ERN’s Options Strategy – Part 2

Today’s post is the second in our series on options trading. We take a closer look at ERN’s strategy of writing at-the-money index puts.

Contents

ERN’s options strategy

ERN is the guy who runs the Early Retirement Now blog.

- We’ve looked at a lot of ERN’s posts before – specifically his mammoth series on safe withdrawal rates.

Here’s what we covered last time:

- People have an aversion to negative skew, which means that they overpay for insurance and lottery tickets.

- This seems to be related to the over-weighting of salient but unlikely events (which does not contradict Taleb’s assertion that we underweight “impossible” events.

- So selling insurance and/or lottery tickets can be profitable.

- Selling insurance (writing options) is the easier of these two strategies for private investors to implement.

- Options are not as complicated or (necessarily) as risky as most people imagine.

- ERN successfully uses a strategy of selling ATM index puts in large size.

Implementation

- ERN uses Interactive Brokers as they have the cheapest per contract commissions.

- He’s not entirely happy with them as they “nickel-and-dime” him with lots of small fees, but he hasn’t found anyone better.

- He sells put options on the S&P 500 e-mini contract future (ticker ES).

- This is a derivative on a derivative.

- This seems to mean that ERN needs less margin cash to hand – he puts 70% of the overall portfolio into a Muni bond fund (which helps with diversification).

- There are also advantages as his 1000 annual trades don’t need to be tallied separately.

- The account size at the time of writing implementation article was $660K, but I think it is a bit larger now.

- Note that ERN started with $30K, which he thinks is the minimum size (supporting the writing of just one put option).

- He uses the shortest contract possible, which used to be a one-week contract.

- There is now a Mon-Wed-Fri cycle, so ERN normally writes options that expire in one or two trading days,

- He thinks this means that he gets bigger premiums per unit of risk.

- He also likes to have the maximum number of independent bets in order to access the “house edge”.

Strike price

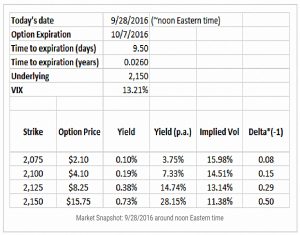

The chart shows a market snapshot from 2016.

The ATM put (strike 2150) yields 28% pa, but ERN prefers the 2,100 put with a yield of 7.33% pa.

- ERN expects to keep on average half of that and will need to use leverage to reach his desired level of return.

- The 2,100 put has an OOM cushion of 2.5% before ERN will lose money.

The implied volatility is higher than the VIX (the implied market volatility.

- Since we know (from Ilmanen, for example) that implied volatility is usually higher than realised volatility, we now have: option vol > VIX > realised vol.

This gives ERN two volatility cushions.

Leverage

ERN uses leverage for two reasons:

- To boost the return from the likely base rate

- In the example above, this is 3.66% pa.

- To overcome taxes.

- ERN uses a 1/(1-tax rate) approach as a minimum.

- For a 20% tax rate, this would mean gearing of 1/0.8 = 1.25 times.

In the example above, the delta of the 2,100 put is 0.15, which means it is 15% as volatile as the underlying.

- So even with say three times leverage, the volatility would be much less than the underlying.

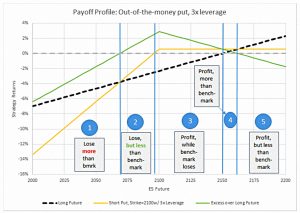

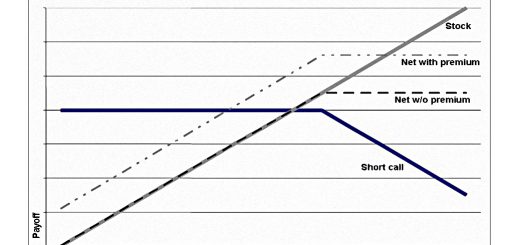

Here’s the pay-off diagram with three times leverage.

- Even if the index falls to 2,000 (-7%), we lose 13% rather than 21% (3x the index fall).

- The strategy will only be more volatile than the index under extreme circumstances.

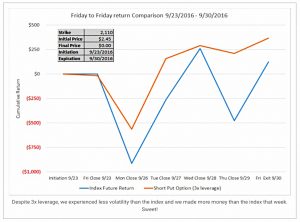

A typical week

Here ERN makes more money than the index, with less volatility.

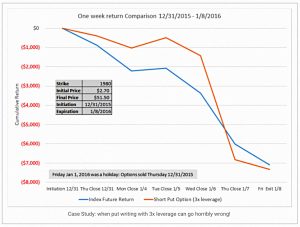

A bad week

This is a terrible week where ERN lost $7K rather than making $405.

- But he didn’t lose three times as much as the index, even with the leverage.

It took 18 weeks after this for the strategy to get back into profit.

A good week

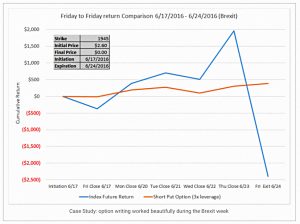

This is the Brexit vote week.

- Despite the bad drop on June 24th, ERN still made money.

The uncertainty about Brexit was already reflected in the option prices on June 17. Thus, we were able to sell put options with strike prices so far out of the money that even the steep decline on June 24 never got even close to causing any losses.

Two-year returns

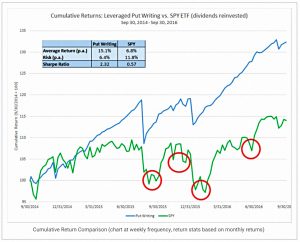

ERN did very well from 2014 to 2016, helped out by a strong Muni bond performance.

- After all fees and taxes, he made 15% pa, compared to 6.8% pa from the index.

- And his volatility was only 6.2% – about half that of the index.

Long-term, ERN expects a 12% gross return (8.5% after-tax) with around 7% volatility.

- Which is a lot better than the index.

ERN notes that the strategy tends to lose money in the first week of a crisis.

- But then panic drives option premiums up so high that he can sell puts further out of the money which are not subsequently hit.

Long-term returns

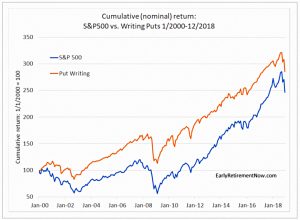

From 2000 to 2018, through two bear markets and two bull markets, the strategy outperformed the S&P 500.

- it also had lower volatility (10% pa, cf. 15% for the S&P 500)

- and it had smaller and shorter-lived drawdowns

This means that ERN thinks that put writing helps with Sequence Risk, and is a good strategy for early retirees.

- He’s promised us a separate post on this topic, but I haven’t seen it yet.

AmberTreeLeaves interview

Soon after his own posts on options, ERN did an interview with AmberTreeLeaves.

- This was part of a series of interviews with options traders that I will look at in a later article.

The interview covered the same theoretical background as ERN’s posts and explained ERN’s professional background (in the finance industry) and his ambitions for his then-new blog and for his life.

- He pitched the put-writing as a hedge against an extended sideways equity market.

He also explained that he traded futures rather than direct options because of compliance issues at work.

And he talked about risk management:

- ERN monitors delta risk (ratio of money at risk per unit move in the underlying)

- He also uses a VaR model to look at how much he could lose in a big market down move (1.5, 2 and 3 standard deviations – with 2 as the cross-over point from doing better than the index to doing worse than it)

- And he tracks historical returns as multiples of weekly volatility, to remind himself that 3-sigma events happen much more frequently than a Normal distribution model would suggest.

The account size was about 20% of net worth at this point.

October 2018 crash

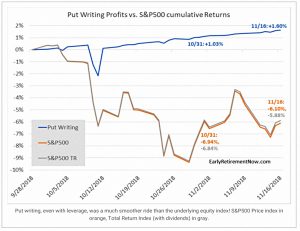

October 2018 was the worst month for the S&P 500 for seven years, down 7%.

- A lot of ERN’s friends and readers were worried that his leveraged options strategy must have lost a lot of money, so he wrote another blog post to put them straight.

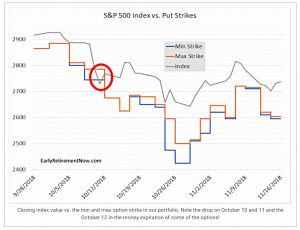

The first chart shows ERN’s returns for the month.

The second compares these to the S&P 500.

- Clearly the strategy has survived a stiff test.

The third chart shows the detail of each trade.

- The market never dropped much below ERN’s strike prices.

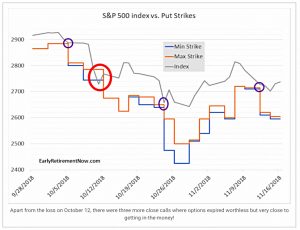

But as the final chart shows, there were four near misses.

Even though the return profile looks really nice in hindsight, the last one and a half months weren’t exactly a walk in the park!

Selling naked put options is not some kind of magical money-making machine. It takes some stomach to run this strategy successfully in the long-run!

2019 update

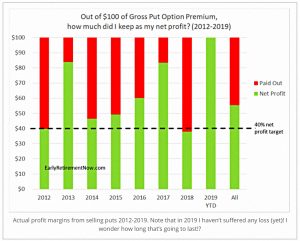

In March 2019, ERN gave an update on how the strategy was progressing:

- The account is now 35% of ERN’s net worth, and around half of his net worth outside retirement accounts.

- Since ERN is retired but below US retirement age, this means that the options strategy has to do half of the work of generating ERN’s family’s income.

- Leverage has been reduced from 3-3.5 times down to 2-2.5 times.

- The time value of the options ERN uses has been reduced from 7% down to 5-5.5% pa.

- Using a $300 premium target on a nominal option value of $280K gives an unleveraged return of 5.57%.

- ERN now targets strikes that are 5 Delta or 1.5 to 2 standard deviations below the index level.

- The loss allowance (how much premium will need to be given back) has been increased from 50-55% up to 60%.

- 2018 was the only year the lower target wasn’t met.

- The margin cash portfolio composition has changed from 100% Muni bonds

- It’s now 30% Muni bond funds, 40% closed-end Muni funds, 25% preferred shares and 5% cash.

- Leaving his job means that ERN can now trade plain SPX options rather than the E-mini futures.

- Commissions are lower by $250 a year

- The margin cash portfolio investments can be used as collateral since they are now in the same account (IB puts the futures in a commodities sub-account).

- The options are cash-settled (don’t need to be manually sold).

- The only downside is shorter trading hours.

- ERN now trades three times a week rather than just on Friday

- Fri to Mon, Mon to Wed, Wed to Fri

- Returns are 4.7% from the options and 4.6% from the margin cash.

- That’s a 9%+ return overall, or more than 7% above 2% inflation expectations.

- That’s better than long-run stocks with better drawdowns and lower volatility.

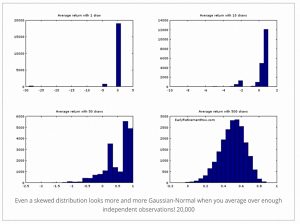

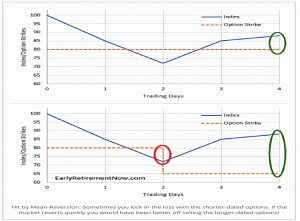

The more frequent trading of shorter options protects against runs of bad trading days:

And more independent bets means that the Central Limit Theorem has more chance to work:

Note that ERN’s graphs don’t do this effect justice since he hasn’t kept the horizontal zero in the same place on each plot.

The downside is that you can get whipsawed:

Conclusions

That’s it for today – we’ve now been through ERN’s six articles to date on options trading, plus his interview and Antti Ilamenen’s paper on selling insurance.

- I’m more convinced than ever that this is a strategy

Up next will be a look at some more FIRE bloggers who use options – it’s a surprisingly common strategy in the US.

- But what would really help would be coming across someone in the UK who does something like this.

Until next time.