Weekly Roundup, 21st January 2020

We begin today’s Weekly Roundup in the FT with Josephine Cumbo, who was writing about proposed changes to the pension taper.

Pension taper

The taper currently starts at an income of £110K pa, but the government is reportedly planning to raise this threshold to £150K.

- This would be good news for those on between £100K and £150K, which includes most NHS consultants

Median earnings are £112K and 90% would fall below the new limit, but the target demographic (NHS doctors) doesn’t seem impressed with the plan.

Dr Vishal Sharma, chairman of the British Medical Association’s pensions committee, said:

In its election manifesto, the government pledged to ‘address the taper problem’, but this proposal would do no such thing. The annual allowance is completely unsuitable for defined benefit schemes.

I’d love to see the annual allowance used for DC schemes, and the lifetime allowance reserved for DB schemes.

Stock returns

Joachim Klement had a couple of good articles on stock returns.

- First, he showed that returns aren’t monomodal (the distribution doesn’t have a single peak).

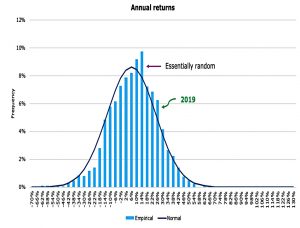

Using Shiller’s data for the S&P from 1871, Joachim shows that annual returns are random and follow the normal distribution closely.

- 2019 was a good year, but not an extreme one.

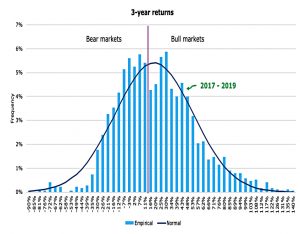

Three-year returns are bimodal, with peaks at 0% (bear markets) and at 30% (bull markets).

- 2017 to 2019 is a typical bull market.

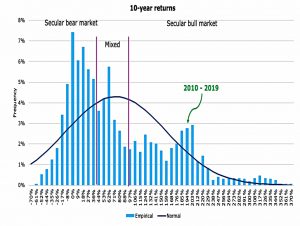

Ten-year returns are tri-modal, with peaks for bear markets (the 1970s, or 2000-2009), bull markets and mixed environments.

- The last ten years have been a typical bull market and not extreme at all.

This means that the next decade will likely be a mixed period where we experience the tail end of the current secular bull market and the front end of the next secular bear market.

There has not been a single secular bull market in history that has lasted for two full decades.

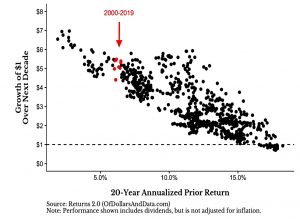

The second article was a response to a post by Nick Magiulli from the Of Dollars and Data blog, called The Investor’s Fallacy.

Nick argues that prior 10-year returns of the S&P 500 have almost no correlation with future 10-year

returns ( -0.19).

- And that the trailing 20-year (nominal) return of the S&P 500 has a significantly

negative correlation (-0.83) with future 10-year returns.

On this basis, we might expect 300% to 400% appreciation over the next decade, rather than the mere doubling that many cautious commentators are predicting.

- Bullish pundits have used Nick’s chart to argue that fears of an upcoming lost decade are overdone.

Joachim is sceptical:

If I assume $1 invested today will be worth $4 in 2030, then the 20-year average return from 2010 to 2029 will be 14.1%. Historically, we have seen such high returns only in the run-up to the tech bubble of the late 1990s.

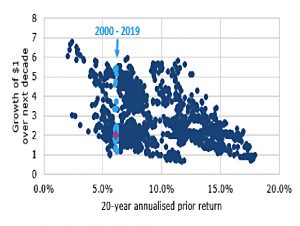

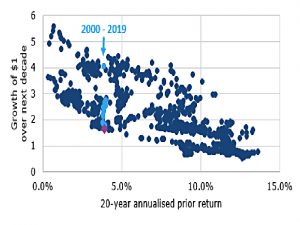

So he replicated Nick’s results using Shiller’s data from 1926 onwards.

I am glad to say that my results are extremely similar to Nick’s and I, too, get a correlation of -0.83 between prior 20-year returns and 10-year future growth of $1. Replication crisis averted. Nick’s analysis seems genuine.

But when he adds the extra Shiller data going back to 1871, things change.

The purple dot is the data point that would be generated by the S&P 500 doubling over the next decade.

- Now a low future return seems much more possible.

Joachim thinks that bulls won’t like him using the old data, so he reverts to date from 1026 onwards,. but this time uses real rather than nominal returns.

- Inflation for the next decade is assumed to be 2% pa.

Now a doubling is at the low end of expectations, but not extraordinary.

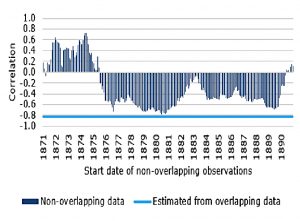

Joachim notes (like Nick) that this analysis uses overlapping data, which means that we have autocorrelation in the time series.

What I did was to calculate the correlation for every month between January 1871 and December 1890. This way I get 240 correlations, each of which is based on non-overlapping data. I can then compare these correlations with the correlation derived from

overlapping data.

The estimated correlation using the overlapping data was -0.83 and lower than all the estimates from non-overlapping data. If I look at the chart above, I would say that the true

correlation is probably slightly negative but somewhere close to zero.

This means that as Nick says “Markets are never due for anything”.

- Joachim concludes that we are not due for a bear market or a lost decade, but are also

not due for double-digit annual returns.

Flybe

The Economist reported that the bail-out of Flybe sends a troubling message.

- The airline had been bought by a consortium including Virgin Atlantic in 2019 but was soon in trouble again.

Its strategy of focusing on less busy routes seems not to be profitable.

So far, the government has only allowed Flybe to defer payment of Air Passenger Duty (APD).

- This will give a (temporary?) cash flow boost but has infuriated competitors (though unions are pleased).

It might also breach EU state aid rules (but we are leaving in two weeks).

The government defends the move as part of a commitment to keeping distant places connected to the rest of Britain.

- Flybe is the main operator at many smaller airports.

The government may also be planning a cut of APD – which the UK charges at a higher rate than the rest of the EU – in the March Budget.

P2P

In the Times, Kate Palmer reported that the provision funds used by P2P lenders to cover losses are running out.

- RateSetter and Zopa have paid out nearly £30m between them.

Zopa has just £1m left in its provision fund, which could be called on to repay up to £75m in outstanding loans. In 2018, it paid out £6.4m from the fund, and in 2017 it paid out £12.2m.

New loans on Zopa have not been covered by the fund since December 2017.

RateSetter’s provision fund has £9.9m left in it — but in 2018, the firm had to pay out £23m to investors who suffered losses, and it is projecting £27m in payouts to cover losses throughout 2019.

When the fund runs out, investors with returns on their loans will take a “haircut” to refill it.

Robo advisors

In FT Adviser, David Thorpe reported on the closure of another robo-advisor.

- Moola – founded in 2015 by TV finance personality Gemma Godfrey – will close at the end of February.

It was later taken over by JLT, which in turn was sold to Mercer.

- Godfrey left in November 2019.

The problem for robos is that despite their high charges, the cost of customer acquisition is too high.

- FTAdviser previously reported that Nutmeg spent £3 of revenue for every £1 of

assets it acquired in 2018.

And £1 of assets will only generate around 0.5p per year in revenue.

- So I think we can expect more closures and takeovers to come.

Quick Links

I have eight for you this week.

- Alpha Architect looked at timing low volatility with factor valuations

- The FT reported that the Woodford effect is weighing heavily on stock market minnows

- The Economist wrote that BlackRock has said that it wants to do more for the climate

- And that EQRX wants to make high-end medicines cheaper

- And that Aston Martin is stuck in idle

- Research Affiliates presented their forecasts for the coming decade

- UK Value Investor wrote that Admiral is his favourite dividend growth stock

- And David Stevenson presented a defensive portfolio of 20 world champion stocks.

Until next time.