Weekly Roundup, 31st January 2022

We begin today’s Weekly Roundup with flow.

Contents

Flow

John Authers looked at the impact of money flows on equity and bond markets.

- He used research from Michael Howell of Crossborder Capital.

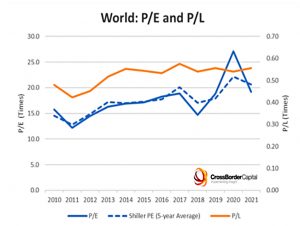

The first chart shows PE against PL (price compared to liquidity).

- PL is much more stable than PE.

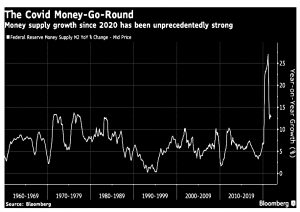

Investors kept putting much the same proportion of the money available to them into equities. It just so happened that vast new sums of money were released by central banks, and so this meant that the price of equities went up a lot.

This has two implications. One is that the market isn’t in the speculative bubble that it appears to be. People aren’t bowled over by enthusiasm; it’s just that they have money on their hands and have to put it somewhere.

The second is that the same logic implies bad things for share prices once money supply growth starts to be cut back significantly.

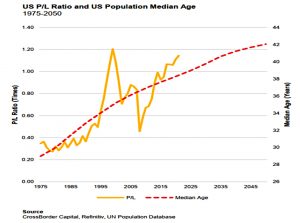

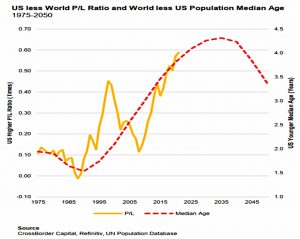

One surprise is that the proportion of money going into stocks has risen even as the median age of the population has gone up.

- This is particularly true of the US (the median US citizen is also four years younger than the median person in Europe or Japan).

This will change in the (distant) future.

Selling out early

In the FT, Howard Marks looked at why so many investors sell too early.

- The two reasons are that their investments are up, or they are down.

The first group are worried that their profits will disappear.

- Losing a gain would be embarrassing.

It’s usually a mistake to view realised gains as less transient than unrealised gains. Proceeds from sales are generally reinvested, meaning the profits — and the principal — are put back at risk.

But according to Howard (a celebrated value investor), it’s even worse to sell when things are down.

- I have to disagree here, you should cut your losses and let your winners run.

A third group sell because they think a decline is coming.

There are very few people who possess the skill needed to profit from market timing. Every market high is followed by a higher one and, after all, only the long-term return matters.

Howard does have his own reasons for selling:

Opportunities for intelligent selling should be based on the outlook for the investment and they have to be identified through hardheaded financial analysis, rigour and discipline.

That sound’s like a lot of work to me, so I use simpler technical rules, based on moving averages and relative strength (to the market and within the portfolio).

But I can agree with Howard’s conclusion:

Simply being invested is by far “the most important thing”. (( This is the title of one of Howard’s most famous books, which we have covered here on the blog ))

Cash

In FT Adviser, Amy Austin reported that more than 3M pensioners are holding all of their ISA savings in cash.

- 5.8M over-65s hold a total of £305 bn in ISAs (an average of £52K each)

Of this, £87 bn is owned by people who exclusively hold cash (with an average of £25k per person).

- A further 1.3M pensions hold a mix of cash and stocks ISAs.

Steve Webb of LCP said:

Whilst holding small amounts of cash in an easy access account can be convenient, these figures show that huge amounts of money are sitting rotting in cash Isas. Inflation is like a tax on savers. The spending power of cash savings is being savagely reduced.

Many instant access cash Isas pay little or no interest. Older savers need to consider urgently whether keeping their money in these cash accounts is the best way to protect their hard-earned savings.

VCTs

Also in FT Adviser, Sally Hickey reported that investment into VCTs is on track for a bumper year.

- With three months of the tax year to go, £580M has been invested, compared with £256M in the previous tax year.

Alex Davies, founder of Wealth Club (( co-incidentally, the VCT broker that I use )) said:

The future is very bright for VCTs and that next tax year is likely to be even

bigger than this. The tax problem isn’t going away, indeed from April 6 it will be even greater when both national insurance and tax on dividends rises. The pension lifetime allowance is also frozen for another four years.For investors looking for growth they are a lot more likely to find it in VCTs than on UK listed markets. There is also more help and encouragement out there than ever before for people who want to set up or scale a business which means there are a lot of opportunities out there for VCTs and subsequently the need to raise money.

I put the same amount into VCTs every year.

- I’m glad that they are getting popular, but I wouldn’t want them to be too popular.

There are only so many suitable opportunities for the funds to invest in, and its hard enough to invest in my preferred funds as things stand.

Debt

Buttonwood explained why the bias for debt over equity is hard to dislodge.

Most countries that levy taxes on corporate profits treat debt more favourably than equity, largely because they allow interest payments, like other costs, to be deducted from tax bills.

This is a huge incentive to borrow money rather than raise equity.

- There are $123 trn of debt securities and $106 trn of listed equities globally.

Higher levels of debt make firms more vulnerable to economic shocks.

Because trouble at highly leveraged lenders can easily throw the rest of the financial system into turmoil, researchers have tended to concentrate on the effects on banks.

But profit margins in banks are thin, and removing the tax deductibility of interest might make some lenders unprofitable.

The debt bias also grows as governments raise corporate taxes, so they are trying to fix this:

A rule that came into effect this year in America caps debt-interest tax-deductibility at 30% of a company’s earnings before interest and taxes. The EU is mulling a “debt-equity bias reduction allowance” , the details of which are yet to be made public.

An alternative would be to remove interest deductibility, but lower corporate taxes, but this would be politically awkward.

- The third option is to make issuing equity more attractive.

Researchers propose an allowance for corporate equity (ACE), which would make some share of a bank’s equity—above its regulatory requirements—as tax-friendly as debt. If a bank had $100bn in equity above what it was required to issue, an allowance of 5% would reduce its taxable profit by $5bn, the same way that $100bn in debt with an interest rate of 5% would be treated.

The same could be applied to non-banks.

- Italy and Malta have introduced ACEs for newly-issued equity, but no one else seems interested at the moment.

Bank stocks

The Economist looked at why bank stocks are falling as interest rates rise.

- It seems that higher rates will hurt rather than boost profits.

Lenders make their money on the difference between the interest they pay out to depositors and the interest they earn on loans and investments. As rates rise, that gap widens.

Rates normally rise when the economy is strong, implying that borrowers will be able to repay their debts.

So the big six US banks predicted more interest income on their January earnings calls.

- But their stock prices have fallen.

Wages costs are rising, but so (until recently) were profits.

- Perhaps the end of easy money could hit those profits, as markets fall and IPOs and company mergers end.

The stock market seems to think so.

Interactive Brokers ISA

Interactive Brokers has added an ISA to its offering, but unfortunately, it’s not very compelling.

- There’s no leverage and you can’t hold the account in dollars. (( These are ISA restrictions, but particularly noticeable with IB, where leverage and dollar accounts are fundamental to the offer ))

It’s also regular shares only (no US ETFs) and has a £3 monthly charge (offset by commissions).

- Trades are not commission-free, though fees are competitive.

FX charges are just 0.03%.

- Insurance is US (SIPC, up to $500K) and obviously, IB is much larger (safer) than Trading 212, Stake or Lightyear.

I still like IB for US stocks and options, but not for my ISA (unless I want to hold US stocks in there).

Financial promotion exemptions

An Angel group of which I am a member sent me a bit more detail on the potential changes to the exemptions for self-certified High Net Worth and Sophisticated investors.

- I’m not an active Angel, (( I don’t have enough money for it to make sense )) but I use the exemptions to invest in VCTs, so I have some skin in the game here.

The idea behind the exemptions (introduced in 2001 and last reviewed in 2005) is to enable small- and medium-sized enterprises (SMEs) to raise finance from angels without the cost of having to comply with the regular financial promotion regime.

- A lot has changed since the last review (not least inflation), and there have also been instances of these exemptions being used to market inappropriate products to retail investors.

The basic exemptions require £100K pa of income or £250K of liquid assets (outside of pensions and your main home).

- In 2001, a £100K income was in the top 1%, but now it’s “only” the top 3% ( which still seems OK to me).

Using inflation, the government would increase the limits to £150K pa and £385K.

- This seems reasonable, though I’m not sure how people now excluded from VCTS would feel.

An alternative approach is to map the limits to the top 1% of earners and asset owners.

- This would increase the thresholds to £175K pa and £900K.

The consultation is ongoing, but at least we know what the government is aiming for.

Quick Links

I have twelve for you this week, the first six from The Economist:

- The newspaper wondered when the semiconductor cycle would peak

- And whether China would dominate semiconductors

- And said that that supply chain problems aren’t going away

- And that Britain’s newly listed tech firms are taking a beating

- The Economist reported that the Bank of England is determined to avoid a wage-price spiral

- And that markets have fallen because the era of free money is coming to an end.

- UK Dividend Stocks asked whether the UK’s 20-year housing bubble would ever end.

- Flip Chart Fairy Tales look at the role played by disappearing occupational pension sin levelling up.

- Alpha Architect look at portfolio strategies for volatility investing

- And at what relative sentiment says about market regime change

- And reported that Factors and Trend-Following are the best strategies for dealing with inflation.

- Musings on Markets provided data update number three, on inflation.

Until next time.