Improving Risk Parity

Today’s post looks at a couple of articles on how to improve Risk Parity portfolios.

Sources

I came across this topic on Risk Parity Chronicles (which is itself a site I found via the Risk Parity Radio podcast).

- RPC is run by a guy called Justin, who recently announced that he would be posting less often, and indeed that he might take down the site after a year or so.

That spurred me to work my way through the site, and one of the interesting posts I came across was from August 2022.

- It’s called “Thoughts on Picture Perfect’s 10 Improvements to an RP Portfolio”.

Picture Perfect is another blog that was new to me.

- It’s run by a guy who styles himself as Nomadic Samuel.

His article is called “10 Ways Investors Can Improve The Classic Risk Parity Portfolio”, and it dates from July 2022.

Picture Perfect

We’ll start with Samuel’s post. He’s a big fan of Risk Parity:

The Risk Parity Portfolio ought to be the default portfolio average DIY investors utilize as a long-term investing strategy as opposed to the industry standard 60/40 portfolio.

If investors are concerned about primarily preparing a portfolio for all four economic regimes, controlling volatility and managing sequence of return risk, it’s a slam dunk no-brainer.

I largely agree, though there are implementation issues, particularly here in the south of England where (1) a lot of your money will be tied up in property and (2) the main tax shelters (ISAs and SIPPs) are not particularly RP-friendly.

- So I would say that moving away from the standard 60/40 and towards RP is a good idea, but you make not be able to complete that journey.

Samuel begins with a long-only RP portfolio as follows:

- 20% stocks

- 30% 10-year Treasuries

- 30% Intermediate bonds

- 20% gold/commodities

This brings us straight to the main problem with RP.

Since the Risk Parity Portfolio is not primarily concerned with returns (and instead focuses on risk) you end up with a portfolio that has a greater allocation to bonds than it does to stocks and gold.

RP is also very concerned with correlations and diversification.

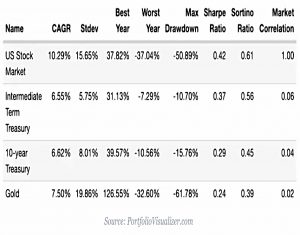

Samuel’s portfolio is very conservative and we might expect low-ish returns.

In fact, returns since 1972 (a decent period for US assets) are 8.3% pa, with a standard deviation of just 7%.

The silky smooth ride of the static Risk Parity Portfolio has offered investors close to equity-like returns with bond-like stability.

The worst year is -9.9%, compared to -37% for US stocks in 2008.

The sequence of returns data is even better – what Samuel calls the Roll period (the period where the portfolio is in drawdown) is just one year.

In comparison the US Total Stock Market has been underwater for a period of an entire decade! How about the 60/40 Portfolio? A five year negative sequence of returns risk.

These are pretty good numbers.

- Let’s see how Samuel thinks they can be improved.

Improvements

Samuel’s first fix is to move from US stocks to a global equity portfolio.

- He uses the 2000s as an example of a decade when US stocks underperformed.

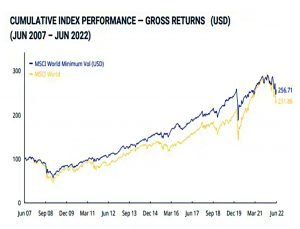

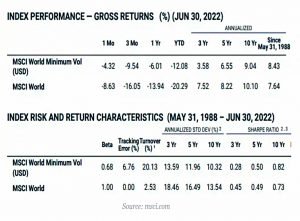

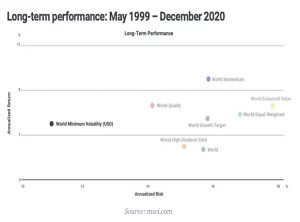

Fix number two is to swap the plain global equities for min vol global equities.

Minimum volatility investing is an equity factor strategy that seeks to “control volatility” by screening for companies that have more stable returns while sifting out companies that are more volatile. You eliminate lottery ticket stocks.

Samuel switches comparison periods once more, moving his starting point to 1998.

- But the results are good.

You get a “free lunch” of potentially greater returns but more importantly you significantly upgrade the standard deviation of an asset class that is one of the portfolios most volatile wings.

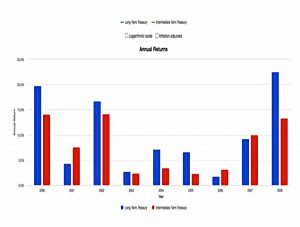

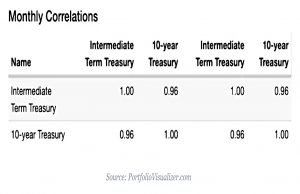

Step number three is to replace intermediate (5- to 10-year) Treasuries with long-term Treasuries (usually the 30-year bond).

Our comparison period now switches to 2000-2008.

Long-Term Treasury provided significantly more protection – it outperformed Intermediate Treasury by over 200 basis points. For a so called “lost decade” for equities, finding assets that provide more stability (when you need it most) and offer higher returns is an upgrade worth taking in my books.

I would prefer longer-term data on this.

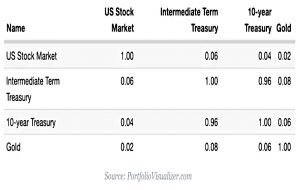

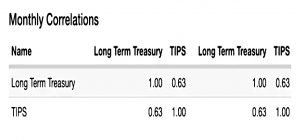

Change number four replaces the 10-Year Treasury bonds with TIPS (Treasury Inflation-Protected Securities).

- Samuel is worried about the high correlations between the 10-year and the intermediate bonds (which we got rid of in Step 3).

TIPS and long-term treasuries have a lower correlation.

Step number five is to add leverage.

- Samuel has a series of articles which look at adding various forms of leverage to his standard RP portfolio – I’ll review these in a future post.

The TL;DR version is this: The Risk Parity Portfolio can handle leverage like a pack-mule. In every round, returns exceeded risk, roll periods remained the same and its Sharpe Ratio and Sortino Ratio improved.

But this time, Samuel will add different asset classes and strategies, rather than simply more of what makes up the base portfolio.

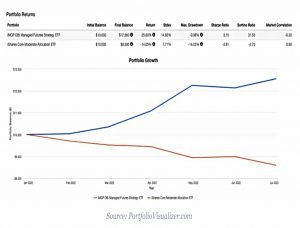

Step six adds Trend (as Managed Futures).

Historically speaking, it has provided equity-like returns with only half of the volatility. Moreover, it is uncorrelated to both long only equity and bond markets. Furthermore, it typically does extremely well during periods of market turmoil when trends are strong.

Samuel highlights trend’s outperformance during a difficult 2022.

Step seven adds other global systematic macro strategies (carry, value, momentum, quality, seasonality and mean reversion) and long-vol option strategies (which protect against tail risk).

Carry is a strategy where investors seek to benefit from a wide differential between high and low carry assets. Long-volatility strategies typically involve buying out of the money put-options, at various strike prices, to provide a type of “portfolio insurance”.

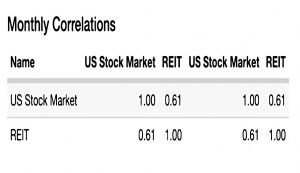

Step 8 adds REITs.

The primary reason for adding them in your portfolio is to diversify your equity sleeve and hedge against inflation.

Samuel highlights the outperformance of REITs during the 2000s.

Step 9 adds market-neutral equity strategies (the original long-short hedge fund approach).

Step 10 adds a mish-mash (Samuel’s description) of other alternative strategies:

Merger Arbitrage, Bitcoin, Reinsurance, Tail Risk, Credit Hedging, Private Equity, Private Loans

I think we’ve had Tail RIsk already, but the rest look new.

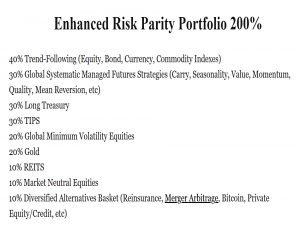

Enhanced RP 200

Samuel’s final portfolio (leveraged to 200%) looks like this:

It’s very different to the base portfolio.

- In the rest of his post, Samuel looks at some (US) ETFs that can help with implementation, but they aren’t available here in the UK.

Risk Parity Chronicles

In his article, Justin works his way through Samuel’s 10 changes.

- Let’s do the same.

He’s fine with the move from US to global stocks.

- And so am I.

He likes the idea of min vol, but would only use it as part of his stock allocation.

- This is my approach, too – and not just for min vol, but for all equity outperformance factors.

On long-term bonds, Justin would go further, and use Extended Duration Treasuries (I had not heard of these).

LT beats IT by 97 basis points; Extended Duration beats LT by 96 more. Also even more negatively correlated.

In practical terms, the bond allocations are less important to me.

- Because it’s hard to access leverage inside UK tax shelters, I need to maintain a high allocation to risk assets, which means a low allocation to stability assets like bonds (usually 20% to 25%).

- With 11% in DB pensions (which behave like a bond portfolio), this means that my listed allocation to bonds and bond alts is usually below 5%.

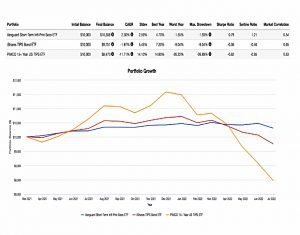

Justin is sceptical about TIPS, and he doesn’t think they protect against inflation.

- He checked using the recent bout of inflation that began in 2022.

Short-term TIPS have done alright, at +2.3% since March 2021, but the two other TIPS funds (total TIPS and then Long-term only) have both been underwater, during what should really be their time to shine.

Just agrees with Samuel that leverage might be a good idea, but like me, he thinks that implementation is not straightforward for individual investors.

- He also highlights the behavioural issues associated with leverage.

One of my unshakeable rules is never risk yourself to losses beyond your purchase price (I never short, I would never borrow money from a friend to pursue a hot tip, etc. I don’t care what the reward is, 0 is my lower bound if it goes south). This may not be mathematically optimal, but behaviorally, it is (for me).

Justin does use leveraged ETFs (in moderation) but they come with a short track record and volatility drag.

He also likes trend, which he can access using three US ETFs.

- As for “Global Systematic Macro + Options Strategies”, he doesn’t know enough about them in a practical sense to use them.

- The same goes for Market Neutral Equities and Meger Arbitrage, Tail Risk, Reinsurance, and Credit Hedging.

Here in the UK, we have one Global Macro investment trust.

- Options are a whole different animal, and not tax-friendly.

Justin does know a lot about REITs (he wrote a series of articles on them), and he’s not convinced.

I’m not actually sure if REITs are necessary, or really, even if they are a distinct asset class at all. Basically, they are just equities with a funky tax structure, and I don’t think they help investors invest in real estate any more than buying shares of Home Depot.

I’m less cynical about REITs than Justin, but I see them as equity alternatives and I would only have a small allocation, particularly as I have 26% of my net worth in physical property.

Justin also has opinions on Bitcoin and Private Assets:

I have been pretty disappointed with my [Bitcoin] experience, but not just for the price decline since I bought some. I expected that. I did think it would have some correlation benefit, though, and that has not been the case.

That’s how I feel at the moment, though things could change in the future.

Been hearing a lot about PE lately, my impression is that it’s hard to track. Mostly just illiquid. Higher fees. Not exactly for me, I think.

I have a minor allocation to PE as an equity alternative.

- I also have a VCT portfolio, which is somewhere between VC and PE.

Private Loans: I do a version of this already – hard money loans for real estate (flipping, new construction, refinancing). If you’re ok with illiquidity, then lots ofupside.

I have no experience with this but would consider it when economic conditions improve and if/when I put together a sizeable taxable portfolio (98% of my assets are sheltered in some way at present).

Conclusions

We’ve covered a lot of possibilities today.

- For me, implementation is the big issue – here in the UK we lack the ETFs available in the US, and our tax shelters are unfriendly to non-mainstream asset classes.

My one approach is to move as far away from the trad 60/40 portfolio as is practical, and towards something that looks more like Samuel’s extended RP 200.

- But I might not get very far down that road.

Until next time.