Finimize

Today’s post is about the daily financial newsletter Finimize.

Finimize

Finimize is a London-based startup aiming to make finance more accessible for millennials.

- They began in 2015 as an email newsletter.

But soon they adopted the tagline “Finimize Your LIfe” and started to build a free-to-use platform “for millennials looking to get their financial life on track” – something they referred to as the TripAdvisor of finance.

The goal was to help anyone take control over their future in three minutes through a personalised financial plan, built using Finimize’s algorithms.

- The idea was to have a beta for the FinimizeMyLife platform during 2017 – I’m not sure what happened to that.

Longer-term, the idea was that FinimizeMyLife would become the platform people checked with before making any financial decision.

Founder Max Rofagha wanted to:

Close the advice gap in the UK and to empower our audience of millennials to

essentially become their own financial advisors.

There’s nothing like aiming high.

Founders

Finimize was founded by Max and Scott Tindle – two friends from university.

- Before starting Finimize, Max co-founded a Swiss travel and home goods e-commerce company called DeinDeal, which he sold in 2015.

Scott is a CFA who used to work at Barclays Capital, but it looks like he’s no longer with the firm.

We created Finimize because it’s unnecessarily difficult to know what to do with your finances. Whether it is the amount of jargon in financial news, the broad range of advice you receive or the sheer number of platforms to choose from – the outcome is often inaction.

Our mission at Finimize is to empower you to become your own financial adviser by giving you the information and tools you need to make smart investment decisions.

Daily email

More recently. Finimize have pivoted to focus once again on their short daily email which gives you the key financial news you need each day.

- The average age of the readers is 28 to 30, which makes me something of an outlier.

Max says that the newsletter:

[Covers] the top two financial news stories of the day [and] is easy to read, concise, and without financial jargon. It takes three minutes to read and it’s free!

The goal is to enhance a user’s financial literacy to be able to make more informed decisions when it comes to their money.

The fact that over 175,000 people subscribe to our daily newsletter demonstrates the appetite for clear and easy to digest financial knowledge.

We’ve done some research on financial literacy with YouGov – 59% of millennials couldn’t explain what an ISA is, 84% couldn’t tell you what the term ‘equity’ means and 90% per cent couldn’t explain what ‘asset management’ is.

Finimize aims to cut through the jargon:

Our goal was to demystify the news stories by simplifying the financial jargon so that anyone could understand them.

Publications like the Financial Times and Wall Street Journal assume a lot of things about what their readers know. If the price of oil goes up, what happens to the dollar? They assume you know that. We assume our readers don’t.

People read us because we’re accessible, but also because there’s real substance and analysis.

You could think of the email as a gateway drug, gradually educating readers to the point where they feel able to trust Finimise with putting together a complete financial plan for them – and they have the knowledge to understand it.

The newsletter was the first step on the ladder. We were testing the appetite of

millennials to engage with what is generally seen as a pretty dry topic – finance.

Audience engagement

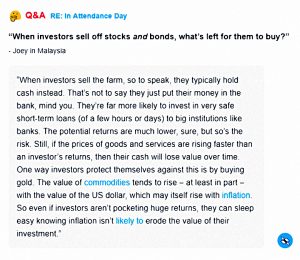

At the end of every story, there’s a link inviting readers green button invites readers to email the Finimize team with questions about the story they just read.

- The team also pick the most interesting question and publish it at the bottom of the email each day.

Here’s one from a couple of weeks ago:

Other stuff

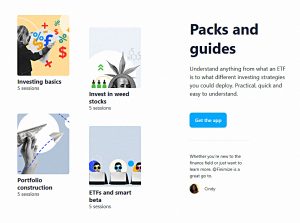

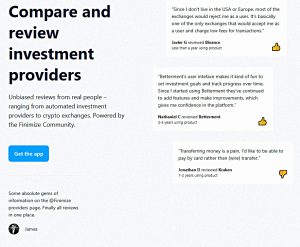

There’s an app of course, which focuses on user reviews of financial products.

- But it only works on Apple kit for now, so I haven’t tried it.

And there are regular events in London (and elsewhere, but I’ve only been to London ones).

- These are usually based around a panel of fintech execs (and they usually have some free beer).

The website

Today, the website leads with the newsletter signup.

Next comes the app, with a focus on the educational aspects.

And finally, you get the TripAdvisor angle – reviews of investment products.

- FinimizeMyLife still seems to be on the back burner.

Conclusions

I’m clearly not a millennial, but I’ve been reading the Finimize daily email for many months now, and I like it.

- It’s even better now that I have a decent phone to read it on.

So why not give the newsletter a go.

- You can always unsubscribe if it’s not for you.

And if you do decide to sign up, please use this link – that way I get a (tiny) affiliate fee that supports my work on this blog.

- Until next time.