Bessembinder 5 – Identifying Outperformers

Today’s post is the fifth in our series on the work of Hendrik Bessembinder on stock returns.

Bessembinder

A couple of years ago we looked at a paper from Professor Hendrik Bessembinder, of the WP Carey School of Business at Arizona State University.

- He examined stock returns in the US from 1926 to 2015.

Stocks have the best (long-term) returns of any asset class, and that this has been the case for more than 100 years.

- But lots of stocks fail in the end, and some have returns worse than bonds, or even negative returns.

Only a tiny minority of companies fight off their competition and grow large.

Bessembinder found that only 42% of listed stocks provided a better return than cash.

- The average stock was listed for just seven years, and the most common lifetime return was a loss of 100%.

The finding that the industry picked up on was that just 4% of listed stocks were responsible for all of the positive gains of stocks during the period.

- A follow-up paper replicated these results for global stocks.

Active managers

Active fund managers like James Anderson, manager of the wildly successful Scottish Mortgage Trust, publicly referenced Bessembinder.

- Anderson is understandably keen to attribute the success of the trust to his stock-picking abilities rather than the stellar run of US tech stocks that he is over-exposed to.

He says that gains will accrue to fewer and fewer dominant firms in the future.

- Two years on, and six months into a pandemic which has further enhanced the value of tech stocks, his thesis is looking pretty good.

Anderson says that winners are:

- Early entrants to markets that later became huge.

- Founder-run.

- Willing to accept/embrace uncertainty.

I agree about the dominance of the major platforms and don’t see more regulation as the answer (since incumbents have deeper pockets with which to fund compliance).

- But overpaying for growth has never worked in the past (see below)

Responses

There are three ways in which to react to Bessembinder’s finding:

- The Anderson route – work out which characteristics will lead to future success, and buy a lot of that kind of thing.

- This is risky but could produce exceptional results (especially over the short-term).

- But it’s hard to identify the winners, and the underlying characteristics are likely to change over time.

- Make sure that you are well-diversified

- If it’s hard to pick the winners, you need to hold everything, to make sure that you include them.

- This way lies the Vanguard passive approach, and it’s proven to work.

- Identify the characteristics of stocks that underperform, and avoid them.

- If 4% of the market has all the returns, then the bottom 96% is flat (compared to Treasury bills).

- But leave out the bottom 58% (the ones that Bessembinder found did worse than cash), and you’re going to do pretty well.

- You could start by simply excluding the smallest 20% (or more) of stocks.

For most private investors, a combination of the second and third approaches – plus an allocation to active managers like Anderson (( I hold SMT, even if it doesn’t sound like it )) – is probably the most practical approach.

Value and Growth

When Hendrik’s paper was first published, Jack Vogel over at Alpha Architect set out to reconcile his findings with the idea that – over the long-term – value stocks tend to outperform the growth stocks which Hendrik’s work suggests capture all the gains.

- Small stock portfolios also tend to outperform, but individual stocks don’t (over their lifetime).

At the individual stock level, over five years, there are more negative growth stocks and more value stocks with moderate returns.

- The highest returns (> 300%) are slightly more likely to be growth stocks.

Over ten years, the distributions close up, but value still has the edge.

- And the big winners (> 690%) are now more likely to be value stocks.

Small caps show similar but more pronounced results.

Individual stocks and portfolios of stocks don’t have the same characteristics.

Many of the big winners over the total return history of the stock are growth stocks.

- But over meaningful investment periods, portfolios of value stocks can beat portfolios of growth stocks.

And individual value stocks also look better on the whole.

Stock Winners

Hendrik’s third paper looks at the drawdowns in winning corporations – those with the greatest shareholder wealth creation.

The most successful company investments involved very substantial peak-to-trough drawdowns. Those investments that are the most successful at long horizons typically involve painful losses over shorter horizons.

The average worst drawdown was 32.5%.

- In the decade prior to that in which these companies were the greatest wealth creators, they suffered worst drawdowns that were on average 51.6%.

Drawdowns lasted from one month to three years (average 10 months) in the decade of greatest performance.

- In the prior decade, they lasted up to eight years (average 22 months).

So to make money from the biggest winners, you need to be prepared to hang on through some savage drawdowns.

Identifying outperformers

Hendrik has published three more papers this year, on the topic of identifying outperforming companies. (( Thank you to Joachim Klement for bringing them to my attention ))

- The first step was to look for outperforming sectors – tech comes to mind.

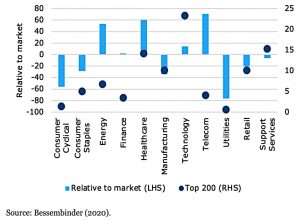

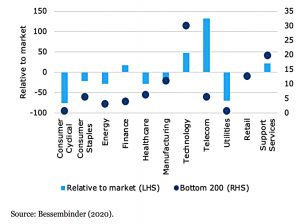

Looking at the best performing 200 stocks, tech is indeed over-represented, but so are healthcare, telecoms and energy.

The problem is that tech (and to a lesser extent, telecoms) is also over-represented at the bottom end of the scale – ever more so than at the top.

- Joachim Klement notes that this makes tech a sector in which it is very important to distinguish between winners and losers, and therefore a sector in which fundamentally analysis can really pay off.

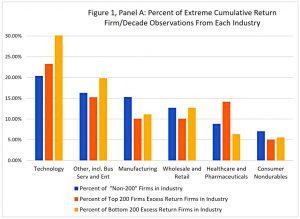

The third chart makes the same point from a different perspective.

The second and third papers drill down into the most common characteristics of future performers, and then look at whether these can be used to identify winners.

Top-performing firms have rapid asset growth, and in particular have strong cash accumulation. Top-performing firms are more profitable on average, despite

higher R&D spending.Top performing firms in terms of accumulated rates of return tend to be younger and have more volatile returns as compared to more ordinary firms, while top performing firms in terms of dollar shareholder wealth creation tend to be older and do not have particularly volatile returns.

The three main characteristics are:

- they invested more in R&D in the previous decade (4.8% of assets compared to an average of 2.8%)

- they had serious drawdowns in the previous decade (81% compared to an average of 70%)

The worst 200 stocks had different features:

- they were losing money in the earlier decade (-10.1% of assets compared to average profits of 1.1% of assets)

- they had high growth in intangibles (19.6% over the decade compared to 8.6%)

- they were slightly more leveraged (debt to assets of 58% compared to 50%)

- they had issued more new equity in the previous decade (26% of assets compared to 9%)

Which all sounds great, apart from the fact that these two sets of features only explained 2% of the variation in returns.

- Leaving 98% unexplained, and the search for the next Amazon still quite difficult.

That’s it for today – we’re up to speed with Hendrik’s work to date.

- I’ll be back with another article in this series when a new paper emerges.

Until next time.