Irregular Roundup, 15th January 2024

We begin today’s Weekly Roundup with inflation.

Inflation

John Authers looked at the hot US inflation print.

- Both the headline rate and the core measures were higher than had been hoped.

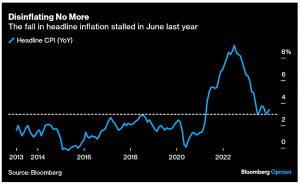

The headline rate bottomed in June 2023 and has been rising since (and even the low was much higher than the pre-pandemic years).

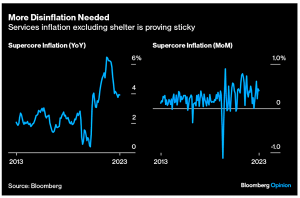

The falls in super-core (services excluding shelter, closely followed by the Fed) have also stalled, and the month-on-month trend is upwards.

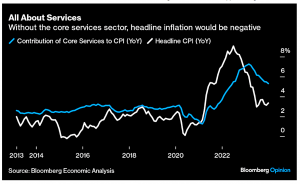

The core services number is now higher than the headline, which means that everything else adds up to a negative number.

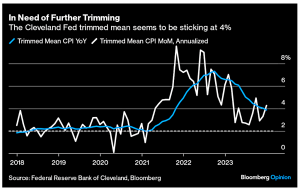

The Cleveland trimmed mean is also stalling, with the last two month-on-month figures showing a rise.

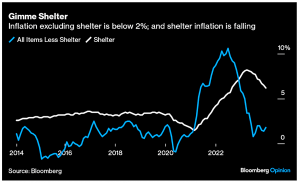

The best reason for optimism is that inflation excluding shelter is now below 2%, and the shelter component (which suffers from a serious time lag) is falling (though it is currently reported at 6%).

It looks like the last bit of reducing inflation from 4% to 2% will be more difficult, which raises the issue of whether the Fed might decide that 3% is close enough for now.

- A Fed cut in March doesn’t seem likely, though the market still seems to expect one.

We also need to factor in politics, and whether Biden can lean on the Fed to cut rates early enough to boost the economy before the election in November.

- Which would increase the chances of renewed inflation in 2025.

Bitcoin

The big news last week (also covered by John Authers) was that the SEC approved a slew of bitcoin ETFs.

- This is less exciting news for UK investors since the ETFs are not available in the UK (and the FAC is generally not keen on us investing in BTC, having banned crypto derivatives in January 2021).

Whilst BTC is hardly a core asset, it is funny in the context of PM Rishi Sunak’s vision of making the UK a “crypto hub”.

- It’s not clear why crypto businesses would want to be based in a country that is hostile to the currency.

It’s not plain sailing on the other side of the Atlantic either, as immediately after the ETF approval, SEC Chair Gary Gensler reiterated that the agency does not approve of BTC itself:

While we approved the listing and trading of certain spot Bitcoin ETP shares today, we did not approve or endorse Bitcoin. Investors should remain cautious about the myriad risks associated with Bitcoin and products whose value is tied to crypto.

The underlying assets in the metals ETPs have consumer and industrial uses, while in contrast, Bitcoin is primarily a speculative, volatile asset that’s also used for illicit activity including ransomware, money laundering, sanction evasion and terrorist financing.

Not exactly a vote of confidence.

The SEC has been turning down bitcoin ETFs for ten years, ever since the first attempt by the Winklevoss twins.

- Their objection used to be that they couldn’t monitor BTC trading adequately, but Ark’s Cathie Wood (amongst others, including Grayscale) appears to have persuaded the SEC that problems on Kraken and Coinbase will show up in the futures traded on the CME platforms.

In a lot more words, the SEC said:

Because the CME’s surveillance can assist in detecting those impacts on CMEBitcoin futures prices, the exchanges’ comprehensive surveillance-sharing agreement with the CME — a US regulated market whose Bitcoin futures market is consistently highly correlated to spot Bitcoin, albeit not of“significant size” related to spot Bitcoin — can be reasonably expected to assist in surveilling for fraudulent and manipulative acts and practices in the specific context of the proposals.

Not everyone agreed. Dennis Kelleher, of Wall Street watchdog Better Markets said:

The SEC has come to the crypto world’s rescue by approving a trusted and familiar investment vehicle that will enable the mass marketing of a known worthless, volatile, and fraud-filled financial product to Main Street Americans.

Bitcoin and crypto are worse than the chips you can buy at a casino because at least the casino is regulated; the spot Bitcoin market is not and that’s what the ETF is going to be pricing. There will be no SEC regulation or policing of Bitcoin.

Some retail platforms (notably Vanguard) are refusing to sell the ETFs eve in the US. A Vanguard spokesman said:

We also have no plans to offer Vanguard ETFs or other crypto-related products – our perspective is long-standing that cryptocurrencies’ high volatility runs counter to our goal of helping investors generate positive real returns over the long term.

This also feels off to me – brokers shouldn’t be taking moral positions on which assets their clients want to own.

- There are similar issues surrounding ESG, which I’ll look at in a later post.

If you can access the ETFs, Morningstar looked at whether you should invest, and if so, which of the eleven ETFs you should choose.

The first argument in favour is cost:

Spot bitcoin ETFs significantly undercut the exorbitant fees charged by current crypto funds. The range of Grayscale trusts currently charge 2% to 3%, and the largest bitcoin futures ETF charges 0.95%, a far cry from the 0.20% price tag in Bitwise’s spot bitcoin ETF filing.

The second is better tracking of the BTC price, though that price is not tied to any fundamental value.

On the other hand, most of the ETFs name Coinbase as the custodian, creating a single point of failure:

Coinbase will be responsible for the security of all the private keys of bitcoin held by these ETFs. Coinbase is also likely the exchange where bitcoin trading will occur for the ETFs when creations and redemptions require it.

And Coinbase is the entity responsible for surveillance-sharing agreements with the ETFs’ listing exchanges—an SEC mandate for a better line of sight into crypto markets where trading could affect ETF prices. Much relies on Coinbase’s safe passage.

As for which ETF to choose, there are two options:

- buy-and-hold investors should choose on price, making Bitwise attractive at 0.20%

- But four more familiar names (ARK, Fidelity, VanEck, and iShares) are only 0.05% higher, and many ETFs offer fee waivers to begin with

- active trades should choose on liquidity, for which the spread is a decent proxy

I’m still on the fence about bitcoin – it’s a good idea but outside of the ETFs, it’s too expensive to trade and its extreme volatility means that it’s no use as money.

- It’s also impossible to value objectively (which presumably drives at least part of the volatility).

My prime interest is in using it for diversification, but in recent years it has tracked too closely to tech for my liking.

The ETF approval is a good thing, as ETFs are cheap, offer more protection than dubious crypto exchanges and should trade close to the spot price.

- But I can’t buy one, even though I can buy “real” BTC.

As to the BTC price, the ETF approval had been expected to lead to a boom as retail cash flooded in.

- That’s what happened when the first gold ETF was launched back in 2005.

A similar move in bitcoin over the first two years of the ETF would lead to a BTC price of $200K in 2025.

- Standard Chartered backs this view and expects inflows of between $50 bn and $100 bn into the ETFs during 2024 alone.

But so far the BTC price is down, back to where it was before Xmas.

- BTC bulls still have April’s halving to look forward to.

The rest of us can hope that the normalisation of BTC as an investment will lead to more “normal” behaviour (lower volatility and a more predictable response to economic forces).

- Let’s also dream that the correlation to stocks is low.

Premium Bonds

NS&I has announced the first of what many expect will be several cuts to the Premium Bond Prize Fund in 2024, after eighteen months of increases.

- From March, the pot will be 4.4% (£5.7M), down from the existing 4.65% (£5.8M)

- That’s still a big improvement from March 2023 (a 3.3% pot and odds of 24K to 1)

The odds of a single bond winning will remain at 1 in 21K, so the number of bigger prizes will be falling:

- £100K prizes will reduce to 85 from 91

- £50K prizes will fall from 182 to 170

It’s the same all the way down – until we get to the smallest £25 prizes, which will increase from 1.04M to 1.443M.

The cuts are unsurprising given that bond yields (and savings rates) have been falling recently, and NS&I doesn’t need to compete for savings.

- It has hit its annual fundraising target six months early, raising £10 bn already.

Andrew Westhead, NS&I retail director, said:

These changes reflect our requirement to strike a balance between the interests of our savers, taxpayers and the stability of the broader financial services sector. In a dynamic savings market, it’s important that our rates are set at an appropriate position against those of our competitors as we work towards meeting our annual Net Financing target.

Overseas Funds

It appears that the consultation on the Overseas Fund Regime (OFR) that I mentioned recently could be aimed at granting “equivalence” for UCITS (EU) vehicles, rather than the US ETFs I have my eyes on.

- I had no idea that UCITS funds needed any further approvals, but it appears that if equivalence is not forthcoming, asset managers would need to launch separate ETFs for the UK (which I assume many would not deem worthwhile).

Managers like Amundi, AXA and abrdn have been delaying new launches or launching on other European exchanges.

- A decision is expected in 2Q24.

Quick Links

I have seven for you today, the first four from The Economist:

- The Economist bid us Welcome to the new era of global sea power

- And asked Will spiking shipping costs cause inflation to surge?

- And said that An influx of Chinese cars is terrifying the West

- And looked at The housing ladder, 1950-2005.

- Alpha Architect asked Is a quantitative defensive factor strategy feasible?

- Ritholtz asked Are You Bullish or Bearish in 2024?

- And UK Divided Stocks provided the 2023 year-end review of their portfolio.

Until next time.