Trend Following with Options 3

Today’s post is the third in our series looking at the use of options for trend following.

Contents

Convexity and Premium

In the first post, we looked at a paper from February 2019 by Corey Hoffstein, called Trend: Convexity and Premium.

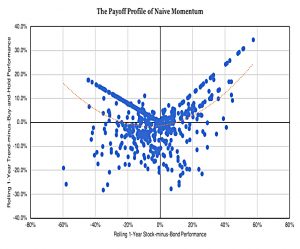

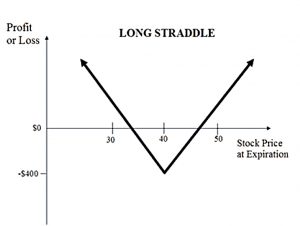

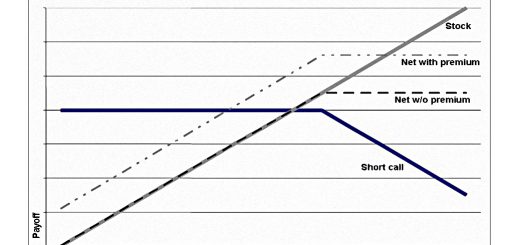

- It introduced us to the idea that a trend strategy can be simulated using a straddle (buying a put and a call at the same maturity and strike).

This has the same convex payoff profile.

- It allows the investor to profit if the price of the underlying moves significantly in either direction; the cost of this opportunity is the option premiums.

Corey modelled a simple trend approach that went long the S&P 500 when the 12-month return was positive and shorted it when it was negative, with monthly rebalancing.

- He used the price from 12-months ago to give the strike point of the straddle and used a 1-month expiry.

Straddles and Trend Following

The second paper was also from NewFound, but this time it was written by Nathan Faber.

- It dates back to May 2020 and is called Straddles and Trend Following.

Nathan looked at straddles in more detail and varied the lookback periods for the strike price.

- He also introduced a simpler approach of buying a put or a call according to the trend signal.

And he discussed the crash protection (crisis alpha) inherent to straddles.

So far, our options strategy for trend looks like it includes seven trades for each index we want to track:

- A straddle (call & put) with a 3-month lookback (strike price = index value from 60 trading days ago)

- A straddle (call & put) with a 6-month lookback

- A straddle (call & put) with a 12-month lookback

- A directional call or put depending on the trend signal

We could use multiple time periods for the directional call, but I will probably start with the “simple” approach.

And of course, we’ll be using the options approach alongside a more traditional trend strategy for further diversification.

Options-Based Trend Following

Paper number three is also by Nathan Faber and dates back to June 2020.

- It’s called Options-Based Trend Following.

This paper looks at buying 1-month at-the-money calls and puts based on the trend signal, and at how effective this strategy is in dealing with whipsaws.

The option strategy will pay a premium up-front to avoid whipsaw. By comparing this strategy to trend following that bears the full risk of whipsaw, we can set a better practical bound for how much investors should expect to pay or earn for bearing this risk.

The trend signal is simply the sign of 12-month equity returns (in this case the S&P 500).

Why are we now using ATM options? Here we are looking to isolate the cost of whipsaw in the premium paid for the option while earning a payout that is close to that of the underlying.

If we utilized OTM options, then our premium would be lower but we would realize smaller gains. ITM options would have downside exposure before the protection kicked in.

Straddles would mean extra premium.

- Nathan distinguishes between the two strategies in terms of their treatment of whipsaw costs, since they are both able to follow the trend signal.

Results

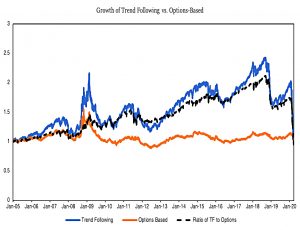

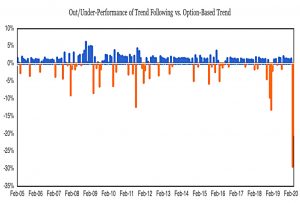

As you might imagine, paying for whipsaw protection only works out when there are whipsaws.

- Under “normal” conditions, pure trend outperformed, but the Covid crash reversed all these gains.

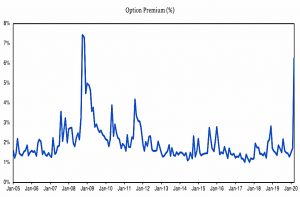

In most months, the option-based strategy forfeits its ~1.5% premium for the ATM option. The 75th percentile cutoff is 2.2% and the 90th percentile cutoff is 2.9%. These premiums have occasionally spiked to 6-7%.

Timing luck

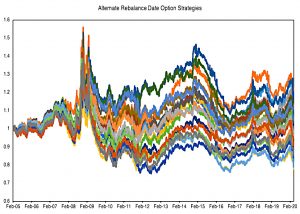

In the next section, Nathan varies the rebalancing date for the option strategy.

Let’s relax our assumption that we roll the options and rebalance the trend strategies on the third Friday of the month and instead allow rebalances and rolls on any day in the month.

There’s quite a variation.

Trade-offs

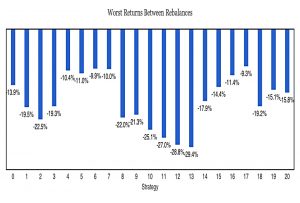

Nathan next looks at how to tailor his “whipsaw risk profile” between the two extremes of paying for whipsaw upfront with options and being fully exposed to whipsaw through trend-following.

If the risk of whipsaw is elevated but the cost of paying for the insurance is cheap, then the options strategy may be favorable. On the other hand, if option premiums are high, trend following may more efficiently capture the market returns.

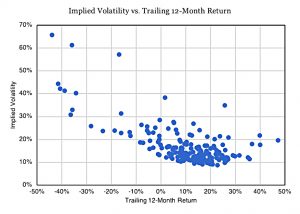

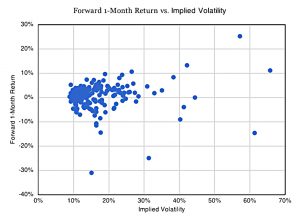

Options are expensive (implied volatility is high) when returns have been negative (during downtrends).

But this is only one piece of the puzzle. Do these implied volatilities relate to the forward 1-month returns for the S&P 500?

There doesn’t seem to be much of a relationship.

However, since we believe that trend following works over the long run, then we must believe there is some relationship between implied volatility and forward returns.

While this monthly trend following signal is directionally correct over the next month 60% of the time, historically, that says nothing about the magnitude of the returns based on the signal.

Nathan decides on a 20% cut-off for implied volatility.

If options cost more than that, we will utilize trend following. If they cost less, we will invest in the options strategy.

The switching strategy worked well until around 2013 when the option prices were cheap, but the risk of whipsaw was not realized. It did make it through 2015, 2016 and 4Q 2018 better than trend following.

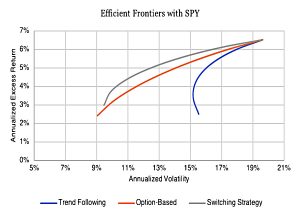

Efficient frontiers

Nathan sees these strategies as alternatives to stocks (SPY), and so his next analysis plots efficient frontiers for allocations from 0% (at the right of the chart below) to 60% (on the left).

The switching strategy looks good here, and the value of the option-based approach (lower volatility) becomes clear.

The Sharpe ratio is maximized at a 35% allocation to the switching strategy, a 25% allocation to the option-based strategy, and 10% for the trend following strategy.

Of course, I would be looking to use a combination of all three strategies, which is not shown on the chart.

Conclusions

Nathan is modest about what he has covered in the paper:

The extent that whipsaw can be mitigated while still maintaining the potential to earn diversified returns is likely limited, but the optimal blend of trend following and options can be a beneficial guideline for investors to weather both sudden and prolonged drawdowns.

We haven’t looked at any new option strategies for trend-following today.

- But we have developed a simple timing model (based on implied volatility) for weighting between the options strategies and pure trend following.

Every little helps.

- Until next time.