DeFi and the Future of Finance – Part 4

Today’s post is our fourth visit to a paper from 2021 on Decentralised Finance (DeFi).

Aave

Aave, launched in 2017, is another lending protocol like Compound, but with more coins.

- Compound had 8 x ERC-20 tokens at the time the paper was written, and Aave had these plus an extra nine.

Aave (lending and borrowing) rates are more predictable because there is no subsidy (in contrast to the volatile COMP token).

- Aave supports separate (new) markets, which avoids contagion with other markets.

Aave can be seen as two markets:

- ERC-20 tokens as on Compound (ETH, USDC, DAI)

- Uniswap LP tokens

Aave also supports flash loans, including for small-cap tokens (charging a 9 bps fee which is paid to asset pool suppliers).

The paper walks through an example of refinancing a loan on Compound using a flash loan on Aave at a lower interest rate.

- This simplifies the process and saves on gas fees.

Aave uses a variable rate and a less-volatile “stable” rate.

Aave is developing a Credit Delegation feature in which users can allocate collateral to potential borrowers who can use it to borrow a desired asset. The process is unsecured and relies on trust. This process allows for uncollateralized loan relationships, such as in traditional finance, and potentially opens the floodgates in terms of sourcing liquidity.

Uniswap

Uniswap is a Decentralised Exchange (DeX), specifically an automated market maker (AMM) on ETH.

Uniswap uses a constant product rule to determine the trading price, using the formula k = x*y, where x is the balance of asset A, and y the balance of asset B. The product k is the invariant and is required to remain fixed at a given level of liquidity. To purchase (withdraw) some x, some y must be sold (deposited). The implied price is x/y and is the risk-neutral price, because the contract is equally willing to buy or sell at this rate.

This makes Uniswap a “constant function market maker” (CFMM).

Deep liquidity helps minimize slippage. Therefore, it is important that Uniswap incentivizes depositors to supply capital.

Liquidity providers supply assets on both sides of the market, increasing k and reducing slippage.

- Uniswap transactions have a 0.3% fee that is paid to liquidity providers, so their income is linked to transaction volumes.

The Uniswap pricing model leaves money on the table for arbitrageurs on high correlation pairs such as stablecoins, because it does not adjust default slippage lower (change the shape of the bonding curve), as would be expected; the profit is subtracted from the liquidity providers. For this reason, competitor AMMs, such as Curve, that specialize in high-correlation trading pairs may cannibalize liquidity in these types of Uniswap markets.

At the same time, with new markets, arbitrageurs will drive the price to the true market price.

A drawback of the AMM model is that it is particularly susceptible to “front-running”. When an Ethereum user posts a transaction to the memory pool, it is publicly visible to all Ethereum nodes.

Front-runners can see this transaction which is public information and post a higher gas-fee transaction to trade against the pair before the user’s transaction is added to a block, and then immediately trade in the reverse direction against the pair.

This strategy allows a user to easily profit from large transactions, especially in illiquid markets with high slippage. For this reason, Uniswap allows users to set a

maximum slippage as a clause in the transaction.

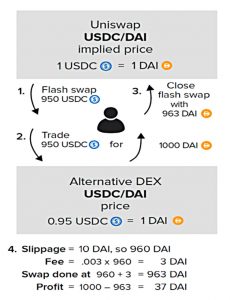

Uniswap also offers flash swaps, where the contract sends the tokens before the user pays for them.

The user can deploy this instant liquidity to acquire the other asset at a discount on another exchange before repaying it; the corresponding amount of the alternate asset must be repaid in order to maintain the invariant. A key aspect of a flash swap is that all trades must take place during a single Ethereum transaction.

I don’t claim to understand the usefulness of this to the average investor.

Uniswap released a governance token (UNI) in September 2020.

- 43% of the supply will be vested over four years to a treasury controlled by UNI governance.

There was also an airdrop to 250K ETH addresses that had used uni-swap before a cutoff date.

Sushiswap is a copy of Uniswap, and Balancer is a more general CFMM that supports more than two markets in a liquidity pool.

Uniswap is critical infrastructure for DeFi applications; it is important to have exchanges operational whenever it is needed.

Yield Protocol

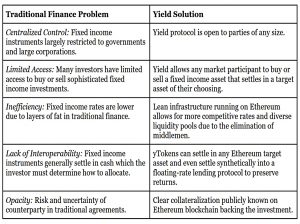

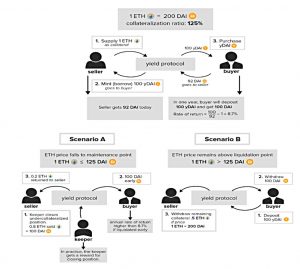

Yield Protocol is a proposal for a derivative model for secured zero-coupon bonds.

- The (ERC-20) yToken settles at a fixed quantity of a target asset at a specific date, with a defined collateral asset and collateralisation.

If the collateral’s value dips below the maintenance requirement, the position can be liquidated with some or all of the collateral sold to cover the debt.

There are three proposals for settlement

- Cash – paying some of the collateral and being returned the remainder.

- Physical – automatic sale of collateral (perhaps on Uniswap), which would cost exchange fees.

- Synthetic

Here, the underlying asset is not directly repaid, but instead rolled into an equivalent amount of that asset pool on a lending platform such as Compound. Synthetic settlement means that yDAI could settle in cDAI, converting the fixed rate into a floating rate.

The buyer could close the position and redeem cDAI for DAI at her leisure. The Yield Protocol handles all of these conversions for the user so that UX simply revolves around the target asset.

Buying a yToken is like lending the target asset.

- Minting (and selling) a yToken is like borrowing the target asset.

The white paper also imagines a fund of different maturities of yToken which are rolled forward to create a perpetual with a floating rate yield.

- The time series of yTokens would also result in a yield curve.

dYdX

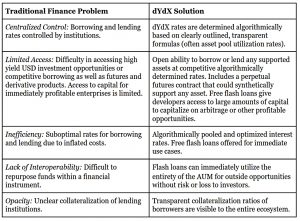

dYdX offers margin trading of USDC, DAI and ETH via a DEX with a hybrid on- and off-chain approach.

- The company stores cryptographically signed orders without submitting them to ETH until they are matched.

- Limit orders and maximum slippage are supported.

This doesn’t sound entirely decentralised and trustless to me.

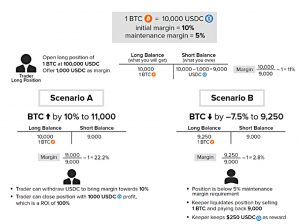

dYdX also supports leverage of up to 10X using margined collateral.

- If the margin is not maintained, collateral will be liquidated to close the position (this can be done by external keepers, as per MakerDAO.

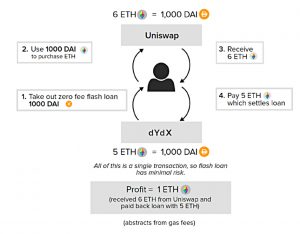

dYdX also offers borrowing and lending like Compound and Aave, including flash loans in DAI, ETH and USDC (which are free).

It makes sense that flash loans rates would be driven to zero given that they are near risk free. Lending rates are determined by the loan’s duration and relative risk of default. For flash loans, repayment is algorithmically enforced and time is infinitesimal: in a single transaction, only the user can make any function calls or transfers.

Free flash loans should attract more traffic to the platform.

dYdX also offers derivatives, in particular, a BTC perpetual futures contract.

- Perpetual futures don’t have a settlement date, which sounds confusing at first (since a futures contract is a bet on the future price of an asset).

Perpetuals would still be useful for speculation, and I guess that hedging strategies could also be adapted to use them.

The dYdX BTC perpetual futures contract allows investors to access BTC return natively on the Ethereum blockchain, while being able to supply any ERC-20 asset as collateral.

The perpetual has an initial and maintenance margin, as with regular futures contracts.

- Margin is important here as unlike with options, futures holders cannot walk away from losing positions.

Keepers will close positions that fall by 5% and keep any remaining collateral.

Synthetix

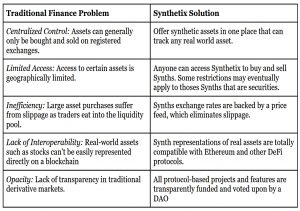

Unlike the other projects we have looked at today, Synthtix is developing a new derivative which the paper says has no TradFi equivalent.

The company issues Synths, tokens whose prices are pegged to an underlying price feed and are backed by collateral. Synths can theoretically track any asset, long or short, and even levered positions. In practice, there is no leverage, and the main tracked assets are cryptocurrencies, fiat currencies, and gold.

I am confused – tracking assets is what every derivative does, and a lack of leverage sounds like a disadvantage to me.

Long Synths are sTokens (sUSD, sBTC); short Synths are iTokens (iETH, iMKR).

- The platform token is SNX, a utility token (not a governance token) that serves as collateral for the whole system.

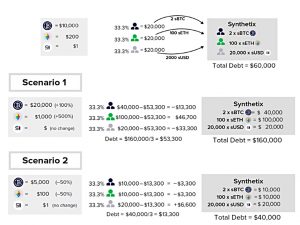

The global debt of all Synths is shared collectively by the Synth holders based on the USD-denominated percentage of the debt they owned when they opened their positions. When a SNX holder’s Synths outperform the collective pool, the holder effectively profits, and vice versa, because their asset value (their Synth position) outpaced the growth of the debt (sum of all sUSD debt).

The platform includes a DEX that will exchange any two Synths.

The required collateralization ratio to mint Synths and participate in staking rewards is high, currently 800%. The Synthetix protocol also mints new SNX tokens via inflation to reward stakeholders for contributing value (maintaining a high collateralization ratio or increasing the liquidity of SNX).

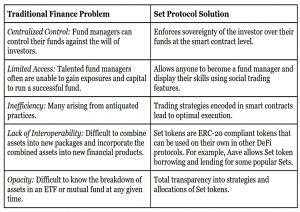

Set Protocol

The set protocol offers one approach to tokenisation.

Tokenization refers to the process of taking some asset or bundle of assets, either on or off chain, and 1. representing that asset on chain with possible fractional ownership, or 2. creating a composite token that holds some number of underlying tokens.

Set protocol is a composite token that combines ETH tokens into Sets that act like ERC-20 ETFs and can be redeemed for their components.

- There are also dynamic sets that use a trading strategy (eg. moving averages) to determine which components are included.

Sets have up-front and ongoing fees and sometimes performance charges.

Sets could democratize wealth management in the future by being more peer to peer, allowing fund managers to gain investment exposures through nontraditional channels and giving all investors access to the best managers.

wBTC

wBTC is a token that represents an off-chain asset, specifically BTC.

- This allows BTC to be used for collateral or liquidity on the ETH chain and DeFi platforms.

BTC has better adoption and lower volatility than ETH tokens, so wBTC allows access to a large and useful pool of capital.

Users buy wBTC from merchants, using BTC (and after passing KYC and AML regulations).

- This is not decentralised or trustless.

BTC is held by custodians who mint new wBTC which is sent to the merchant, and on to the user.

The mechanism by which merchants and custodians enter and leave the network is a multi-signature wallet controlled by the wBTC DAO. In this case, the DAO does not have a governance token; instead, a set of owners who can add and remove owners controls the DAO.

This is not decentralised either, but it is less centralised than using a single custodian for all wBTC.

That’s it for today – it’s been a bit of a slog covering so many tokens which paint a confusing picture for non-crypto experts.

- It’s interesting to see how the various coins can ape features of the TradFi world, but I’m no closer to understanding why a rich-country citizen would want to use DeFi while it remains expensive (high gas fees) and difficult to access.

We’re about eighty per cent of the way through the report now, so there will be just one more article in this series.

- Until next time.