Evidence-Based Rebalancing

Today’s post looks at a recent research note from Betafolio about evidence-based rebalancing.

Betafolio

Betafolio is “the UK’s premier turnkey asset management provider (TAMP), offering: a flat fee, low-cost, evidence-based, discretionary model portfolio service exclusive to financial planning firms”.

- It seems to be a restyling of the FinalytiQ brand established by Abraham Okusanya.

We’ve looked at Abraham’s work on several occasions previously, usually in the context of decumulation and particularly in the area of sequencing risk (which he calls “pound cost ravaging”).

- But today, his firm is looking at a technique which adds value in both accumulation and decumulation.

Rebalancing

We’ve looked at rebalancing on a number of previous occasions – you can find those articles here.

Let’s start with a summary of what we already know:

- Rebalancing is the process of re-aligning the asset allocation within your portfolio when it drifts from your ideal allocation.

- This will happen naturally as different investments grow at different rates (or even shrink).

- Typically, risky assets like stocks will grow at the expense of less risky assets like bonds.

- The process itself is simple – sell overweight assets and/or buy underweight assets.

- This is what makes rebalancing psychologically difficult because you need to sell your winners, and buy your losers.

- You’re betting on a reversion to the mean, which is a dominant factor in most markets over the long run (momentum is important in the shorter-term).

- This is anti-cyclical, or contrarian investing.

- You can carry out this process on a calendar basis.

- Most people use annual re-balancing, though there’s a lot of evidence that you should go more slowly than that, probably in order to catch the full benefits of momentum.

- Somewhere between eighteen months and as long as four years seems to be optimal, depending on market conditions.

- You should also take advantage of the natural cashflows in to (and later on, out of) your portfolio.

- This will mean that some of your rebalancing follows a monthly (buying in accumulation) or yearly (selling in decumulation) cycle – and there will also be regularly dividends to reinvest.

- Luckily, the sums of money involved will be small relative to the size of the portfolio (except in the very earliest years of investing) and the negative effects will be outweighed by progress towards longer-term goals.

- The alternative approach is threshold rebalancing.

- Here you use minimum and maximum weighting bands for each of your assets.

- You don’t rebalance until you are 5%, 10% or even 20% overweight (or underweight) in a particular asset class.

- In a steady market, you might not need to rebalance for years.

- The higher you set your threshold, the more potential you have to take advantage of momentum effects, but you are also potentially taking on more risk.

- An alternative to percentage banding is to use a minimum trade size (in the £3K to £10K range), below which no rebalancing is triggered.

- With threshold rebalancing, you also have to decide on the frequency with which you will check your portfolio.

- Every two weeks is recommended a lot in the literature.

- Rebalancing works best with portfolios that include more asset classes.

- Rebalancing has been shown to add more than 1% pa to returns from globally diversified multi-asset portfolios.

- Note that rebalancing only works on a risk-adjusted basis – you are usually selling risky assets and buying safety assets, which will impact your expected nominal returns.

- The benefits of rebalancing tail off as your equity allocation increases –

- You can’t beat a 100% stock portfolio if you are prepared to stick with it. (( Or if you prefer, a 100% allocation to Tesla or Bitcoin, depending on the year ))

- Note also that many diversification benefits disappear during a crash, as correlations increase.

- Rebalancing is best done within tax-sheltered accounts – here in the UK, within SIPPs and ISAs – since selling investments in taxable accounts can trigger a tax bill.

- Before rebalancing away from equities, check that you are over your target allocation.

- Most people aren’t when they include their non-portfolio assets (home equity, DB pensions, cash reserves etc.)

- Don’t sell equities when markets are falling – not selling in a bear market is more important than rebalancing.

- Perform some kind of momentum check, and delay rebalancing until the result is positive.

- There’s more detail on this approach in the article on Man’s strategic rebalancing strategy.

Cullen Roche has a relevant quote on what he calls behavioural alpha:

You don’t rebalance to beat the market. You rebalance to ensure you don’t get scared out of the market. The suboptimal strategy that you stick with is better than the optimal strategy that you bail on.

Evidence-based Rebalancing

On to today’s research paper.

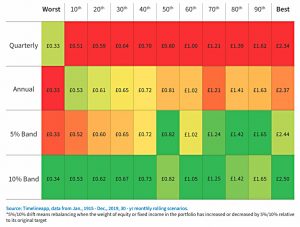

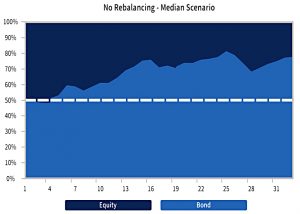

- Betafolio looked at a £100K portfolio invested 50/50 in stocks and bonds over a 30-year period.

They used (monthly) historical data from Jan 1915 to Dec 2019, which provides 910 scenarios.

They looked at four rebalancing strategies:

- Quarterly

- Annual

- 5% threshold

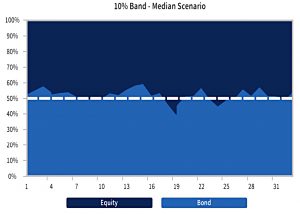

- 10% threshold

It’s pretty clear that the 10% threshold is best.

- I wish they had also tested a 20% threshold.

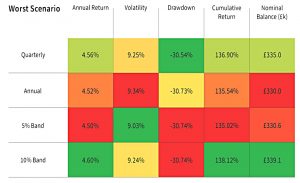

For a deeper dive, Betafolio looked at the best, median and worst-case scenarios.

- I’m naturally drawn to the worst.

To be honest, there’s not much to choose between them here.

- The difference in terminal balance between best and worst is only 3% over 30 years!

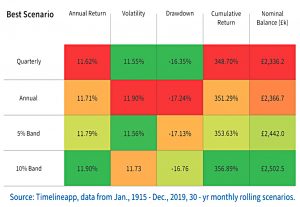

For the median scenarios, the gap is closer to 5%.

By the time we get to the best scenarios, the gap is up to about 7%.

- Still not much over 30 years.

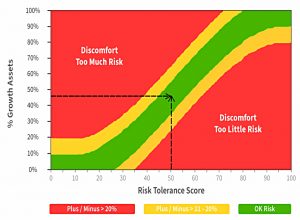

Betafolio explains threshold rebalancing in terms of risk tolerance.

- You need to keep “the client” (the investor) within the range of asset allocation with which they are comfortable.

They also show nicely how rebalancing prevents portfolio drift.

Conclusions

This is a pretty underwhelming (though nicely presented) note.

- It only looks at frequency/threshold rebalancing, leaving out all the other factors we noted above.

- It doesn’t include a 20% threshold regime.

- It doesn’t compare the regimes to a “no rebalancing” option.

- The terminal portfolio values are pretty close to one another after 30 years.

So as you were.

- Until next time.