Bubble Wealth

Today’s post looks at a paper from Bradford Cornell called Bubble Wealth.

Bradford Cornell

All I know about Bradford Cornell is what it says in the paper:

- He’s the Emeritus Professor of Finance at the Anderson Graduate School of Management at UCLA, and he also works at Cornell Capital Group.

In the intro, Bradford namechecks some people that I have heard of for their helpful comments, including Rob Arnott and Aswath Damodaran.

Bubble Wealth

Bradford has written this short note to explain why the bubble in crypto hasn’t created any real wealth, but only bubble wealth.

Crypto is now worth more than $1 trn – in fact, Bradford says that:

Americans now hold over $1 trillion in cryptocurrencies.

But this doesn’t mean that $1 trn in wealth has been created. For Bradford:

The wealth of a society consists of its real assets that produce consumable goods and services.

Crypto doesn’t really have any productive uses right now (outside of countries with broken currencies.

- But Bradford accepts that those who hold crypto think of it as wealth since it can be converted back to dollars that can be spent (consumed). (( There are also ways to consume directly with crypto, but they make up a very small proportion of the things that you can spend fiat on ))

Bradford wants to resolve this apparent paradox by running through some numbers.

The numbers

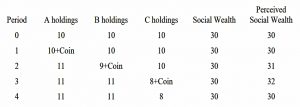

Bradford’s hypothetical “economy” has three people who each own 10 units of a stock which will pay out for (has rights to) future consumption.

The aggregate social wealth (the claims to future consumption) and the perceived social wealth (calculated by summing the perceived wealth of all the individuals) are both 30 units.

This is period 0 in the table below.

Next (Period 1), A invents a digital Coin.

- Since Coin has no interest or rights to future consumption, nothing has changed.

In Period 2, A sells the Coin for 1 unit of stock to B.

- Now the Coin is worth 1, and perceived wealth has increased by 1.

- Real wealth remains at 30 since the Coin has not increased production.

- A now has 11 and B is down to 9 (plus the Coin).

In Period 3, C buys the Coin for 2, convinced that it will rise in value.

- Perceived wealth is now 32

- Real stock is split 11 to A, 11 to B and 8 to C (plus Coin).

The bubble wealth is the gap between the perceived social wealth and the actual wealth (production and consumption).

- Adding more people and more rounds of trading will inflate the bubble further.

Why?

Bradford notes that in the example, there is no reason for trading to begin.

In the real world, however, there may be a number of catalysts. Trading Coin

could be a way for criminals to move funds around or could serve as a mechanism for avoiding tax.

The Coin might also provide an alternative means of exchange (a convenience yield), though as previously discussed this is hard to argue for crypto at present.

- Bradford says that both bitcoin and meme stocks (Nikola, AMC, GameStop) look like a combination of a security (with rights to future consumption) and Coin.

A crash

The fact that Coin does not create social wealth does not mean its crash cannot destroy wealth in a more realistic context than the simple example. If market frictions and politics are involved, wealth transfers caused by the crash of Coin could have important real effects.

And the perceived wealth that Coin holders feel they have can lead to spending which might have macro-economic effects.

- The NFT bubble and its spillover into the real art world look like this to me, as does the adoption of bitcoin by El Salvador.

Catalyst

What might trigger a crash?

- Same as always, somebody who needs to cash out.

If investors currently holding Coin want to convert their holdings into consumption, they will have to sell. Because Coin provides no rights to future consumption, there are no fundamental investors willing to buy Coin. The only buyers are other speculators.

At some point, there are no more speculators willing to buy at a higher price, and the process reverses.

As soon as the price falls, the speculative reason for holding Coin disappears and the price collapses.

What is value?

As an explanation of how bubbles form, the paper is fine.

- But it doesn’t feel specific to crypto to me, and it says nothing about when the bubble might pop.

All forms of money have no intrinsic/productive value – they are worth what you can get someone else to trade for them.

- Some things have constraints (production costs, or “scarcity”) but even forms of money that have some utility (eg. gold) usually trade far above their “true” value.

We also need to think about flows.

- When one house on a street of 100 which are work £1M is sold for £1.1M, only an extra £100K has changed hands, but £10M of “value” has been created.

The stock market works the same way.

- Marginal, flow-based price changes can read across to entire asset classes, however large or small people define those to be.

It doesn’t matter what people think crypto is worth, any more than whether they prefer Beeple to Bacon or Marvel comics to Shakespeare.

- It only matters what people are prepared to pay for something.

My job as an investor is to work out the most likely distribution of future values across asset classes and allocate accordingly.

- Everything – not just the stock market – is a voting machine, and a dollar is a vote.

Until next time.