Hawk and Serpent

Today’s post is about a paper on asset allocation called Hawk and Serpent – from Artemis Capital in Texas.

Contents

Artemis Capital

I found this paper because I listened to a podcast from Jesse Felder, in which he interviewed Christopher Cole from Artemis.

- Christopher is a volatility trader who started out as a cinematographer in the film business.

The podcast page included links to several papers from Christopher, and this one was most relevant to the topics discussed in the podcast.

- As always, I recommend that you read the paper in full – it’s available here and the direct download link is here.

Hawk and Serpent

The purpose of the paper is to design an asset allocation that will preserve wealth over a 100-year timescale.

- You might see it as a new spin on the Lazy Portfolios approach.

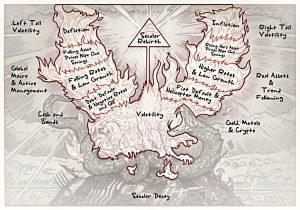

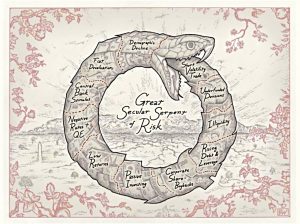

The Hawk and Serpent themselves are an allegory borrowed from history.

The Hawk and Serpent are hidden in plain sight on the Great Seal of the United States of America, the Coat of Arms of Mexico, and have roots in Greek, Egyptian, Indian, and Aztec mythology.

The underlying idea of the allegory is a conflict of opposites – the Hawk is the enlightened mind and the Serpent is the “lower self”.

- Left alone, the serpent will constantly devour its own tail and simultaneously regenerate (this is known as Ouroboros).

In the investment context, the serpent represents the secular growth cycle (rising asset prices followed by fiat devaluation and debt expansion) and the Hawk’s wings represent the forces of destruction. (( This Serpent = good, Hawk = bad system seems the reverse of the mythical interpretation ))

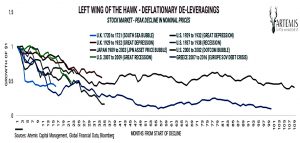

The left wing is deflation, though an ageing population, low growth and debt default.

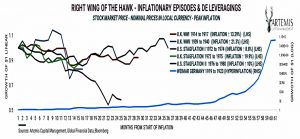

The right wing is inflation, fiat default and helicopter money.

The 100-year portfolio needs to work through these booms and busts.

- Traditionally diversified portfolios (including my own) are mostly long-growth, with a modest allocation to crash protection in order to reduce volatility and increase the Sharpe ratio.

Seasons

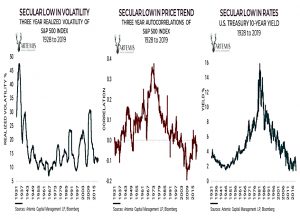

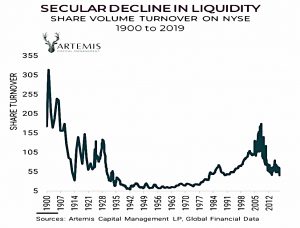

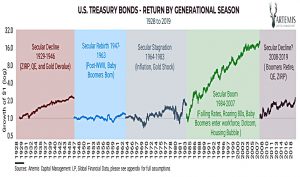

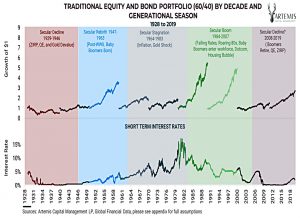

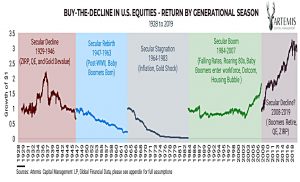

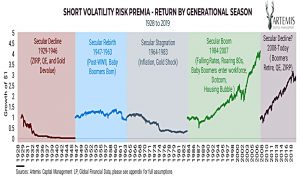

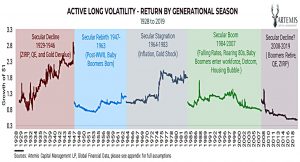

Artemis divide the last 100 years into five “generational seasons”.

After a tremendous boom from 1984 to 2007, Artemis believes that we are now into a secular decline.

You wouldn’t know it from looking at stock returns (until the last couple of months, of course).

Treasuries also seem to be doing fine.

And the industry-standard 60-40 stock-bond portfolio also seems to have coped.

Losing long-term strategies

Artemis point out that several strategies that have worked well in recent years have lead to total capital depletion at various points during the past century.

- These include “buy the dip” and “short vol”.

Anti-correlation

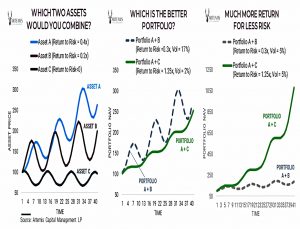

The paper emphasises the benefits of low and negative correlations.

- In the chart above, A and B are too closely correlated.

Asset C has much lower returns than B but is still a better partner for A.

Anti-correlation is worth more than excess return. A defensive asset can be precious to the total portfolio, even if it fails to make money consistently.

This is not a new idea – to me at least – but I’m still very interested to see which assets and strategies can take on this role over a 100-year time-frame.

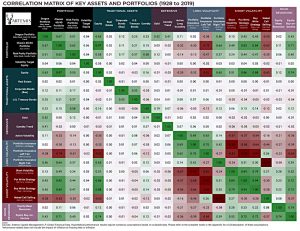

Here’s a useful table of correlations from the Appendix:

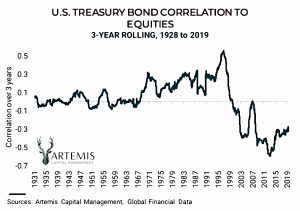

And here’s one showing that the current negative stock-bond correlation is not typical:

This is why Treasuries don’t work as a stock diversifier over a 100-year time scale.

Extra assets

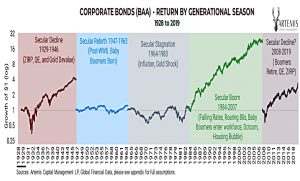

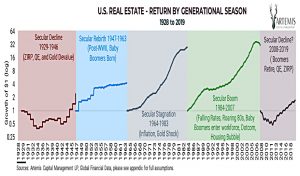

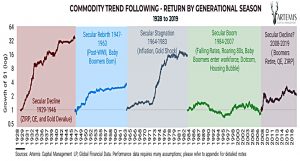

Artemis look a several other traditional and non-traditional assets in order to build up their 100-year portfolio.

- Serpent assets (Stocks, Real Estate, Corporate Bonds) benefit from secular growth and stability.

- Hawk assets benefit from secular chance (Long vol, Commodity trend) or from monetary debasement (Gold).

Corporate bonds look remarkably similar to Treasuries.

Real estate is something like stocks.

Gold looks interesting.

As does commodity trend following.

And long vol (though not recently).

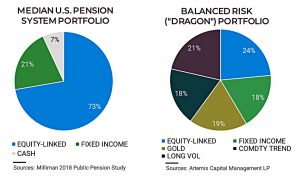

The dragon portfolio

Artemis calls their winning 100-year portfolio the Dragon.

It’s a strange beast:

- 24% stocks

- 18% bonds

- 19% gold

- 18% commodity trend

- 21% long vol

But it performs well under all of the five “generational season” regimes.

Most investors think the role of DEFENSIVE ASSETS is to make money during a rainy DAY, but history shows the real reason to hold these assets is to make money during a rainy DECADE.

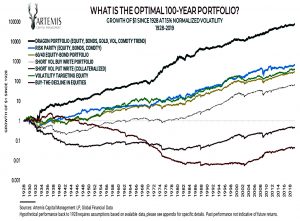

And it beats all of the competition over the last 90 years.

On an unadjusted basis, the Dragon Portfolio generates approximately the same returns as a Traditional 60/40 Portfolio with half the risk.

I was pleased to see that risk parity (the core of my own approach) came second.

Conclusions

According to the paper, my portfolio (in common with most people’s, I would imagine) is:

- Overweight stocks and bonds

- Underweight gold, trend and vol

There are a few things to think about here:

- Leverage

- Over-fitting

- Implementation

The chart showing the outperformance of the dragon portfolio is standardised to 15% volatility.

- Which means that many of the portfolios use leverage (since their natural volatility will be lower than that).

I have run into this issue already with risk parity.

- I’m unwilling to use much leverage (I’m too old and don’t have an income stream, plus I can’t borrow cheaply – so at the moment my leverage is zero).

Which means that I have to hold a higher equity allocation than the maths requires, in order to hit my return target (my SWR).

- And I would have to do something similar if I switched to the Dragon portfolio.

The second issue is over-fitting.

- The Dragon portfolio fits our experience over the last 90 years, but the future (especially the next 40 years – which is my particular concern) might be different.

So I don’t see the Dragon as a new target allocation.

- My takeaway is that I should consider upping my allocation to my underweights (gold, trend and vol).

The lesson from the Dragon is that there is nothing to fear from doing this.

Which brings us to implementation.

- I know how to add more gold to my portfolio, but the other two strategies are trickier.

They are very open to interpretation, and many solutions won’t be available to the private investor.

- So in a follow-up post, I’ll dig into the technical appendices of the paper, so see if I can use any of the methods that Artemis did.

Until next time.

Nice waiting for the follow-up article

It’s on my list – once the gardening season is over I’ll get around to it.