Options 7 – The ATL Interviews

Today’s post is the seventh in our series on options trading. We look at the interviews by blogger AmberTreeLeaves of other finance bloggers who use option strategies.

Contents

The story so far

The lessons from the articles so far were getting to be quite extensive, so I have moved them to their own page.

ATL interviews

As well as writing posts about his own exploits with options, ATL also interviews other bloggers about their use of options.

- ATL has eleven interview posts, of which we’ve already covered two – ERN and Fritz.

So that leaves nine to get through – we might not manage all of them in one go, but let’s get started.

Investment Hunting

Nathan from Investment Hunting is a dividend growth investor (DGI) who uses the same two options strategies we’ve met before.

He has some book suggestions:

- All About Dividend Investing by Don Schreiber Jr and Gary Stroik

- Generate Thousands In Cash On Your Stocks Before Buying Or Selling Them, by Dr. Samir

Elias - Options as a Strategic Investment by Lawrence G. McMillan

He spends 10-20 minutes a day placing his trades, and his option portfolio is about $100K in size (including the collateral from shares for calls and cash for puts).

He only trades options on stocks he is willing to own and that have enough volatility to mean that options strategies have a reasonable yield.

He used to write about options strategies on his blog but found that his readers were not interested (the relevant pages weren’t working on the day that I checked).

StalFlare

StalFlare is a DGI investor from Italy.

- He was only paper trading options at the time he was interviewed.

He was practising using the same two strategies as everyone else.

- Like the other DG investors, he sells calls against stocks he owns and puts against stocks on his watchlist.

Rico Dilello

Rico is older than most financial bloggers and was already retired at the time of his interview.

- As such his priorities are capital protection and income generation.

He says that:

I am at the highest level available for option trading. It allows me to use more option combination strategies.

Unfortunately, he doesn’t detail what those strategies are, though he does mention call and put spreads.

- These involve buying ATM and selling OTM.

He does have a blog, though, but there’s no Options category for his posts.

This might be because he thinks most people aren’t interested:

The majority of viewers on word press are not interested in reading about option strategies.

It took me three years’ worth of quarterly meetings to get my investment club members comfortable with my option trades. Keep in mind that they are all financial advisors with years of financial work experience.

But I did find an Options tag, so I might revisit Rico in a separate article.

Rico runs 25 to 30 open positions at a time, which might take him 20 minutes per day.

Lizard King

Lizard King is also retired, though younger than Rico (early forties at the time of the interview).

- He appears to be largely an income investor who trades options around the edges.

He uses the same two strategies as everyone else (except Rico), focusing ona few stocks that he is familiar with.

- LK was cagey about the size of his options portfolio, saying only that the account had $200K in it.

Hello Suckers

Martin from Hello Suckers is a young and aggressive options trader.

- He doesn’t detail his strategies, but he spends one hour per day on his trades.

His account size is only $4K.

Easy Dividend

Christopher from Easy Dividend lives in Austria.

- He was 24 at the time of the interview.

He’s another dividend growth investor trading options on the side, via the usual two strategies.

- He chooses a strike to target a 12% annualised yield.

He spends less than 30 minutes a day on his trades.

- His account size is €59K.

Lyn Alden

Lyn is in her late twenties, with 12 years of investing experience, and five in options.

- She is a value and dividend investor at heart but also uses the core two options strategies.

I’m a long-term focused value/dividend investor that happens to use option-selling as

one more tool in my arsenal. Selling options is a great strategy for fully-valued or over-

valued markets, in particular.

Lyn sells longer options that most traders – from two to fourteen months.

- She also sells options on commodities and precious metals (or rather, on their ETFs).

She aims for 12% annualised in her options trades, too.

- She uses Charles Schwab and Fidelity for her trades.

It only takes Lyn two hours per month to manage all her portfolios.

- She normally only has a couple of options trades open at one time.

Her account size is $80K.

FerdiS

FerdiS is another dividend growth investor who trades options on the side, using the classic pair of strategies.

- He only trades two or three times per month.

His options account is 25% of his portfolio (no details on how that relates to his net worth), but he plans to increase that to 50%.

Roadmap2Retire

R2R mostly writes covered calls on stocks that he thinks have gone up too much.

Conclusions

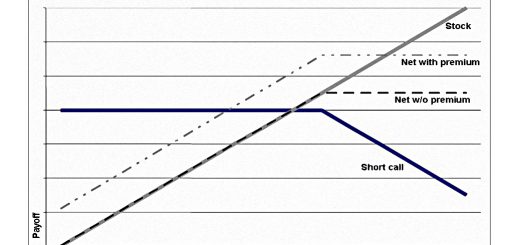

We’ve now looked at the way that fourteen bloggers use basically the same couple of options strategies:

- Selling puts

- Selling covered calls

I am sold on the strategies, but we have a few more bloggers to look at before I get started on how to implement these techniques here in the UK.

- Until next time.