Cut Your Losses – Elm Wealth

Today’s post looks at an article from Elm Wealth on the old adage “Cut your losses and let your profits run.”

Elm Wealth

I recently read the book Missing Billionaires by Victor Haghani and James White.

- It’s very good so far and deals mostly with how much risk to take on under various circumstances.

This is a topic that each of the authors has experience with.

- Victor lost $100M when LTCM collapsed 25 years ago, and James also lost a lot of money when the hedge fund he was working at ran into difficulties (it later recovered).

They both work today at Elm Wealth, which uses a methodology that they call Dynamic Index Investing.

- It sounds like a form of TAA, and I’ll be looking at it in more detail in a future post.

Whilst I was poking around on their site, I found an article from August 2023 on cutting your losses.

Cut Your Losses

The authors begin with a couple of quotes from Edwin Lefevre (Jesse Livermore) in Reminiscences of a Stock Operator (from way back in 1923):

Cutting losses quickly is the foremost rule of speculating.

The big money is not in the buying or the selling, but in the waiting.

Taken together, they add up to the old adage “Cut your losses early; let your profits run” (which Elm calls CLE-LPR).

- In Jack Schwager’s classic Market Wizards, 12 of the 14 traders he interviewed gave CLE-LPR as their top piece of advice to newbies.

For an opposing point of view, Phil Dybvig wrote in his 1988 paper “Inefficient Dynamic Portfolio Strategies or How to Throw Away a Million Dollars in the Stock Market” that CLE-LPR is suboptimal.

- This argument depends on asset prices following random walks and investors having a smoothly decreasing marginal utility of wealth.

Since one or both of these are likely not to be true (trends exist and people are not rational) CLE-PLR often makes sense.

The stock market

The chart shows returns from a static 70-30 stock/bond portfolio versus a CLE-LPR strategy.

- The trend strategy switches to T-bills when the trailing 12-month return is below -5%.

- After an enforced three-month gap, the system starts checking for returns higher than -5%, at which point it re-enters the market.

The CLE-LPR annual return is 1.4% higher, with the same level of risk (daily volatility), and roughly the same average exposure to stocks.

- The Sharpe is 0.53 compared to 0.43 for the 70/30 portfolio.

Max drawdowns in 1929-32 and 2007-09 were 42% and 21%, compared to 70% and 41% for the 70/30.

CLE-PLR works because it is a momentum strategy, but then you have to ask why does momentum work:

There are many theories to choose from: Underreaction to new information, overreliance on recent returns in forming expectations of future returns (a.k.a “return chasing”), and slow recognition of regime shifts.

Hedge funds

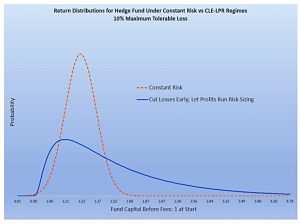

In the second part of the paper, Elm imagines a hedge fund with a trader who can generate $2 for every $1 of risk he takes on (a very good Sharpe of 2).

- The fund investors will only tolerate a loss of 10% in any one year, and the boss of the funds has to work out how to manage the trader.

One option is to fix his risk (standard deviation of returns) at 10%.

- With a Sharpe of 2, this gives a 1.3% chance of losing more than 10%.

The second option is to vary the risk level depending on how far away the trader is from losing 10%.

- When he is 5% up for the year, he is 15% away, and so his risk level can be increased to 15%.

The chart shows the distribution of outcomes for these two approaches.

We believe everyone involved – you as the hedge fund manager, the trader who works for you, and your investors – will prefer the return pattern from the CLE-LPR regime to the return pattern arising from taking constant risk.

The CLE-LPR approach has a much higher average return (50% vs 18%) and only bumps up the chance of loss by 4% (6% vs 2%).

- This also means higher fees for the fund and a bigger bonus for the trader.

Even better, if the trader/strategy turns out to have a Sharpe of zero rather than 2, then the risk of a 10% loss – which rises to 1 in 3 for the constant risk regime – remains at zero (by design) for CLE-LPR.

It is often the case that controlling our natural instincts can be rewarding. We suspect that much of the power of cutting losses quickly and letting profits run lies in the difficulty of overcoming our propensity to do the exact opposite.

This tendency is known in behavioural finance as the disposition effect and is closely related to the endowment effect (the tendency to become attached to assets even when better opportunities emerge).

That’s it for today – always remember to Cut Your Losses.

- Until next time.