Alternative Lending – State of the Market

Today’s post looks at a recent report from AltFi on the state of the Alternative Lending Market.

Headlines

In their press release advertising the launch of the report – which in previous years was called the State of P2P Lending – AltFi contrasted the growth in European P2P and marketplace lending platforms – up 80% from €3.6 bn to €6.6 bn in 2019 – with the maturity of the UK platforms (which “only” grew by 10.7% to £6.2 bn).

- Drilling down, 45% of European volume comes from Latvian P2P firm Mintos, a multi-source platform on which 70 underlying loan originators list their offers.

These differing growth rates mean that Europe could well be ahead of the UK by next year’s report.

- Of course, 2020 is proving to be an exceptional year in so many ways that we could yet be surprised.

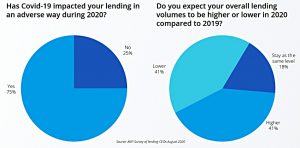

AltFi also foregrounded their sentiment survey of 44 lending CEOs and a deep-dive on post-Covid lending.

- So let’s get started.

UK

2019 was a year of transition for the UK alternative lending sector as it battled both the external influences and uncertainty of Brexit and prepared for regulatory changes that overhauled the way platforms operate.

Retail-focused platforms had to develop systems to categorise investors and introduce appropriateness tests to ensure users understood the risks of P2P lending. There were also new requirements to have a wind-down plan in place should a platform fail. All this adds costs to a business.

The impact of Covid-19 in 2020 is likely to have made things worse.

During the year, Lendy, FundingSecure and MoneyThing folded and Landbay and ThinCats switched from retail to institutional money.

- In 2020, Wellesley has collapsed and RateSetter has been sold to Metro Bank.

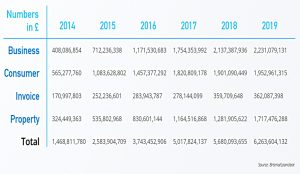

Growth fell to 10.7% from 12% in 2018.

- Total lending was £6.3 bn, for a cumulative total of £25 bn.

Loan originations in the P2P business space hit £2.2bn in 2019, up from £2.1bn in 2019, while consumer lending was flat at £1.9bn.

Property P2P went up from £1.2 bn to £1.7 bn, but £994M of this came from LendInvest, backed by institutional money.

- Retail P2P property lending was just £595M.

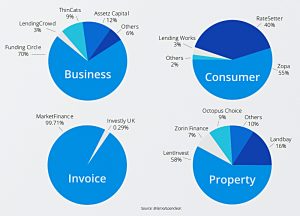

Competition is not great, as each sector has a dominant player:

- Funding Circle has a 70% share in Business Lending (£1.5 bn)

- Zopa has 55% of consumer lending (£1.1 bn – and RateSetter another 40% share)

- LendInvest has a 58% share of Property lending

- And MarketFinance has a 99% share of Invoice finance.

Funding Circle, Zopa and RateSetter have consistently been the largest lenders – the ‘big three’ – but RateSetter was pushed into fourth place in 2019 by LendInvest, which even overtook Zopa for originations during the first and fourth quarter of the year.

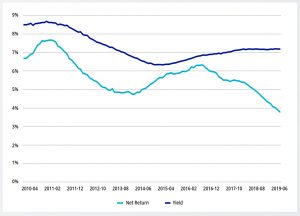

Returns continue to fall.

- Headline rates are still above 7% pa, but after bad debts and commissions, net returns are now below 4% pa.

This is still way above returns from cash and bonds but the direction of travel over the last couple of years is worrying.

- Defaults were up to more than 2.8% in 1H19.

Covid

For all alternative lenders other than Zopa, the Covid-19 recession/depression is the first test of how they will perform through the rough end of an economic cycle.

It has also been a test of how they can keep investors and borrowers happy at the same time as they manage requests for withdrawals on the supply side and the need

for payment breaks and further financial support on the other.

At the start of the pandemic, there was a rush of withdraw requests, which led to delays on platforms like Assetz Capital and RateSetter.

- Ratesetter stopped taking on new investors in May 2020 and was acquired by Matro Bank in August.

Assetz Capital initially lowered its loan-to-value to below 65 per cent and Zopa temporarily stopped lending to higher-risk borrowers in its C, D and E risk bands.

The FCA ordered personal loan lenders to offer a three-month payment holiday to borrowers and although this technically didn’t apply to alternative lenders, most of the big players followed suit.

Alternative lenders were slow to get involved in the governments pandemic loans schemes (CBILS and BBLS) but now 60% of the accredited lenders are alternative/fintech firms.

Listed Direct Lending Funds

I was an early adopter of P2P lending, joining Zopa soon after its launch.

- I’m a fan of disintermediation, and there is a good idea at the core of P2P – split the spread between lending and borrowing, which is fat enough so that even if the platform takes a modest cut, both borrowers and lenders should be better off.

But I never committed too much money, because I had three issues:

- what might happen to default rates during a recession

- how to achieve diversification and the amount of money required to achieve this

- how to shelter returns

As previously discussed, Zopa was the only platform to face the last recession, but it didn’t do too badly and so the first issue went away for a while.

When P2P launched, no tax shelter was available.

- Then the IF-ISA launched, but you could only shelter £20K each year with a single platform – which meant you would need upwards of £100K to diversify (which in turn requires a £2M portfolio, given a 5% allocation to P2P).

Platforms which allowed access to multiple lenders did eventually emerge, but none of the better lenders had an incentive to be on them.

So the listed investment trusts looked like a way to solve all of the problems at once:

- You could buy them within your regular ISAs and SIPPs

- With ten or more funds to choose from, you could achieve diversification with as little as £25K (within a £500K portfolio).

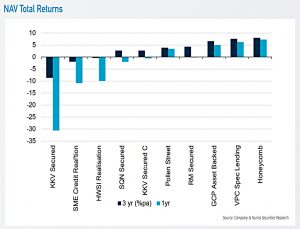

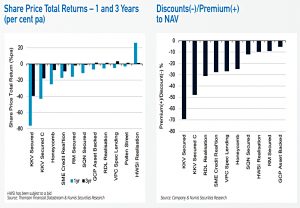

Unfortunately, returns have been poor and lots of the trusts have experienced problems.

The problems continued into 2019:

- The economic impact of lockdowns has led to widespread increases in provisions based on the expectation of rising defaults and uncertainty about the outlook for portfolios, as well as several dividend cuts.

- In addition, shares have come under pressure from a number of large institutional investors seeking to exit the sector.

- The share prices of most ICs are now trading at substantial discounts to their net asset values (NAV), but most investors are struggling to assess value given inconsistent and often poor levels of disclosure.

There has also been a fair amount of activist investor action, resulting in manager changes, returns of capital, the implementation of realisation strategies and M&A activity.

- Some funds (eg. SQN, now renamed KKV, and Hadrian’s Wall, now renamed HWSI) had credit issues and write-downs.

As AltFi put it:

Even funds with solid performance records have failed to deliver against over-inflated expectations at launch.

I’m not sure the sector can bounce back from here, but I hope so.

I’ll leave it there for today.

- This is a fifty-page report, and I’ve just picked out a few topics that I’m interested in.

If you want to read the full report, you can sign up for a copy here.

- Until next time.