ShareAction — Asset Manager Voting

Today we’re going to take a look at a recent report from ShareAction – a shareholder lobby group – which looks at the issue of Asset Manager Voting patterns not serving the best interests of shareholders.

Contents

ShareAction (formerly known as FairPensions) is a charity that promotes responsible investment on behalf of individual shareholders as well as charities, faith groups and unions. The promote shareholder activism and the best use of voting at AGMs.

Their goal is to steer companies away from practices which they feel are “harmful to people and the environment” in order to bring about “a healthy planet and a fairer society”. The corporate “focus on profit must be balanced with social and environmental responsibility”.

They back the campaign for the Living Wage. More practically, they train individuals to attend company AGMs and hold directors to account. They also lobby parliament and regulators.

ShareAction is a charity, and amongst the donors listed on their website are other charities (Oxfam, Cafod, Christian Aid), environmental groups (Friends of the Earth, Greenpeace, World Wildlife fund) and trades unions (the Communication Workers Union, Prospect, the TSSA, UCU, Unison, Unite). A motley crew, but certainly a left-wing one.

The report

The report – Asset Manager Voting Practices: In Whose Interests? – looked at the voting records and levels of transparency of the largest 33 Asset Managers in the UK on what ShareAction described as “controversial” votes during a year’s worth of Annual General Meetings in 2014.

This is ShareAction’s first survey to focus in detail on the asset management industry’s voting policies and practices.

ShareAction defined controversial votes as a vote where the percentage of votes cast against management was greater than 30%, and where this shareholder revolt could not be attributed to the actions of one major shareholder. ((The thinking here is that many shareholders saw there to be a strong case for voting against management’s recommendations)) Most covered executive pay and re-electing board members.

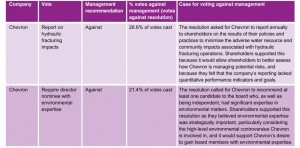

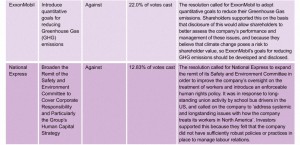

The report also examined four shareholder resolutions on environmental and social issues.

The research was carried out between January 2015 and April 2015. During the analysis, asset managers were informed of their ranking by email and were given the opportunity to comment or ask questions, and to make additional disclosures or to provide clarification.

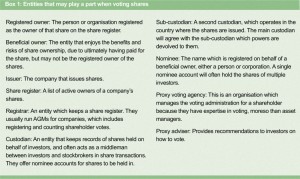

Voting at AGMS

AGM voting is a key way for shareholders to exert influence over their investee companies. Trustees of pension funds and foundations need to act in the best interests of their beneficiaries.

After the financial crisis, shareholders were given new voting powers over executive pay. The intention is reduce inappropriately large pay packages, and the focus on short-term performance.

Companies now have to hold a binding vote on the directors’ remuneration policy at least every three years and an advisory vote on the directors’ remuneration report every year. If this advisory vote fails to pass, the company must hold a vote on the remuneration policy the following year.

Problems with the voting system

There are a couple of problems with the current voting system:

- votes can be lost or changed during transmission from the shareholder to the company

- in 2003 Unilever discovered that approximately 12.6 million votes cast by shareholders were ‘lost’ due to an error in the paperwork filled out by a proxy advisory firm

- in 2012 Dutch asset manager Robeco discovered that a number of the votes they cast during AGM season were processed incorrectly, with ‘for’ votes being registered as ‘against’

- beneficial owners holding shares in nominee accounts do not have automatic rights to vote shares or attend AGMs, and must rely on contractual arrangements with nominee providers to do so

- the 2006 Companies Act did not legally oblige nominee operators to provide these rights, and some do not

- we have previously looked at the campaign by ShareSoc to improve the rights of nominee investors

The Asset Management firms

The asset management firms reviewed in the report are responsible for £13.8 trillion of global assets held on behalf of individual pensions, charities and universities.

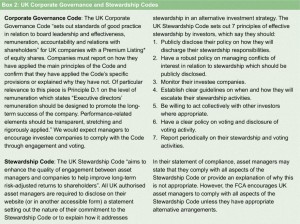

- All of the managers surveyed have signed up to the UK Stewardship Code, first published in 2010 in the wake of the financial crisis, which recommends that asset managers publicly disclose their voting records

- Thirty-one of the thirty-three have also signed the Principles for Responsible Investment

The UK Stewardship Code states that “effective stewardship benefits companies, investors and the economy as a whole,” and highlights that “asset managers, with day-to-day responsibility for managing investments, are well positioned to influence companies’ long-term performance through stewardship.”

The investee companies

Sectors affected by the controversial votes include:

- pharmaceuticals

- energy

- fashion

- tourism

- defence

- consumer goods

- transport

- financial services

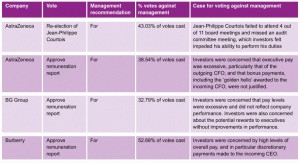

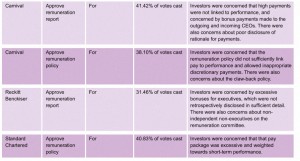

Investee companies included:

- AstraZeneca

- BG Group

- Burberry

- Carnival

- Reckitt Benckiser

- Standard Chartered

The controversial votes

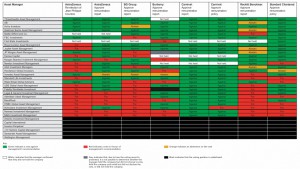

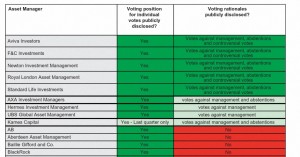

Asset Manager Voting Patterns

The key here is the colour coding:

- Green indicates a vote against management’s recommendation

- White indicates that the manager confirmed that they did not hold the company

- Red indicates a vote in favour of management’s recommendation

- Orange indicates an abstention on the vote

- Grey indicates that it is not possible to determine whether:

- the manager held the company but did not choose to vote

- the manager held the company and voted but did not disclose the vote

- the manager did not hold the company

- Black indicates that the voting position is undisclosed

Findings

- Asset Managers side too often with company management on controversial votes at company AGMs, even when there is a clear case for challenging company management on a vote.

- There is a disconnect between what some asset managers’ voting policies say they will do, and how they actually voted in 2014.

Only a small number of managers disclose rationales for votes against management, or controversial votes with management, which hinders the ability of investors and other stakeholders to assess how managers make voting decisions and hold them to account.

ShareAction Chief Executive Catherine Howarth said: “Most of us investing with big-name Asset Managers trust them to vote sensibly on a host of controversial issues at the Annual General Meetings of the companies we own. But our survey suggests a wide range of big names in asset management aren’t exercising their stewardship responsibilities at some of the world’s biggest companies.”

Report author Jo Mountford said: “Asset managers’ voting decisions have a strong impact on companies’ activities, so it is important that investors understand how these decisions are made. Transparency of voting records and rationales for votes is crucial for ensuring that asset managers are held to account for their decisions, and will help to drive careful consideration of these decisions in the industry.”

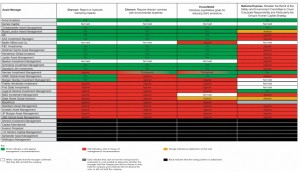

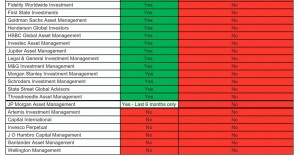

Asset manager disclosure

Good Asset Managers

The asset managers with a strong track record of voting against recommendations by corporate management on controversial votes:

- Threadneedle Asset Management

- AB (Alliance Bernstein)

- Aviva Investors

- Goldman Sachs Asset Management

On Shareholder resolutions about environmental and social issues, the following Asset Managers voted most often for such resolutions:

The five most transparent Asset Managers on disclosure are:

- Aviva Investors

- F&C Investments

- Newton Investment Management

- Royal London Asset Management

- Standard Life Investments

Bad Asset Managers

The asset managers who most consistently support corporate management even on the most controversial votes were:

- Aberdeen Asset Management

- BlackRock

- HSBC Global Asset Management

- Schroders Investment Management

- Hermes Investment Management

- M&G Investment Management

On Shareholder resolutions about environmental and social issues, the following Asset Managers voted most often against such resolutions:

- Aberdeen Asset Management

- Investec Asset Management

- JP Morgan Asset Management

- UBS Global Asset Management

Six Asset Managers do not disclose their votes as a matter of practice:

- Artemis

- Capital International

- Invesco Perpetual

- J O Hambro Capital Management

- Santander

- Wellington

The Stewardship Code, to which all are signatories, recommends that asset managers should routinely disclose how they voted.

Conclusions

There is clearly an issue with asset managers supporting company management too easily. This will be more easily addressed through group action that by individuals, who are unlikely to boycott an Invesco Perpetual fund in favour of one from Aviva.

ShareAction are coming at this problem from the social justice warrior (SJW) end of the spectrum, whereas I am more concerned about excessive executive remuneration and short-termism, but all hands to the pump.

Until next time.