used line-engraving to give better results

- classifications include: un-mounted mint, mounted mint, fine used, unused, unused without gum

- Authenticity

- documented history and provenance is important

- a certificate of authenticity is only as good as the company issuing it

- Liquidity

- demand from buyers dictates value – there must be a healthy secondary market to sell into

Investment grade coins

There are three categories of coins:

- fiat currency

- eg. the UK £1 coin, worth one pound only because the UK government says so

- bullion coins

- made of gold, silver or platinum with a value largely determined by their precious metal content

- rare and collectible coins

- these may have precious metal content, but their value is determined by demand from collectors and investors

- gold coins of similar age, rarity, design and workmanship are usually worth more than equivalent silver coins

Collectible coins need to be professionally graded as to condition:

- fleur-de-coin (FDC) – perfect

- uncirculated (UNC)

- extremely fine (EF)

- very fine (VF) – some rubbing or minor damage

- fine (F)

- fair – serious wear or damage

- poor in inscription and date not distinguishable

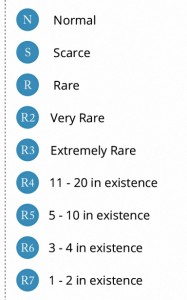

As with stamps, rarity is a factor:

- few coins originally produced

- ruler was short-lived

- sample that was never produced

- good condition relative to other coins available

- high demand compared to the available supply

Stanley Gibbons

The stamps and coins business in the UK is dominated by Stanley Gibbons (SG). They have been around since 1856 and have held the Royal Warrant for services to philately since 1914. SG is the world’s largest rare stamp merchant. ((Disclosure: at the time of writing, I hold shares in Stanley Gibbons))

SG Indices

SG produce two rare stamp indices and a rare coin index:

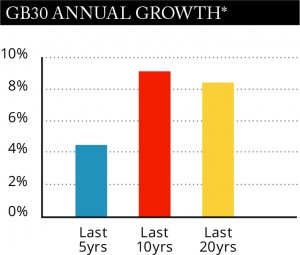

- the Great Britain 30 Rarities (GB30) index was launched in 2004 and comprises the 30 rarest British stamps

- the index has data back to 1954, though not all years are covered

- compound annual growth has been fairly good: 4.5% over 5 years, 9.1% over 10 years and 8.4% over 20 years

- the stamps in this index are too rare and expensive to be of interest to the typical private investor

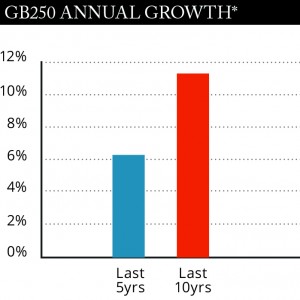

- the GB250 stamp index tracks the top 250 traded investment grade stamps

- it only has price information for the past 12 years

- compound annual growth has been fairly good: 6.4% over 5 years, 11.4% over 10 years

- it is price weighted, which means that the performance of the more expensive stamps weighs more heavily

- some of the stamps in this index are still too expensive for the typical private investor

- SG catalogue prices are used

- the GB200 coin index was launched in 2012 with backdated information

- it is price weighted, which means that the performance of the more expensive coins weighs more heavily

- coins range from 1st Century Celtic to mid-20th Century George V

- coins range in value from £5K to £275K at 2014 prices

- compound annual growth was 12.8% over 10 years and 13.9% over 5 years, higher than the stamp indices (particularly so in recent years)

Both of the stamp indices and the coin index are listed on Bloomberg (STIGIGB30, STIGIGB25 and STIGIRCIX). SG also track an index of 200 Chinese stamps which has shown annual growth of 10.7% over 25 years, but has been more volatile than the GB stamp indices.

Academic Research

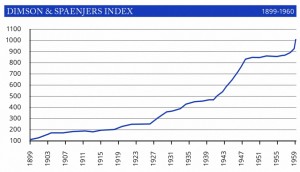

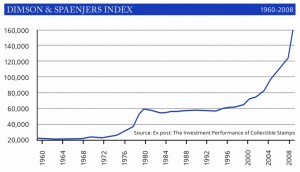

In Ex Post: The Investment Performance of Collectible Stamps, Dimson and Spaenjers (2010) looked at British stamps from 1899 to 2008. They excluded “special varieties” (rare and valuable stamps) which make up more than half of the SG indices.

Annual compound growth was 7% over 109 years, 7% over 20 years and 12.7% over 10 years. There was a price bubble in the 1970s, lower returns in the 80s and 90s, strong growth in the 2000s before the financial crisis, and steady but slower growth since then.

Diversification

Attitudes to diversification vary. Some people think 5 stocks are enough, some 30, others 1000. ((See The Illusion Of Diversification: The Myth Of The 30 Stock Portfolio on Investopedia)) What we can say for sure is that 10 holdings are much better than one, and 20 holdings are significantly better than 10.

It should also be remembered that the proposed stamps and coins portfolio is being added to stocks, bonds, property, cash infrastructure and commodities to provide additional diversification. Perfect diversification within the stamps and coins portfolio itself, though welcome, is not mandatory.

Without knowing more about the components of the SG indices, it’s impossible to say what size portfolio will be required for reasonable diversification. Informal conversations at the Alternative Investing Show lead me to believe that £25K might be enough, spread across perhaps 15 coins and stamps. This seems light to me, and I am prepared for this figure to rise.

SG Products

SG have four investment offerings:

- Flexible Trading Portfolio (FTP)

- SG put the initial portfolio together

- stamps only

- the investor receives ongoing advice from an Investment Portfolio Manager

- free storage, valuations and insurance

- guarantee of authenticity

- the minimum initial investment is £15K

- SG share of the profits on sales reduces with the holding period:

- 70% in the first year

- 50% in years 2 and 3

- 30% in years 4 and 5

- 20% after 5 years

- Capital Growth Plan (CGP)

- as per the FTP, except for:

- stamps and coins

- SG share of the profits on sales reduces with the holding period:

- no sales in the first year

- 50% in years 2 through 5

- 20% after 5 or 10 years (fixed-term sale)

- Portfolio Builder (PB)

- minimum initial investment of £1K, plus minimum £100 per month (£1.2K pa)

- over 5 years this is £7K in total and over 10 years it is £13K

- investors decide which assets to buy

- SG share of profits is fixed at 50%

- Premium Portfolio Builder (PPB)

- minimum initial investment of £10K plus £1.5K per quarter (£6K pa)

- over 5 years this is £40K in total and over 10 years it is £70K

- investors decide which assets to buy

- SG share of profits is fixed at 30%

At first sight, none of these products are entirely suitable:

- FTP is stamps only, and SG choose the stamps

- CGP is fixed length, risking sales at the wrong point in the market; also SG choose the stamps and coins

- PB has a ludicrous SG profit share of 50%

- PPB has a high SG profit share of 30% and a likely investment of £40K to £70K

The PPB probably comes closest to what is required, but the minimum contributions and the SG profit share are too high.

A better product

Here’s what I would be looking for before I could invest:

- stamps and coins in the portfolio

- I choose the investments

- I choose when to sell

- phased investment over say 5 years

- reasonable minimums (no more than £5K per year for 5 years)

- annual charges based on purchase cost to cover insurance and storage (say 1%)

- lower commission on profits from sales (say 10%)

Costs

Costs will depend on the scheme used, the holding period and the investment performance, but they are always high. ((The calculations below are assuming that SG operate an internal matching process for sales and purchases, so that there is no bid / offer spread; this is obviously a best case scenario))

As an example, we’ll consider a £25K portfolio under the PB scheme. This would involve year 1 contributions of say £5K, plus £2K per year. The portfolio is held for 10 years, during which time it grows to £40K. ((The average value of the cumulative contributions over the 10 years is £15K, so this is effectively a “doubling” of what went in))

The profit is £15K, of which SG will want £7.5K (50%). This works out at 18.75% of the final portfolio, or a simplistic but apparently only somewhat expensive 1.9% pa charge. It’s actually worse than this:

- the portfolio starts out at £7K in year 1 and the £750 “annual” charge is then 10.7%

- by year 10 the £750 charge is only 1.9% of the £40K portfolio value

- the average annual charge over 10 years will be more like the mean of these, or 6.3% pa!

If we can put together a £70k portfolio we qualify for the PPB scheme. This would involve year 1 contributions of £16K, plus £6K per year. The portfolio is held for 10 years, during which time it grows to £113K. ((The average value of the cumulative contributions over the 10 years is £43K, so this is again effectively a “doubling”))

The profit is £43K, of which SG will want £12.9K (30%). This works out at 11.4% of the final portfolio, or a simplistic but apparently reasonable 1.1% pa charge. It’s actually much worse than this:

- the portfolio starts out at £16K in year 1 and the £1290 “annual” charge is then 8.1%

- by year 10 the £1290 charge is only 1.1% of the £113K portfolio value

- the average annual charge over 10 years will be more like the mean of these, or 4.6% pa!

So even with a £70K portfolio held for 10 years and increasing substantially in value, the annual charge is around 4.6%.

Tax

There are no tax shelters available for coins and stamps, so we are relying on the annual capital gains tax allowance of £11,100 in order to shelter any gains.

On a hypothetical £25K portfolio which increased to £40K over 10 years, this would mean spreading the sales over 2 years. ((In fact, after deducting SG commission of £7.5K, we could sell in a single year)) The larger portfolio (£70 growing to £113K) would take four years to realise. ((Again, after SG commission, the profit is only £30.1K and the portfolio can be sold over three years))

Regulation

Stamps and coins are unregulated, and treated as personal property rather than financial securities. They are not covered by the Financial Services Compensation Scheme (FSCS) or the Financial Ombudsman Scheme (FOS). However, should a broker like SG go bust, the assets themselves would still be owned by the investor, and could be sold on the open market.

Conclusions and next steps

- stamps and coins could potentially be a viable asset class for the UK private investor

- a £25K or larger portfolio is needed to achieve diversification with stamps and coins

- this implies a minimum overall portfolio size of £250K to £500K (5% to 10% weighting)

- none of the SG products are suitable for this size of investment

- costs are very high

Next steps are:

- drill down into the SG GB250 stamp index and the GB200 coin index to work out the performance of the “affordable” stamps and coins we may be interested in

- investigate whether excluding “special varieties” would greatly impact the GB250 and GB200 returns

- find out how SG catalogue prices are set

- look into price spreads and transaction costs

- do more detailed modelling of costs

- identify a candidate portfolio of 15 stamps and coins

- investigate how the purchase of such a portfolio can be phased over time (eg. £5K to £10K per year, subject to the target stamps and coins becoming available)

Until next time.

Sources

- Presentation by Keith Heddle at the Alternative Investing Show, May 2015

- Alternative Investment Report: Rare Stamps and Coins 2015 – Intelligent Partnership

- Stanley Gibbons Investment website

Interesting analysis of how to invest with SG. SIgn me up.