Concentration and Leverage

Today’s post looks at a paper from AQR on the choice between Concentration and Leverage.

Contents

Concentration and Leverage

The note we will be looking at dates back to 2Q2012, and is part of a series from AQR called “Alternative Thinking”.

- The note asks: “Why Do Most Investors Choose Concentration Over Leverage?”

Academic research which was already 50 years old at the time that the AQR paper was written shows that leverage should lead to higher returns than a concentration in one dominant risk (stocks).

- This arises from the standard 60/40 portfolio which appears diversified by capital allocation, but because of the much lower volatility of bonds, the vast majority of the risk comes from stocks.

The correlation between the monthly returns of a global 60/40 portfolio and a global equity index is 0.99 (1990-2011).

To answer the question, AQR looks outside the academic mean-variance framework.

- AQR believes that leverage is better compensated than concentration, and can be more manageable.

Using leverage will not be attractive to all investors, which is one reason why we might expect a return premium for using it.

- This was particularly the case when the paper was written (soon after the 2008 crash, which was partly caused by excess leverage) due to both new regulation and investor preferences.

Two paths

AQR identify two options for investors (who want high returns):

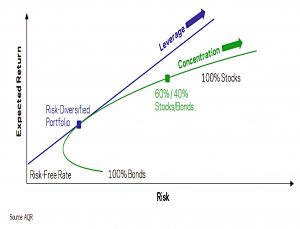

Here, volatility corresponds to return, and the levered SR approach is generally known as risk parity (RP).

- You can see from the chart that the purple line (RP) is above the green line (concentration).

This is a simplified chart using just stocks and bonds, but the principles are the same when using more (or all) assets, and including international diversification.

Building Portfolios

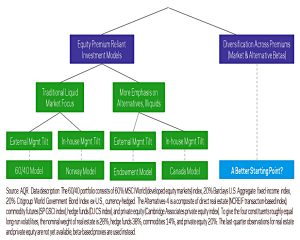

AQR look at alternatives to 60/40, including the Yale/Endowment model and the Canada model (which uses in-house rather than external managers).

- Both of these approaches use lots of alternatives (hedge funds, private equity, real estate/infrastructure, natural resources/commodities, etc.) but retain a high equity market beta.

This is because most alternatives are equity alternatives.

- Infrastructure and royalty firms are bond alternatives, and precious metals, long vol and global macro are true alternatives.

Over the past decade, the correlation between the quarterly returns of a composite alternative asset portfolio and a global equity index is 0.75 (per asset class: 0.86 for hedge funds, 0.80 for private equity, 0.45 for commodities and 0.21 for real estate).

Hedge funds have done better in terms of correlation since the paper was written but at the expense of low returns.

AQR note that the stock market contains embedded leverage, even though most investors seem to want to avoid this.

The U.S. equity market has had a book debt to equity ratio between one and two in recent decades, and many alternatives contain much more embedded leverage (managers using leverage but no leverage at the plan level).

They also note that Warren Buffett uses leverage:

The Sage of Omaha has favored low-beta stocks as much as value stocks and uses leverage through insurance company float.

Why?

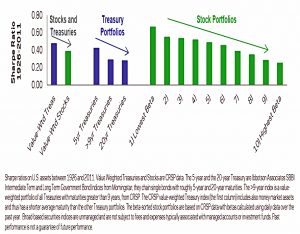

The logical reason to prefer equities is that they have a higher Sharpe Ratio.

- But they don’t – major asset classes have broadly similar long-term SRs.

Between 1971 and 2010, global equities, U.S. Treasuries, and commodities all had SRs between 0.24 and 0.29.

Stocks do have higher returns, but they also have higher volatility, which cancels that out (in SR terms).

- Interestingly, low-risk (low-beta) stocks tend to have higher returns than high-risk stocks.

To explain the bias, AQR look at other factors:

- Confidence – stocks have a long track record of positive returns in most countries

- Familiarity and career risk – stocks minimise peer risk since everyone is buying them

- High liquidity and capacity

- Relatively low costs (eg. compared to many alternatives)

- Embedded leverage

- Leverage aversion – leverage feels like speculation

The one positive effect of all this is that stock-heavy investors may be more likely to stick with stocks through a bad period for returns.

Low risk

Lower-risk investments offer higher long-run SRs than their speculative peers. Bearing a small amount of risk appears amply rewarded, while further risk-taking and especially moving to become concentrated in the most speculative investments within an asset class is poorly rewarded or even punished.

Managing leverage

Leverage does add one risk:

The ultimate risk is being forced to delever with the crowd at firesale prices.

AQR offer several ways to manage leverage:

- keeping large cash balances

- limiting illiquidity

- establishing caps on exposures

- monitoring counterparties

You also need to understand what you are levering:

Levering up liquid investments with low standalone volatility, such as 2-year Treasury futures, is less risky than levering up illiquid, high-volatility ventures.

Conclusion

AQR’s argument is really that leverage is essential in order to fully exploit the benefits from diversification, which will usually entail exposure to low-return assets.

A portfolio of return sources should be balanced so that each can meaningfully contribute to risk and return.

Heavy equity allocations give up some of the diversification benefits and tie returns to the stock market.

Investors should consider risk parity investing across asset classes, and scaling up low-volatility securities (and reducing exposure to high volatility securities) within asset classes.

They also recommend hedge funds and reinsurance as alternative assets.

- Until next time.