Aikido

Today’s post is about a new portfolio service called Aikido Finance.

What is Aikido Finance?

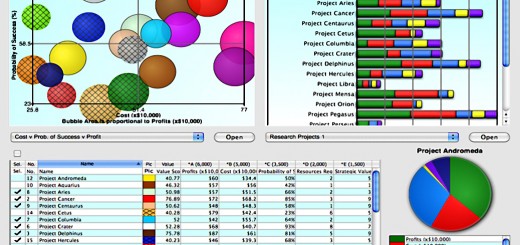

Aikido is a strange hybrid of a stock screener and a robo advisor.

Instead, you need to link your own brokerage account in order to turn the Aikido portfolios into trades.

- Unfortunately, the only available broker that I recognised was Interactive Brokers.

Here’s how the firm describes itself:

Aikido Finance is the leading resource for long term investment strategies. We provide a catalog of evidence-based strategies which we have backtested over the past 20 years. All of our strategies have out-performed the market.

With Aikido you can build a portfolio in minutes and integrate your broker to live trade a strategy. Our mission is to democratize Wall Street and bring quantitative investing to everyone.

Strategies

It’s not clear how many strategies are in the Aikido Catalog, nor is it clear how to screen for strategies that meet particular criteria.

The front page has twelve strategies, plus a “More” button which adds four more strategies at a time.

The strategies in white are “free” whilst the ones in blue-green are premium.

Universe

All of the strategies are currently long-only and US equity only.

- Aikido says that international stocks, ETFs and crypto will be added in the coming months.

Costs

You don’t get much on the free plan – some basic strategies and no broker integration.

- The premium plan is $99 pa or $9 per month.

Note also that since there is no integration with any of the free brokers available in the UK, rebalancing to follow the strategies could work out quite expensive.

Tax

Aikido is an Irish company, (( Though they seem to have been based in the Level39 incubator in Canary Wharf at some point )) and there are no UK tax shelters (ISAs or SIPPs) available.

- So you would need to keep an eye on gains and regularly close positions in order to use up your capital gains allowance each year.

Note also that this will limit the size of your account, and make the $99 annual fee loom larger.

- $99 on a £50K account works out at around 0.14% pa, which you can think of as a platform charge.

Founder interview

I couldn’t find much information about Aikido on the internet, but I did find an interview with founder Shane Monks O’Byrne on the podcast Money Never Sleeps.

- Shane moved quickly from being a Computer Science graduate to founding a startup.

He pitches his mission as the democratization of quant investing:

The problem with quant investing is that traditionally, it’s been confined to sophisticated financial institutions. You need a lot of financial knowledge, a lot of data science and coding experience and a lot of capital. These funds are super-elite, and you need a lot of time to build these portfolios as well, and there’s such a high barrier to entry. This is where we come in, as we want to tear down those barriers to entry.

He explains the Aikido belief system:

We believe in data. We believe in evidence. We believe in the scientific method. We believe in process. We believe in structure, and our take on quant investing is all about long-term and systematic thinking.

And their long-term approach:

The amount of activity in the retail investing space is off the charts. One-third of Robinhood’s profit came from Dogecoin last quarter. That’s the antithesis of the type of investing that we do, which is rules-based, scientific and logical. We want more people to get involved, but there’s a high chance of people burning

themselves if they aren’t investing smartly.

Conclusions

It’s always nice to see innovation in the investment marketplace, but I fear for Aikido’s future.

- There’s a good idea here, but the cost (including trading fees) and lack of a tax wrapper will probably prove insurmountable.

I also think that the target market is obsessed with crypto and meme stocks and that older investors (with more money) will stick to manual stock-picking in the hope of emulating Buffett.

Aikido needs to add UK stocks and integration with one of the free brokers (probably Trading 212, which has a free ISA).

- Stockopedia could also look at ways of producing portfolios from its screening tools which can then be easily implemented on broker platforms.

And everybody should be looking to add social trading features like the Copy Portfolios available on eToro.

- Until next time.