Expected Returns 1

Today’s post is our first look at Expected Returns by Antti Ilmanen.

Contents

Antti Ilmanen

Antti Ilmanen is Head of the Portfolio Solutions Group at AQR Capital Management, advising institutional investors and sovereign wealth funds.

- Before that, he worked at Brevan Howard, Salomon Brothers, Citigroup and advised the Norwegian Government Pension Fund and the Singapore Investment Corporation.

He started out in the central bank of Finland.

Antti is famous for his 2011 book Expected Returns, which the AQR website describes as “broad synthesis of the central issues in investing”.

Antti says:

I decided to cover this huge topic because I have dealt with so many different asset classes over the years. My goal in writing the book is to help improve the marketplace and the investor experience.

Expected Returns is a big (500 pages) and hard book, so we’re going to work our way up to it by looking at some of the shorter papers and presentations from Antti that are available on the internet.

- Let’s start with a paper from around the time of the book, and which is based on it.

Understanding Expected Returns

This paper comes from the Fourth Annual European Investment Conference of the CFA (Chartered Financial Analyst) Institute.

- It was held in Paris on 2–3 November 2011

Anttis central argument, as explained in the abstract, is:

- Investors tend to think of expected returns as a function of asset class risk.

- This leads them to take on too much equity risk

- For behavioural reasons, diversifying across investment styles (eg. momentum and value) may offer greater returns for less risk.

- Limited market timing may also increase returns.

The elephant

Antti starts with the Indian fable of six blind men and the elephant.

- Each of the men is right in a sense, but they are all wrong in the end.

People should look at multiple perspectives when thinking about expected returns. Investors need to look beyond historical average returns; they should also look at theories and forward-looking indicators.

No matter how well diversified investors think they are, typically 90 percent or more of their portfolio risk comes from equities.

It’s difficult to argue with that, but my portfolio has a heavy allocation to equities for a good reason – I need the returns.

- Particularly in today’s low return environment, it’s hard to be confident that you will hit your SWR (say a minimum of 3% pa, plus inflation) without a 75% allocation to equities (and equity alternatives).

At the same time, I am very conscious of the need to diversify away from equity risk wherever possible.

- I’m probably more interested in multi-asset and multi-strategy diversification than any other UK private investor that I come across.

Reducing risk

Antti says there are three approaches to reducing risk:

- Move towards riskless assets (and lower returns)

- Insurance (currently popular and therefore expensive)

- Diversification (but correlations are higher when things get tough)

His recommended approach is:

- Harvest multiple premiums (from multiple sources of risk)

- Identify return sources which have worked well over long periods

- Use styles (value, carry, trend/momentum, volatility and liquidity)

- Take advantage of time variation in return sources (contrarianism – but timing is risky and should, therefore, be a minority component)

I like the sound of all this, as it seems to fit pretty well with my own approach.

Returns

In the next section, Antii provides a table of returns, but I’ll stick to the graphs.

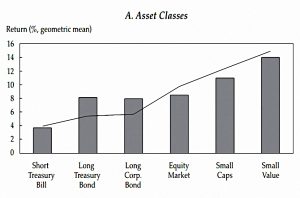

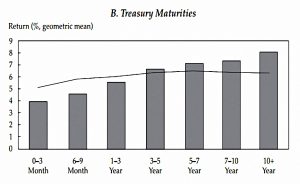

It will come as no shock that stocks beat bonds, and small-cap value does particularly well.

Long bonds return more than short ones, but the effect tails off after 5 years.

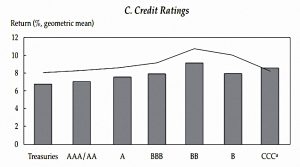

Bonds with good credit ratings have lower returns than risky bonds, but the effect starts to reverse at ratings below BB.

Antti makes a number of points:

- Bond market premiums are lower than those in equity markets, and leverage would be needed to juice them up to the level of stock returns.

- Value, carry/yield, trend/momentum, volatility and liquidity all do better than the stock baseline.

- The styles have lower volatility than stocks, and so without shorting or leverage, they won’t cancel out much of the basic equity risk.

- Value works with individual equities, but also with sectors, countries and in other asset classes.

- This may be a risk-based effect, as it disappears in deflationary recessions.

- But Antti prefers behavioural explanations (overpricing of the hope for growth).

- Carry is best known in FX but works in all asset classes.

- It works best across countries but does poorly during bad times.

- Trend/momentum can be long-only (trend) or market neutral (classic momentum).

- Value and trend may seem contradictory, but it’s a matter of timescale.

- Trend dominates for up to a year, before mean reversion sets in.

- This means that chasing multi-year returns (as many investors do, even when choosing funds) runs straight into reversal effects.

- Value and trend actually combine well together (recent winners can still be cheap).

- And they act as good diversifiers for each other.

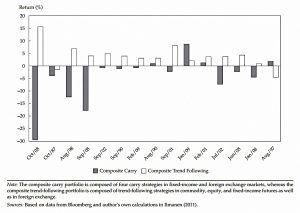

The next chart shows trend and carry returns in the worst 15 months for global stocks from 1985 to 2009 (a 5% tail):

Trend was up in 13 of the 15 months, whilst carry was down in 11 of the 15.

- Antti can’t think of a risk explanation for why protects against tail risk and assumes a behavioural explanation.

Volatility

You can play volatility by either selling or buying insurance, or by buying / not buying “lottery tickets”.

- The common insurance strategy is trading the equity index volatility (the VIX).

Selling volatility gives good returns except in a crash, as people over-pay for insurance.

- This should be expected – investments should have a risk premium when they do badly in bad times.

The severity of the bad times in 2008 put a lot of people off trading equity volatility.

“Lottery tickets” are the most volatile members of an asset class (eg. small cap blue-sky growth stocks) and they generally offer poor returns.

- They are over-priced because of the preference of some investors to chase outsize returns.

Low volatility stocks outperform in absolute terms and have much better risk-adjusted volatility (a higher Sharpe ratio – SR).

- Antti notes also that there is no reward for buying bonds longer than 5 years or riskier than BB.

Note that the reluctance of many investors (myself included) to use leverage means that some of the strategies with the best SRs don’t provide high enough returns.

- Unwise members of this group may substitute by buying lottery tickets.

Antti also says that fund managers treat risk symmetrically because both conservative and aggressive strategies lead to larger tracking error from the benchmark.

- This leads to risk not being properly rewarded.

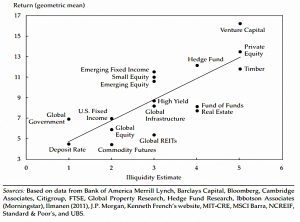

Liquidity

Traditionally, illiquid assets had higher returns.

- But this illiquidity premium shrank in 2006 and 2007, and then was rewarded with catastrophe in 2008.

You can see the premium in venture capital, private equity, commodities, listed equity and bonds, though the nature of illiquidity is different in each case.

The chart plots asset returns (1990 to 2009) against Antti’s own composite measure of illiquidity.

Antti’s conclusion is that style diversification is more effective than asset class diversification.

- But low style volatility means that stocks will still drive risk.

If you are prepared to use shorting and leverage, you can halve volatility (and double the SR for the same return).

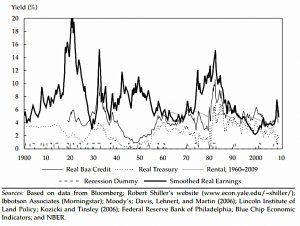

Time

Antti says that contrarian timing based on valuation indicators (buy cheap, sell expensive) can be useful.

The next chart shows forward-looking real yields over 100 years for various US assets:

There are positive correlations with future returns, which will improve SRs.

- Antti also suggests timing based on the macro environment and on investor risk aversion.

Note that as well as the usual momentum/reversion tension, timing introduces a value vs investor attitude dynamic (things are usually cheap because they are unpopular).

Conclusions

From my personal perspective, this has been a terrific start, since the approach Antti recommends matches closely with my own:

- A base passive diversified portfolio, with equity allocation matched to the required return

- Style (factor) overlays

- A market-timing (tactical asset allocation) overlay based on valuation, macro indicators and investor sentiment.

I look forward to putting more flesh on the bones as we work through more of the articles and finally the book itself.

Until next time.