Weekly Roundup, 14th February 2022

We begin today’s Weekly Roundup with a look at earnings.

Earnings

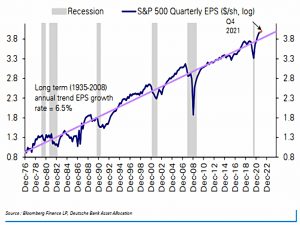

John Authers reported that S&P earnings have returned to trend following the pandemic.

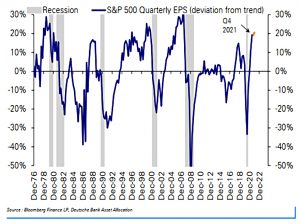

And indeed, that the gap above trend is becoming quite large.

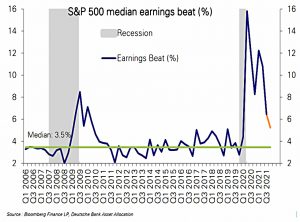

Meanwhile, earnings beats (relative to expectations/earlier corporate briefings) have come off their record highs but are still running well above the historical average.

Investors have caught up with the reality of post-pandemic earnings growth. After four successive quarters in which forecasts were being almost constantly upgraded (and providing some great fuel for the overall market in the process), markets are no longer needing to make up lost ground.

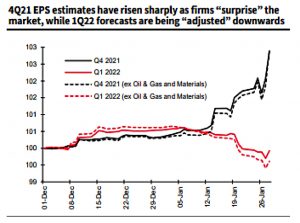

The market is also starting to punish “misses” more than usual – witness Netflix, PayPal and Meta.

Chief executives are instead talking down their prospects. Thus, as the prospective earnings for the quarter just ended have risen, hopes for the current quarter have stagnated.

CEOs are no longer mentioning (ability to raise) prices more than (the risk of higher) wages, which bodes ill for margins.

- And supply chain problems remain.

John is not surprised that decent earnings have failed to prop up share prices.

Bubbles and crashes

In the FT, Merryn Somerset Webb recommended an online course in the Practical History of Financial Markets, run by Russell Napier.

- One of the modules looks at bubbles and crashes.

Of the 29 business cycles in the US since 1881 only a few have ended in [a bubble]. The basic driver has been much the same: the ability of investors to believe absolutely in something that always turns out to be impossible.

This can be new technology or permanently high profits or permanently low interest rates.

- Most of the time, investors assume cyclicality – for example, that growth leads to capacity constraints and hence inflation and rate rises.

Bubbles end badly, but the end can be quick or slow, depending on whether investors believe interest rates won’t rise (long bear, eg. from 1966) or that earnings will stay high (short and sharp, as in 2020).

- This one looks like the slow option, as rates finally start to track upwards.

Merryn recommends the cheap UK stock market over the expensive US one.

Saving too much

The Economist said that the world is saving too much and that the pandemic won’t change this.

Since 2000, the value of global wealth held by households, firms and governments has roughly tripled, from $160trn to $510trn, or from about 460% of global GDP to 610%.

This pushes asset prices higher and interest rates lower. Can the pandemic help?

Tight labour markets are shifting money to workers who are eager to spend, contributing to the highest inflation in a generation. Central banks which had found themselves unable to push interest rates down enough to keep inflation from falling below their targets are beginning to push rates up to keep inflation from soaring.

But it probably won’t make any difference. According to The Economist, there are three main saving sources:

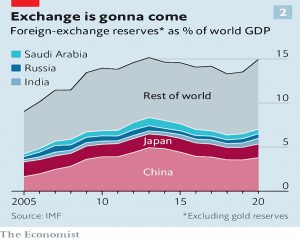

- governments who want FX reserves

- households and firms, and

- workers near retirement age.

Resource-exporting economies save part of the windfall earned from their exports and plough it into stocks and bonds. Some of these piles are held as official reserves.

Other economies pile up foreign-exchange reserves as they intervene in markets to reduce the value of their currencies, to boost exports or to build up a hoard of safe assets which can be drawn upon in times of financial stress.

This squeezes home consumption and leads to current-account surpluses.

A shift to zero-carbon energy may eventually doom fossil-fuel windfalls, but the transition might well mean high prices for oil and gas, since new production is likely to stagnate. Meanwhile, the pandemic and its aftermath will probably reinvigorate the appeal of defensive foreign-exchange reserves.

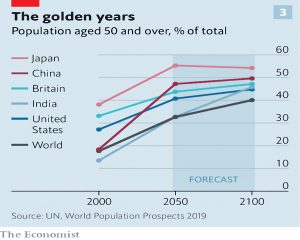

Meanwhile, the world is not getting any younger.

When workers are young, they save little or even take on debt. Their savings rise through their 30s and 40s before peaking a decade or so before retirement.

The pandemic made things worse here, depressing birth rates.

Charles Goodhart and Manoj Pradhan have argues that eventually there will be a “great demographic reversal” as retirees spend their savings.

- I’ll discuss this in detail in a future post, but a key point is that the median age matters.

A great demographic reversal seems intuitive, particularly in places like America where an oversize cohort—the baby-boomers—is easing into retirement. But the median age in America is still just 38. The median age in India is only 28.

The newspaper concludes that the world will come to look more like Japan.

Capital at risk

In the FT, Akila Quinio reported on FCA Research which points to an overhaul of the “capital at risk” investor warning.

The standard small-print risk alert is perceived as “white noise” by consumers and fails to illustrate potential losses. A survey found that 45 per cent of new self-directed investors were unaware that losing some money was a potential risk.

The drivers for the review appear to be high-risk retail investments like crypto (inevitably) and equity crowdfunding.

- The plan is to use “louder” risk warnings with bold text and a red background, with the aim of interrupting “automatic behaviours”.

Tick box forms to acknowledge that risks are understood are also planned. The FCA said:

Disclosures cannot only help people understand financial products, but also draw attention to neglected considerations like risk, perhaps deterring some consumers from buying products that are unsuitable for them.

Yet more state nanny-ism on the way.

High Yield Bonds

Buttonwood said that high-yield bond investors should worry.

- So far, the stock market jitters haven’t spread to the credit market – but that doesn’t mean that they won’t.

Bank of America’s US high-yield index, a popular barometer for the price of “junk” bonds issued by the least credit worthy borrowers, has fallen by just 2.4% since late December.

Bonds are generally more stable than stocks:

The value of a stock stems from a stream of potential earnings extending far into the future. That of a bond depends on the issuer’s ability to pay interest until the security matures, and then to find the cash to repay the principal (probably by issuing another bond). If a firm wants to change the world, great—but avoiding going broke for a few years is fine, too.

In fact, the credit ratings of junk bonds were improved by Covid, as the pandemic created more “fallen angels” at the safe end of the junk spectrum.

- But a lot of junk was issues over the last two years ($869, or half of the total stock) – and eventually, it will need refinancing.

With the Fed’s asset purchasing over, this will be more difficult.

It’s also true that the decline of interest rates has made junk less attractive.

- In the 1980s, Milken pushed bonds at yields of 14.5% and default rates of 2.2%.

Junk now averages 5.1% in the US and just 3.3% in Europe, leaving the bonds more vulnerable to defaults.

Crypto

In the FT, Izabella Kaminska said that all digital creations are NFTs – we just don’t know it yet.

She began with the “rampant piracy and fraud in the NFT space:

On most NFT platforms including OpenSea, by far the largest NFT marketplace,

people can create an account and start selling whatever digital images they want to upload.

So your NFT might not be creator-approved, and might not be a genuine claim to a copyrighted work.

It’s become increasingly obvious blockchains do not solve the Garbage In Garbage Out (GIGO) problem.

Just because you can’t hack the NFT itself doesn’t mean that it’s legit, to begin with.

- So we are back to trusting the originator (as well as the blockchain).

Centralised content platforms (eg. YouTube) police content for copyright abuse as it is added.

- The best you can how for from a “decentralised” NFT platform is that they respond to a takedown request from a genuine creator.

The benefits of [the market’s] decentralised state in giving creators more power have been massively exaggerated.

Izabella also used the recent downtime on the Solana network as an entry point to the issue of what happens to NFTs on a blockchain that goes to zero?

The chain would likely still continue to be validated by the originating entity, meaning the only negative consequence would be more centralised control of the system. In the worst-case scenario, NFTs could be transferred to more functional blockchains.

There’s a parallel here with bank runs – in the end, a platform would need to burn its own capital in supporting the blockchain.

- But would its investors allow this?

Izabell sees NFTs as an “advertising market”:

Valuations reflect a sunk cost rather than any sustainable long-term value. NFTs use outrageous upfront cash flows to direct eyeballs to images or messages spenders want to promote.

The art is the advertising. Only those images or assets that satisfy the cultural agendas of the hyper-moneyed classes are likely to continue to do well.

Which is crypto millionaires and billionaires at the moment.

The fundamental issue is that NFT “assets” don’t provide cash flows.

- Without them, NFTs will end up as centralised as YouTube or the regular art market.

Izabella winders why YouTube doesn’t create a secondary market for NFTs of the cash-flow generating content it already has.

Quick Links

I have seven for you this week, the first four from The Economist:

- The newspaper looked at the truth about dirty assets

- And explained who buys the dirty energy assets that public companies no longer want.

- The Economist also wrote about Facebook’s big-tech competition

- And asked if anyone is winning the streaming wars.

- Musings on Markets revisited the FANGAM stocks

- UK Dividend Stocks said that Domino’s dividends were at risk from debt and dark kitchens

- And Pragmatic Capitalism said that MMT has failed its first big inflation test.

Until next time.