100 Baggers 2 – Studies and Funds

Today’s post is our second visit to 100 Baggers by Christopher Mayer.

Four studies

Chapter 4 of Mayer’s book looks at other studies of 100-baggers (other than Phelp’s book).

- Like Mayer, at least a couple of them were inspired by Phelps.

The first is Tony’s 100-Baggers.

A fellow named Tony at TS Analysis published one informal 15-page study called “An Analysis of 100-Baggers.

Tony looks at 19 100-baggers, with four conclusions:

- The biggest price moves came during extended periods of growing earnings plus PE expansion.

- Since P = E/PS * P/E this is pretty much a tautology

- PE expansion is linked to accelerating earnings growth

- Again, not surprising, given the popularity of the PEG ratio

- Beaten down forgotten stocks that are returning to profitability (turnarounds) are good candidates

- PE ratios in 100 baggers can get very high

Monster beverage is a good example:

Earnings growth rates went from negative in 2001 to 0 per cent in 2002. From there, earnings increased on a quarterly basis by 20 per cent, 40 per cent and then 100 per cent. In 2004, quarterly earnings growth accelerated to 120 per cent, and then 150 per cent, 170 per cent and finally 220 per cent by the fourth quarter.

The PE went from 10 to 50.

The second study (by Motilal Oswal) looked at 100-baggers in the Indian market.

- I will skip past this, as my focus is on the UK and US markets.

Study number three is a presentation called “10x Return Stocks in the Last 15 Years,” by Kevin Martelli of Martek Partners in 2014.

- Although inspired by Phelps, this isn’t a 100-bagger study.

Martelli found 3,795 10-baggers (18% of his sample).

- Find this population too unpredictable, he cherry-picked 100 with more identifiable properties.

His conclusions for finding a winner:

- a low entry price relative to long-term profit potential

- small market cap (68% started at below $300M)

- there are often long periods when it’s a good time to buy

- you have to be patient

The fourth study is another slide presentation, by Hewitt Heiserman Jr. and is called “Ben Graham and the Growth Investor.”

- This is a study of growth stocks that became multi-baggers.

Heiserman makes a few points about not focussing on earnings alone:

- Earnings omits investment in fixed capital, so when capital expenditures are greater than depreciation, the net cash drain is excluded.

- Earnings omits investment in working capital, so when receivables and inventory grow faster than payables and accrued expenses, the net cash drain is excluded.

- Intangible growth-producing initiatives such as R&D and advertising are expenses (i.e. not investments), even though the benefits will last for several accounting periods.

The 100-Baggers

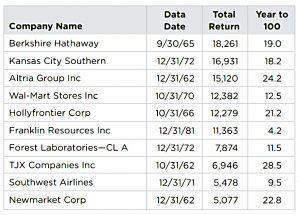

Chapter 5 brings us to the 365 100-baggers that Mayer himself uncovered.

He starts by reminding us of the long holding period needed for most 100-baggers, and how this helps minimise capital gains tax.

- The tax regime is different here in the UK, and SIPPs and ISAs mean that you can avoid direct tax on your gains in any case.

The 100-bagger population seems to favor no particular industry. There are retailers, beverage makers, food processors, tech firms and many other kinds. The median sales figure for the 365 names at the start was about $170 million and the median market cap was about $500 million.

That is a median starting price-to-sales is close to three, which is not cheap.

You must look forward to find 100-baggers. You have to train your mind to look for ideas that could be big, to think about the size of a company now versus what it could be.

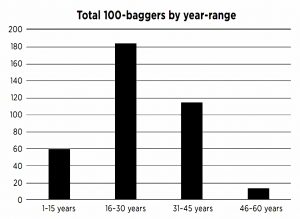

The average time was 26 years. That was also the median.

Case Studies

The next section looks at some of the companies in detail.

Mayer covers:

- Monster Beverage

- Amazon

- Electronic Arts

- Comcast

- Pepsi

- Gillette

The Key to 100-baggers

Chapter 6 looks at the importance of return on equity (ROE). Mayer says:

Many 100-baggers enjoyed high ROEs, 15 per cent or better in most years.

Mayer quotes Jason Donville at Donville Kent Asset Management:

Over time, the return of a stock and its ROE tend to coincide quite nicely.

Home Capital is the company he uses as an example.

- The company 49-bagged over 16 years.

Donville writes a newsletter in Canada, and also runs a fund.

- Buffett mark two was his inspiration, and he looks for compounders.

If a company has a high ROE for four or five years in a row—and earned it not with leverage but from high profit margins—that’s a great place to start.

The second thing Donville looks for is the capital allocation skills of the management.

The guys who make consistently good decisions tend to be owners with skin in the game. The smart entrepreneurs don’t actually go for home runs, they hit a ton of singles.

This is obviously more of a qualitative judgement, though we can look for insider ownership.

Donville uses “through-the-cycle ROE”.

If in an off-year ROE is 10 per cent, and in a good year it’s 30 per cent, then that counts as a 20 per cent average.

A good trick is to buy in the off-year.

- Donville also looks for at least 10% growth in sales.

That’s it for today.

- We’ve covered another 20% of the book, so we’re still on track to get through the book in five articles (plus a summary).

It’s been pretty thin fare today – we’ve heard a lot of war stories, but we only have a few clues about what to look for:

- High ROE (> 15% pa)

- Growing EPS (> 15% pa ?)

- RISING PE ratio

- Small market cap (< £500M? or £1 bn ?)

- Growing Sales (at least 10% pa)

- High insider ownership.

Until next time.