Trend Following with Options 2

Today’s post is the second in our series looking at the use of options for trend following.

Contents

Convexity and Premium

In the first post, we looked at a paper from February 2019 by Corey Hoffstein, called Trend: Convexity and Premium.

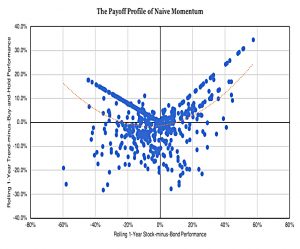

- It introduced us to the idea that a trend strategy can be simulated using a straddle (buying a put and a call at the same maturity and strike).

This has the same convex payoff profile.

- It allows the investor to profit if the price of the underlying moves significantly in either direction; the cost of this opportunity is the option premiums.

Corey modelled a simple trend approach that went long the S&P 500 when the 12-month return was positive and shorted it when it was negative, with monthly rebalancing.

- He used the price from 12-months ago to give the strike point of the straddle and used a 1-month expiry.

Straddles and Trend Following

Today’s paper is also from NewFound, but this time it was written by Nathan Faber.

- It dates back to May 2020 and is called Straddles and Trend Following.

Delta

Nathan begins by explaining why the straddle works like this:

Simple total return trend following signals coarsely approximate the delta of the straddle.

Delta is the sensitivity of the option value to moves in the underlying – a delta of 1 means that a $1 move in the underlying produces a $1 profit in the option.

When the current level is above the strike, the strategy’s delta will be positive and when the level is below the strike, the delta will be negative.

Thus the straddle delta has the same sign as the trend strategy signal.

- The difference is that the trend signal is always +1 or -1, whereas the option delta can be anything in-between.

The straddle also has two simultaneous bets (on an up and a down move) whereas trend usually backs one horse at a time.

Analysis

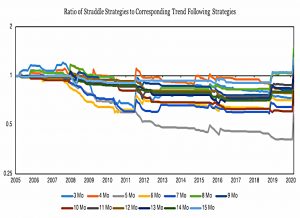

Generally, trend outperformed straddles until March 2020 (the Covid crash), when the options paid off (especially on shorter lookbacks).

I actually like this built-in crash protection, though I note that Nathan’s experiment did not use stop losses for the trend strategy (whereas I often do).

The amount of overall trend outperformance varied by lookback period, though the optimum period is not easy to determine from the chart.

Prior to March 2020, only the 8- and 15-month lookback window strategies had outperformed their corresponding trend following strategies. Longer-term straddle strategies (lookbacks greater than 9 months) shared similar movements during many periods while shorter-term lookbacks (3-6 months) showed more dispersion over time.

So longer lookback straddles are more like trend (but underperform) whereas shorter lookbacks offer more crisis alpha.

Delta and gamma

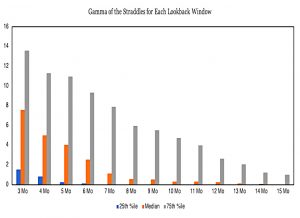

Longer lookbacks are also more likely to have a lower strike, and to be deeper in the money, with a delta closer to 1.

- Very short lookbacks would lead to strikes close to recent prices, where delta will be closer to zero.

This effectively translates to a binary bet for trend, but a modulated exposure for straddles.

Gamma measures the rate of change in delta for a unit change in the underlying.

- When the delta is close to zero, the gamma is higher (we’re on the steep part of the delta S-curve.

So the long lookback straddles (more in the money) should have lower gamma.

The trend strategy has no gamma between monthly rebalances, as its exposure is fixed, but a long lookback trend will respond more slowly to recent changes in the underlying.

- Thus Nathan uses straddles to link gamma with the speed of change.

Insurance

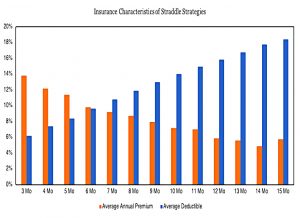

In the next section, Nathan looks at straddles as a form of insurance (crisis alpha/crash protection).

- An option strategy can only lose as much as the premiums paid up-front, whereas a trend strategy (without stops) can lose much more. (( This is why I normally use trailing stops when they are available ))

The straddle strategy goes one step further and [buys] a put option. So not only does it have a fixed loss on the call if price reverses course, but it can also profit if it reverses sufficiently.

A straddle is like an insurance policy with a deductible – the strategy doesn’t pay out until the distance that the option is struck in the money is passed.

On average, the 3-month straddle strategy pays annual premiums of about 14% for the benefit of only having to wait for a price reversal of 6% before protection kicks in. Toward the other end of the spectrum, the 12-month strategy has an annual average premium of under 6% with a 16% deductible.

Nathan also analyses the deltas for the two strategies at some length.

There is significant overlap, especially as trends get longer. The differences in the deltas in the 3-month straddle model highlight its tradeoff between lower deductibles and higher insurance premiums. However, this leads it to be more adaptive at capitalizing on equity moves in the opposite direction that lead to losses in the binary trend-following model.

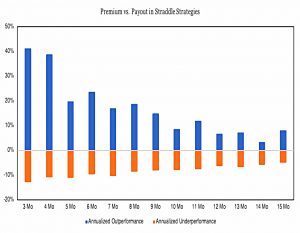

And he compares the annualised performance of the straddle in two phases – outperforming trend (payout) and underperforming (premium).

As the lookback window increases, both of these figures generally decline in absolute value.

The straddle involves more premiums but protects against whipsaws better than trend.

Investors mostly benefitted over the past 15 years by bearing this risk of whipsaw and large, sudden price-reversals. However, as the final moths of data indicates, option strategies can provide benefits that option-like strategies cannot.

A diversified convex strategy, using both trend and and options is probably the best approach.

Puts and calls

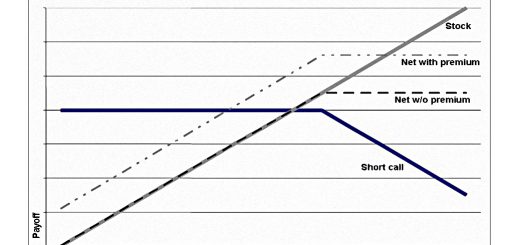

A simpler strategy would be to buy only a call or a put, depending on the trend signal.

This strategy would not profit from a reversion of the trend, but it would cap losses.

Buying only puts or calls generally helped [over 3 and 12 month lookbacks]. However, there are some notable instances where the extra protection of the straddle was very helpful, e.g. August 2011 and late 2014 for the 3-month lookback strategy and March 2020 for both.

Conclusions

Today’s paper adds some flesh to the idea of a straddle options strategy to mimic trend following.

- We can diversify the straddles across lookback periods, and also add a call or a put according to the trend signal.

And the option strategies should offer good diversification against vanilla trend approaches, particularly as crisis alpha/crash protection.

- We are lucky in this regard that the period covered by the paper includes the Covid crash.

Risk cannot be destroyed, only transformed. In this case, the trend strategy was willing to bear the risk of large intra-month price reversals to avoid paying any up-front premium. This was a benefit to the trend investor for 15 years. And then it wasn’t.

Until next time.