Weekly Roundup, 7th December 2020

We begin today’s Weekly Roundup with a look at taxes.

Contents

Taxes

Joachim Klement looked at an experiment which shows that people view taxes as losses.

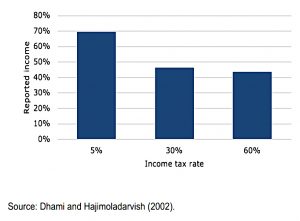

- Subjects were told they could under-report their income, with a 3% chance of being audited.

Under-reporting was more than 30% of income, even at a 5% tax rate.

- At 30% tax, this increased to 55% under-reporting, but there was not much further under-reporting when the tax rate was 60%.

When the chance of an audit was reduced to zero, only 31% of income was reported.

- So people do see taxes as a loss, and loss aversion kicks in.

Risk-averse people declare more when the rick of an audit is increased.

- But on average, we like to pay around 10% in tax (30% of 31%) for moral/self-esteem reasons.

Joachim warns of the implications for investors:

Aggressive tax accounting by companies should be a warning flag. The prevalence of

tax evasion amongst these firms is likely higher than average.

Efficient Markets

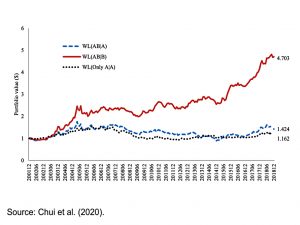

In a second article, Joachim explored the idea that momentum might become more dominant as markets become more efficient.

- A recent paper looked at the markets for Chinese A and B shares.

The China A share market is almost exclusively accessible to Chinese investors while the China B share market is accessible to both domestic and international investors.

Since some shares trade on both markets, the effect of noise traders on A shares can be compared to that of professional investors on B shares.

- Because no direct arbitrage is available, share prices can diverge because of supply and demand effects.

Shares that trade on both the A and B share market show strong momentum effects in the B share market but not on the A share market. There simply is so much more noise trading in the A share market due to the larger number of retail investors that they destroy momentum effects.

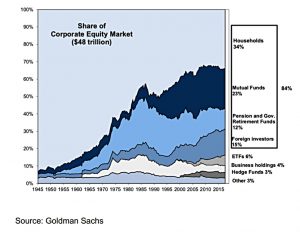

Joachim notes that in the West, fewer and fewer private investors manage their own money.

- So there are fewer noise trades and more momentum (herding by professionals).

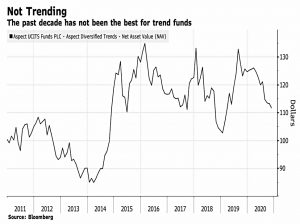

Quants lag

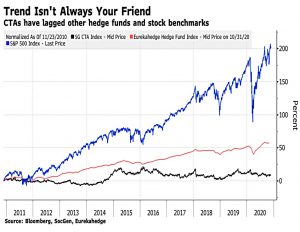

On Bloomberg, Justina Lee reported on the crisis in trend following.

- CTAs are down 2% this year, lagging hedge funds, global benchmarks and the S&P 500.

They have underperformed for a decade, as markets exhibit record-low volatility punctuated by violent short-term swings.

Rotation

In the FT, Merryn Somerset Webb wrote about the coming commodities surge.

- She thinks there is a lot of pent-up demand in the economy (I agree, for certain things) and that the vaccines will release it.

She sees the rotation from Covid winners to Covid losers as part of a relation trade – a shift in medium- to long-term inflation expectations.

A huge amount of money is being printed and handed directly to consumers – and that is triggering a shift from growth stocks, where you buy earnings you might get in the future, to value stocks where you buy earnings which already exist (or in the case of these Covid days will exist again in the spring).

She suggests we trim tech and but financials, travel stocks and retailers.

- Plus commodities, which are “generationally cheap”.

SIPP charges

Vanguard has added a drawdown facility to its SIPP.

- The good news is that it’s free, like the HL drawdown arrangement that I currently use (and other platforms like interactive investor).

The bad news is that the annual £375 fee cap remains (as does the restriction on Vanguard funds only), which means that Vanguard is still not competitive.

Nevertheless, AJ Bell YouInvest decided to remove their drawdown charges in order to compete.

- More good news, except that they have chosen to recoup their losses by increasing the annual custody charge on their SIPP to £120 (from £100).

Unlike ISAs, which are often free, there are no bargain offers on SIPPs.

- Fidelity remains cheapest, at £45 for access to a limited range of ETFs and ITs.

- interactive investor charges £240, with iWeb at £220.

So I will keep both Fidelity and AJ Bell for now, and continue to run down my HL SIPP.

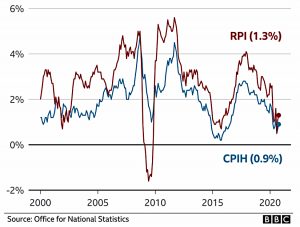

RPI

In his Annual Spending review last month, Rishi Sunak confirmed that the RPI inflation measure will be replaced by the lower CPIH measure in areas such as private (DB) pension indexation (Public-sector pensions were switched to CPIH a couple of years ago).

- The good news is that the change won’t happen until 2030.

CPIH runs about 0.8% pa lower than RPI, which over 25 years of a pension could mean a 20% shortfall in your final payments (or a lifetime payout that is more than 10% smaller).

- State-pensions currently have a triple lock with a base of 2.5% pa which should protect them from most of the CPIH impact.

Around 10M people are thought to have pensions linked to the RPI, and the Association of British Insurers calculated the change would cost pensioners £96 bn (over an unstated period of time).

- The Pension and Lifetimes Savings Associaton estimated that the change would reduce the value of pension schemes by £60 bn.

The change will also save the Treasury around £2 bn pa in interest on index-linked gilts, and theoretically reduces the value of these bonds by £100 bn.

- Company pension deficits might increase, as the value of their investments falls, although future liabilities would also shrink for most.

In fact, bond prices rose slightly on the announcement, as many in the market had expected the change to happen in five years time.

There is also an impact on some public sector infrastructure contracts, which might knock 1p tp 2p off the value of shares like HICL, INPP and BBGI.

Crown Preference

From 1st December, the principle of crown preference has been restored.

- This makes HMRC a secondary preferential creditor in UK insolvencies, alongside things like employee wage arrears and redundancy payments.

- HMRC was a preferential creditor until 2002 when it was downgraded.

After preferential creditors come secured creditors (banks and bonds) and then finally everyone else (unsecured creditors like suppliers).

- Fixed charges on assets like property won’t be affected, and nor will administration/liquidation expenses, but floating charges against the general assets of a firm will be.

- Corporation tax is not included, but VAT, PAYE and NICs are.

Since lots of companies will now have big PAYE and VAT bill due to Covid deferrals this year, this restoration could have a big impact on any insolvencies in the near future.

- In effect, it makes bank lending riskier since it might not be repaid.

This might lead to more invoice discounting and more equity raises, and more expensive lending.

- So investors should be more careful than usual when assessing a dodgy balance sheet.

CGT boost

In the FT, Emma Agyemang reported a boost to CGT receipts in the wake of the scare stories that the tax is about to be reformed.

- CGT take was £72M in October, compared to just £4M in the same month last year.

CGT has been rising since April, partly because those who sell a property now have to report and pay CGT within 30 days, rather than 22 months as they used to.

- So the higher receipts could also reflect buy-to-let landlords unloading properties before expected increases in the tax.

They could also be trying to pre-empt house price falls if unemployment rises next year.

Book title indicator

Writing for Forbes, John Tobey said that the books on the Amazon stock-market best-sellers list are signalling that a generational bull market is starting.

- The Top 100 includes 123 titles with the word “beginner” and two “dummies”.

That sizeable, burgeoning interest is a meaningful -and rare- indication that a new generation of stock investors is entering the field. And that occurrence, in turn, could produce a lengthy bull market as assets flow into stocks, creating more interest and setting off a positive cycle.

John also notes what kind of book is missing:

Books forecasting big stock market gains ahead. Those are published after a bull market run produces investor excitement.

Quick Links

I have eleven for you this week:

- Bloomberg reported that water futures are about to start trading

- On LinkedIn, Vladimir Pakhomov wrote a eulogy for Quantopian

- Alpha Architect looked at how mutual funds move performance around to suit their managers’ needs

- And at why stock-picking is difficult

- And at the Profitability Factor

- The Economist looked at the failure of Arcadia and Debenhams, and what it means for retail

- And at the music royalty funds

- And at the takeover of Slack by Salesforce

- And at Nestle

- And at digital medicine

- Meanwhile, Musings on Markets looked at the Airbnb IPO.

Until next time.

Is it not the case that the change is to maintain the RPI but alter how it is calculated. Thus, all links to RPI are preserved – i.e. it is the method of calculating the RPI that will change. Apologies if this appears at first reading to be nit-picky but IMO this is a subtle but important distinction. More of which follows. Also, many court cases have been successfully fought to maintain the RPI links! In summary – and to steal Baldrick’s phrase – this is a “a cunning plan”!

Currently DB pensions use a variety of indices/methods for revaluation (increases to deferred DB pensions before they come into payment ) and indexation (increases after the DB pension comes into payment). For example, if a schemes revaluation uses the “statutory ” approach benefits [over and above any GMP] are now (although not previously) linked to CPI. As I understand the proposal (adjust how RPI is calculated) this linkage to CPI for revaluation will not change. By the same logic, my understanding is that any scheme that uses fixed rates (for either revaluation or indexation) will not change either. More details on revaluation and indexation can be found at https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/595103/security-and-sustainability-in-defined-benefit-pension-schemes.pdf

In particular, Table 5 on page 63 provides some further summarised details on the distribution of indexation indices/methods across DB schemes.

It is also worth noting that for any long-serving member of any one scheme it is not unusual to have several tranches of pensionable service that each use different revaluation and/or indexation indices/methods too!

As usual with DB schemes, the devil really is in the details!

Lastly, I think public sector pensions are now linked to CPI – rather then CPIH?

Nitpicky is in the eye of the beholder. I thought I’d mentioned that the name was being retained, but it’s the number that matters. All I care about is my indexation shrinking from 2030 – but at least it’s not from 2025.

Well done if you have a fixed-rate indexation – I think they went out while I was at school. Nor do I have tranches. I also don’t have a public sector pension (other than the state pension, which is triple-locked) – so that’s of less interest to me. If you say it’s CPI, who am I to argue.

Table 3 supports explicit use of fixed-rate indexation waning over time. However, please note the footnote about caps and floors. The latter, in particular, can provide an implicit form of fixed-rate indexation. I understand that these rules/methods often take the form of: “index to a max of x%, with an underpin of y%”. By my reading, the proposed changes to RPI calculation will not impact either x% or y%.