Risk Parity and Rising Rates – Rabener

Today’s post looks at a research note from Factor Research on how rising interest rates might affect the performance of risk parity portfolios.

Risk parity

We recently looked at an old (2013) paper from AQR on this topic.

- Today’s paper is much more recent (2022) and comes from Nicolas Rabener at Factor Research.

Risk Parity (RP) does well in a falling interest rate environment since an equal allocation of risk across asset classes results in a high allocation to the less volatile (risky) assets.

But eventually, rates got down to zero and became more likely to go up.

- Then along came inflation, and rates started to rise – and are likely to keep rising until something breaks (a recession, or a big stock market crash).

Now rising interest rates imply higher long-term returns from bonds (the return is linked to the starting yield.

- But is this enough to offset the losses from selling bonds that have gone down in price?

Risk parity and interest rates

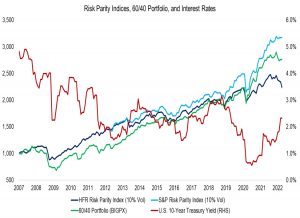

Nicolas looks at the two available RP indices – which each target 10% annual volatility via the use of leverage – and compares them to a 60/40 portfolio over the last 15 years.

- Returns are quite similar until 2022 when rising rates turned returns flat to negative.

This reflects both falling stock prices and particularly falling bond prices.

ETFs and mutual funds

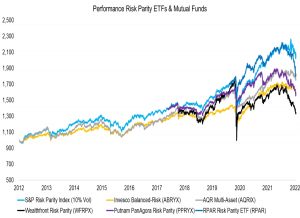

Nicolas also looks at the performance of the RP mutual funds and ETFs (just one ETF) now available in the US.

- They don’t do a brilliant job of matching the RP index (the ETF looks best but has a shorter track record) but again, the key point is the declines in 2022.

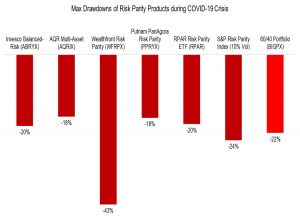

Nicolas attributes the variance between funds to differences in portfolio construction, and investigated further by looking at drawdowns during the Covid crash of March 2020:

All strategies experienced significant drawdowns that can be attributed to the equity exposure. Although all products lost money and failed to be all weather strategies, some did considerably better.

In fact, if we ignore robo-advisor Wealthfront, all the funds did better than the RP index and the 60/40 portfolio.

Factors

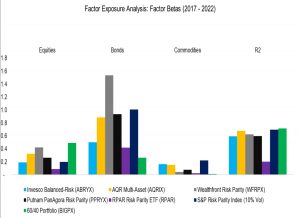

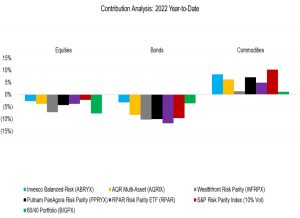

Nicolas also did a factor analysis of the funds, to estimate allocations to bonds, stocks and commodities.

There is a fair amount of variability, but bonds dominate as expected.

- The next step was to use the factor analysis to break down 2022 returns (YTD):

As expected, both stocks and bonds were negative, with commodities providing a positive offset.

Conclusions

We’ve drifted away from the initial idea of what happens to RP when rates rise, but Nicolas returns to this at the end:

If bond prices decline rapidly, then their volatility would increase, and allocations to fixed income decrease in a risk parity portfolio accordingly. Rising interest rates lower the expected return for risk parity strategies, but do not necessarily make the asset allocation framework unattractive.

There is another problem, however:

The more significant threat would be a rising correlation between stocks and bonds.

This is the issue facing the 60/40 portfolio at the moment, and it’s also a problem for other leveraged strategies such as HFEA.

- Nicolas points to Japan as a model for a long-term increase in correlations, but it seems more likely to me that we might only need to get through this rate-hiking cycle.

This would mean that whilst 2022 and perhaps 2023 were bad for RP (and 60/40, and HFEA) normal service might eventually be resumed.

- Until next time.