TastyTrade

Today’s post looks at opening a TastyTrade account from the UK.

Contents

TastyTrade

TastyTrade is a US-based online brokerage and investment education platform.

- TastyTrade (the education platform) is the better-known brand within the group – the brokerage is called TastyWorks.

So we’ll really be opening a TastyWorks account today.

TastyTrade merged with IG during 2021, so it’s technically part of a UK group now.

Why?

Spoiler alert – opening and funding a TastyWorks (TW) account is a bit of a chore, so why do I want to go to the trouble of adding a new broker?

- TW has no commissions, but we have several UK brokers with that function, including some with low/zero FX charges if we are interested in US stocks (I’m looking at Stake and LightYear here).

TW has two further advantages:

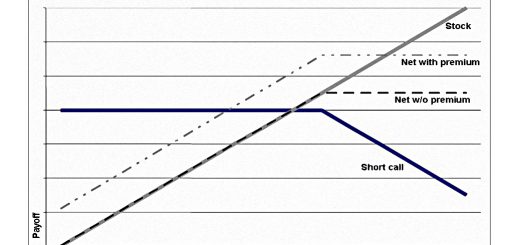

- Access to options

- Interactive Brokers is the only rival platform that I know of for UK investors.

- IG will let you spread bet on options prices (which has the advantage of being tax-free on any profits) – I’ll look at this in a future post.

- IG also emailed me this week to say that 12 options markets (all individual US stocks) had been added to the platform – I’ll look at this in a future post, also.

- Access to US ETFs

- Stake will also let you access these, once you have $25K in your account and self-certify as a sophisticated investor.

- You can also spread bet on some (but not all) US ETFs via IG.

Both of these features are attractive to me.

The process

The key steps involved are:

- Open a TastyWorks account

- Open a CurrencyFair (CF) account

- This is the only way to get money into a TW account from the UK.

- Transfers need to be in dollars, and TW won’t accept transfers from Wise or Revolut.

- Move £££ from your UK bank into CF

- Convert £££ to $$$ within CF

- Send $$$ from CF to TW

- Buy an option or a US ETF on TW

The process is described pretty well on the TW site, but I have also leant on the Europoor.com website, which has a series of posts on how to carry out the above steps. (( For some reason, Europoor only uses capital letters on his website, which can make the posts difficult to read ))

Opening a TastyWorks account

The application process begins with you choosing a username, and entering an email address and a password.

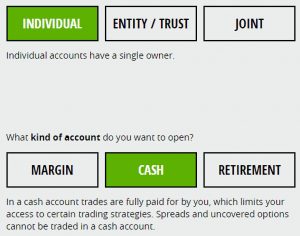

You’ll need to choose between a cash account and a margin account.

- I chose margin because I want to trade option spreads.

Then you enter the traditional personal details (name, address, phone, citizenship status etc).

- This includes your employment status and your tax identifier (here in the UK, this is your NI number).

You also need to supply a trusted contact – I used my partner.

- And you will be asked about your trading experience and objectives.

UK investors need to take a photo of their passport and upload a document which verifies your address (I used a bank statement).

- The phone app will try to match a selfie with your passport photo, but this process failed for me.

I was contacted by the onboarding team via email and had to reupload the passport photo and bank statement.

- It usually takes three to five days for your account to be approved, and that was my experience.

Note that TW automatically complete a W8-BEN form on your behalf during the application process, so you won’t be paying more withholding tax than you need to.

Opening a CurrencyFair account

As discussed above, TW won’t accept transfers from Wise or Revolut, the more natural choices for sending dollars.

- The only alternative to a bank wire transfer is CurrencyFair.

The difference (( According to EuroPoor )) is that CF correctly uses the Swift payment network, whereas the other services try to use ACH, which can lead to a $30 reversal fee.

- EuroPoor found that CF was even cheaper than Wise, so the FX transaction should be at a competitive rate.

Setting up the CF account is a similar process to opening the TW account, and uses the same identity verification documentation (passport and bank statement).

- You’ll need to specify which currencies you want to use – I only ticked pounds and dollars.

You also need to choose a personal account rather than a business one and choose “investments” as the purpose of the account.

If you do decide to open a CurrencyFair account, please consider using my affiliate link:

Putting money into the CF account is simple – you just make a Faster Payment (in sterling) from your UK bank account.

- This usually arrives within a couple of hours, and often in a few minutes.

CF charges $4 plus a percentage fee for an FX conversion.

According to TW, although TW and CF don’t charge for the wire transfer, CurrencyFair’s intermediary bank charges $20.

- It doesn’t seem possible to avoid this, but it does mean that you will want to transfer cash in relatively large chunks.

On a £1K transfer, $20 works out at around 1.6%, which is more than double the typical broker FX charge of 0.5%.

- On a £10K transfer, it’s only 0.16%, which is much more reasonable.

Adding on the fixed $4 FX fee gets us up to around 0.2%.

- The variable fee would be around $50 on a £10K transfer (0.4%) which takes us up to 0.6%.

The bottom line is that you want to be making large transfers, and leaving the money in TW for a while.

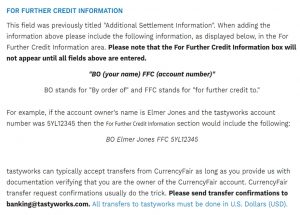

The transfer process is a bit more complicated than the UK’s faster payments system – there are more fields to fill in.

- You can find your own TW account number under “Account Status”.

Wire transfers from CF can take up to 3-5 business days to arrive in your TW account.

- TW recommends that you forward the transfer confirmation from CF to banking@tastyworks.com, so that they know to expect the money.

Conclusions

That’s it for today.

- The process of setting up a TW account – and the associated CF account – is a bit more long-winded than using a UK trading app, but it does provide access to some new instruments (options and US ETFs).

I’ll be back with a review of the service when I’ve made a few trades.

- Until next time.