ISA ISA Baby

Today’s post looks at a recent report from the Resolution Foundation, which wants to restrict the use of ISAs.

Contents

ISA ISA Baby

We’ve come across the Resolution Foundation before.

- They’re a Robin Hood think tank that lobbies for taking money away from the rich and giving it to the poor, and this report is no exception.

Unfortunately, they have a very wide definition of the rich and little concept of how much money is required to secure the future of a family.

The official topic of the report is an assessment of the government’s policies to encourage household saving, but its conclusion is that such saving should be encouraged less.

The report considers three schemes:

- The personal savings allowance (tax-free interest up to £1K pa)

- Help to Save (tax relief on savings of £40 per week)

- ISAs (a tax shelter for up to £20K pa)

ISAs are much more significant than the other two schemes.

Low savings

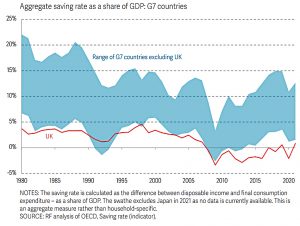

The UK has a low savings rate compared to the rest of the G7, which might contribute to the UK’s low levels of investment.

- There are also potential issues for an ageing society, which will need more savings to support consumption in retirement.

Savings by income

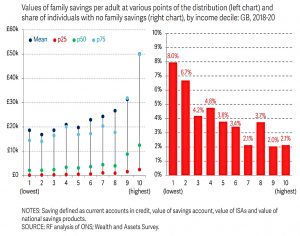

Unsurprisingly, those with low incomes also have lower savings.

And they have lower levels of financial resilience.

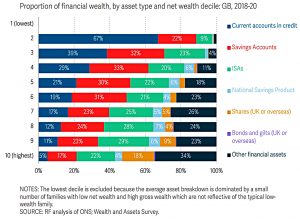

This is compounded by lower-wealth families holding more of their financial wealth in low-return assets.

Timing

The report mentions the current “cost of living crisis” (by which they mean high inflation) at several points, arguing that now is the perfect time to encourage savings.

- I think that very few people will be thinking about saving more this year.

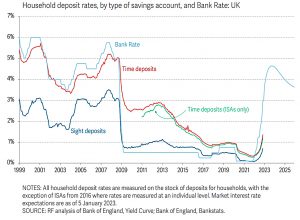

There is better evidence that people tend to save more when interest rates are higher, but the supporting chart largely covers a low inflation period, so this may not carry forward to today.

The report in general treats inflation in a peculiar way, for example in ignoring it as a driver (and benefit destroyer) of the higher nominal interest rates that will “significantly boost savings returns” in coming years.

Tax-free savings by income

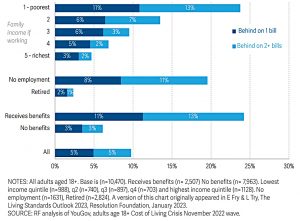

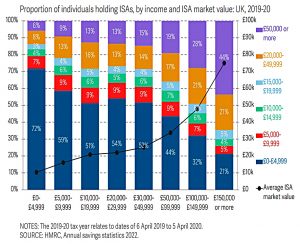

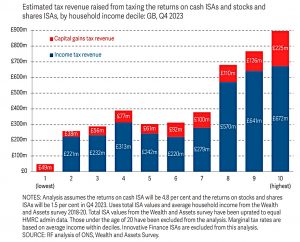

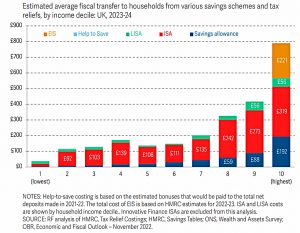

Unsurprisingly, the tax savings from government-sponsored savings products largely accrue to those on high incomes.

- They have more money to save, and under the UK’s progressive taxation system, they have more taxes that they can avoid.

Note that the actual impacts are small, presumably because only a minority of people take advantage of the schemes.

ISAs

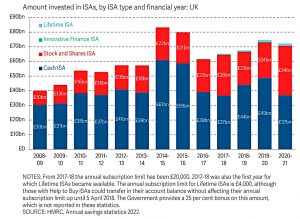

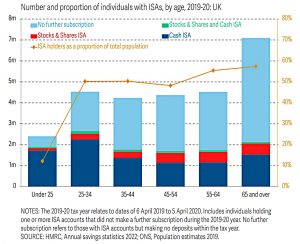

ISA deposits have tended to increase over time, though the peak was from 2014 to 2016.

- Note that cash ISAs dominate, with stocks and shares ISAs a poor second.

Larger ISAs tend to be owned by those on higher incomes, though it should be noted that the top band of the six chosen by the Resolution Foundation (RF) starts at just £50K, or two and a half times the annual contribution limit.

- Someone who has consistently invested in ISAs since they were introduced (( Or rather, since their predecessor the PEP was introduced )) would be likely to have a pot many times this size.

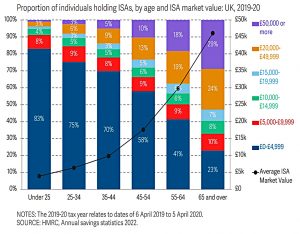

Another stunning revelation from the report is that old people are more likely to have an ISA (since they have had more opportunities to open one).

- Note that the active contribution rates are fairly constant by age, and in fact peak between 25 and 35 (older people may perhaps be focusing on pensions, which young people seem to largely ignore).

Older people also have larger ISA pots.

- Perhaps the concept of compounding is unfamiliar to the RF.

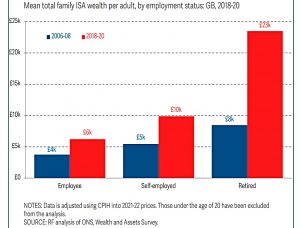

It’s also the case that the retired have larger pots than the employed.

- Note, however, that the average ISA pot in retirement is just £23K, which won’t get you very far.

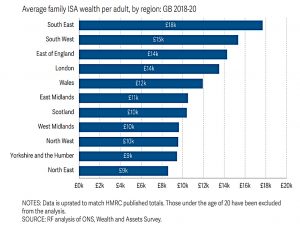

There are also regional differences in pot size, as you would expect since there are regional differences in income.

- Note that the difference between the highest and lowest region is an insignificant £9K per person.

Tax

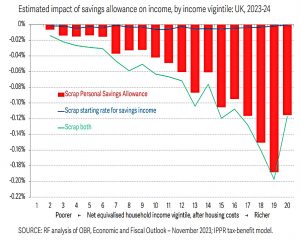

The report has a second chart hammering home the obvious point that most of the tax savings from ISAs accrue to those on higher incomes.

The difference becomes larger when the impacts of the other savings support schemes are added in.

Proposal

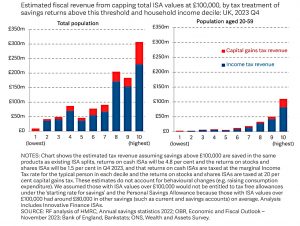

The central proposal from the RFF is that those who have more than £100K in their ISA should not be allowed to add more money.

- The chart shows the revenue that would be raised by income decile, both for the whole population and then again for those below 60 (who are presumably more important in some sense).

This would be halfway towards the odious LTA cap on SIPPs (lacking the punitive tax for exceeding the cap).

There are three main objections:

- ISAs have an annual cap on the way in, so no overall cap is needed

- Such a cap penalises prudent savings and investment

- ISAs are funded from income that has already been taxed, so why does the money need to be taxed again?

- The limit is laughably low

- To be financially secure, a family in the UK needs upwards of £1M in assets (perhaps £3M in London) and £200K from a couple’s ISAs is a long way short of this.

The report also takes aim at EIS and Business Asset Disposal Relief but does not go into detail.

- And they would like to see Hep to Save expanded.

Comment

This report is a classic of the left – it identifies a problem (not enough saving) and decides that the best fix for this is to attack the sub-group which is exhibiting the desired behaviour.

What the RF wants is for everyone to have the same (modest) savings.

- Since poor people cannot save (and cannot be persuaded to save, even with tax incentives) the next best thing is for everyone to have no savings.

And since most people are so bad at saving, we can put our cap on savings really low, and it still won’t affect the average person.

- The RF thinks that the difference between £0 and £100K is enormous, but in the context of a lifetime’s consumption, it is not.

The report also makes the usual heroic assumptions that people won’t change their behaviour in the light of changed incentives.

We need to think about what people might do with the money they can’t put into an ISA. There are four options:

- Find another tax shelter, if they have one available

- Put it into housing, which is taxed less aggressively

- Spend it (increase consumption)

- Save it in a taxable account (and suffer the consequences of the reduced CGT allowance).

The RF is clearly hoping that option four will prevail, but I would have that last on my personal list of priorities.

I doubt that this report will persuade the current Chancellor to restrict ISAs, but if we have a Labour government in a couple of years, who knows what might happen?

- Until next time.

“The report has a second chart hammering home the obvious point that most of the tax savings from ISAs accrue to those on higher incomes.”

What surprised me from the report was how much EIS relief the top decile of earners receive.

I’m surprised that it is that popular (to be worth £XM and that VCTs were neglected (or counted as EIS – I don’t know).

I liked your report and how you wrote. It should be whispered though that maxing out your ISA for a decade (spouses too…) is a very prudent way to get the sort of financial security you need in the UK.

Even more so given the state of the LTA.

ISAs are ridiculously generous and long may they stay that way for our sake

Thanks for the kind words.

I think that UK tax shelters are now quite generous in the accumulation phase (ISA and pension allowances were much smaller when I was young), but the decumulation phase is not so great. Living in London, I find the tax regime limiting in many places.