HFEA 7 – Leveraged Permanent Portfolio and Golden Butterfly

Today’s post is another in our series on Leveraged Portfolios. We look at applying leverage to Harry Browne’s Permanent Portfolio and to the Golden Butterfly Portfolio.

Contents

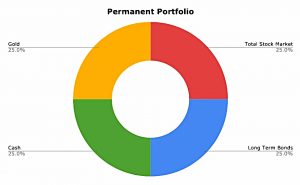

Permanent Portfolio

We’re going to be looking at a couple of blog posts from Optimized Portfolio, but they are a bit shorter than the one we looked at last time.

- The Permanent Portfolio – also sometimes called the Cockroach Portfolio – was invented by Harry Browne in the 1980s and featured in his book Fail-Safe Investing.

It’s a very simple approach that equally weights four assets:

- US stocks

- Long-term bonds

- Cash and

- Gold

There are no allocations to non-US assets, but if you were implementing it today you would probably use at least a global stock fund.

It’s reminiscent of Ray Dalio’s All-Weather Portfolio in that it’s designed to survive all sorts of economic conditions.

- Stocks – economic expansion

- Bonds – deflation

- Cash – economic recession

- Gold – inflation

Note that these conditions do not occur with equal frequency, so the equal allocation is not intuitive.

- We should also note that gold is not a reliable inflation hedge (as we are seeing at the moment).

The PP will likely outperform a 60/40 portfolio in a bear market but will lag behind in a bull market.

The PP shares the same downside of the All-Weather in having low-ish returns over the entire cycle, because of the high allocation (75% in this case) to assets with low real returns.

- Which in turn makes it a good candidate for leverage.

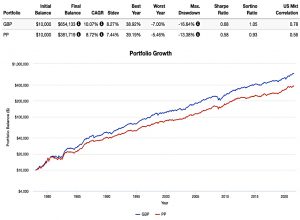

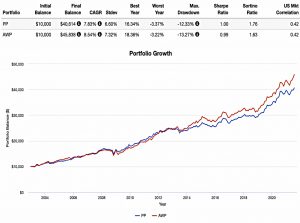

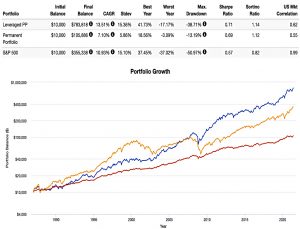

PP Performance

The PP has half the volatility of the S&P 500, and one-quarter of the max drawdown in 2008.

- But overall returns are much lower and the Sharpe ratios are very close.

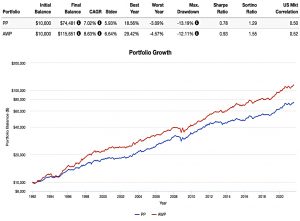

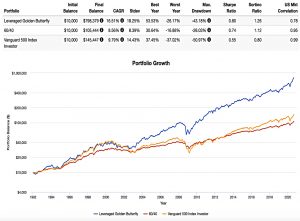

Golden Butterfly

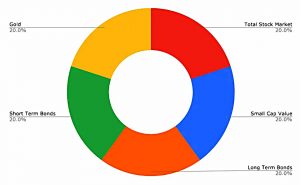

The Golden Butterfly Portfolio – created by Tyler who runs the Portfolio Charts website – adds Small Cap Value as a fifth asset class and divides equally between the five. (( When Harry Browne invented the PP, the size and value factors were not accepted in the academic literature, and there were no index funds tracking them ))

- This takes the stock allocation up from 25% to 40%, which is the minimum level I would consider for a portfolio.

Note that the GBP has no international stock allocation and I would add that.

The GBP has most of the stability of the PP (it has worse drawdowns) but with better returns.

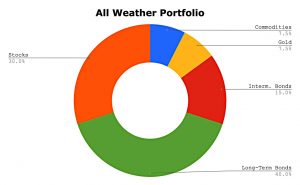

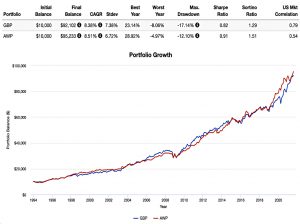

All-Weather Portfolio

The All-Weather Portfolio has more stocks than the PP, but less gold and no cash.

- It has some commodities and a lot of bonds.

Like the GBP, the AWP is as stable as the PP, but with higher returns and a similar Sharpe.

The OP site prefers Utilities to Commodities for diversification, and so ran a backtest of the PP against this AWP-Util portfolio.

- AQP-Util has better returns and a higher Sharpe (but with a slightly higher max drawdown).

AWP vs GBP

The AWP and the GBP show similar performance.

- GBP does slightly better but is slightly riskier.

When we look at the AWP-Util variation, results are very similar to GBP, but with lower volatility and lower max drawdown for the AWP-Util.

Leveraged PP

Having 25% cash and 25% long bonds is roughly the same as 50% intermediate bonds. Ideally, a 3x leveraged Permanent Portfolio would look like this:

- 25% 3x U.S. Stocks

- 50% 3x Intermediate Bonds

- 25% 3x Gold

I would go for international stocks, but I follow OP’s logic.

The snag with this plan is that the US-listed 3X Gold ETF has been withdrawn. (( I haven’t checked whether a UK-listed equivalent exists ))

- So OP has to use UGL, which is 2X

This leads to a portfolio with 2.67X leverage:

- UPRO – 22%

- TYD – 45%

- UGL – 33%

The leveraged PP has higher returns (and Sharpe) than both the unleveraged PP and the S&P 500.

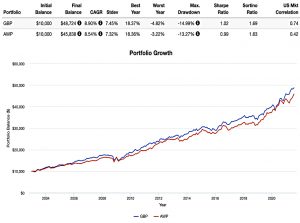

Leveraged GBP

There are no leveraged ETFs for short-term bonds or small-cap value (in the US – I haven’t checked for the UK yet).

- OP fixes the short-term bond issue by substituting intermediate bonds for the combination of short and long bonds.

He also combines the stock positions to a single 40% allocation to the S&P 500.

- He also applies the gold fix from the leveraged PP.

The final weightings are:

- 36% 3X stocks

- 36% 3X intermediate treasury bonds

- 28% 2X gold

This leveraged Golden Butterfly Portfolio essentially becomes a variant of HFEA with a heavy allocation to gold.

The leveraged GBP shows much higher returns than the S&P 500, with slightly more volatility and a slightly lower max drawdown.

- It also has a higher Sharpe than the 60/40.

Conclusions

It’s interesting to look at other flavours of HFEA than the original portfolio based on the 60/40.

- PP, AWP and GBP are all “safe” portfolios for the long term, and it appears that leverage can usefully be applied to all of them.

I expect that my final portfolio will be a combination of all of the above, but with a more international flavour, and perhaps with even more diversifiers if they are available.

- But before we get to that, I have more portfolios and back tests to look at.

Until next time.