Weekly Roundup, 23rd July 2019

We begin today’s Weekly Roundup in the FT with Paul Lewis, who can’t see the fuss about IHT.

IHT

Despite hosting Radio 4’s flagship money programme, Paul is no stranger to funny ideas.

- Three years ago, he tried to persuade us that cash (or as he calls it “active cash“) is a better investment strategy than stocks.

Spoiler alert – it isn’t.

This week, Paul’s line is that since few people pay IHT, what’s all the fuss about?

- He’s only a couple of weeks late on the OTS review of IHT, but let’s take a look at what he has to say.

Paul’s view is one aspect of the “other people’s money” approach so common on the left.

- He admits he’s in the minority on this one, as IHT is usually found to be the most hated tax of all.

The reasons are simple – it’s a tax on money that’s already been taxed, and on money that people want to pass to their children.

- More widely, it’s part of a suite of disincentives to save rather than spend, and then fall on the state for help.

I’ve got an idea as funny as Paul’s – let’s make IHT voluntary.

- Then I can opt-out of paying it, and perhaps he can offer to pay mine on my behalf.

Life Two

Don Ezra has come up with a new name for retirement – Life Two, a phrase I’m afraid we might hear more of.

- Don’s also written a book with the same title, and the FT gave him a double-page spread on which to promote it.

His main point seems to be that we need to be re-educated in order to prepare correctly for Life Two.

- And that this process needs to start 20 years before retirement.

I’m seven years into Life Two, but I’m afraid I didn’t get much out of the article.

- Perhaps you’ll have better luck.

Lendy

Marry Somerset Webb looked at the decline of P2P platform Lendy (previously Saving Stream).

- Lendy offer loans paying up to 12% and secured against property.

Lendy started out in bridging loans on existing properties but moved into riskier loans to developers.

- Ongoing developments are more difficult to value since the timeline is longer and potential time and cost overruns are unknown.

The demise of Lendy is a new take on an old story — one of mispriced risk, misleading marketing and complacent regulation.

John Cronin of Goodbody Stockbrokers notes:

[It is] hard to see how an infant could underperform Lendy’s underwriting decisions [given that] 35 of Lendy’s 54 corporate borrowers have gone bust.

Merryn notes:

If it were really possible to get anything close to 12 per cent without taking massive risk, it would be institutional investors [who got it]. Most things left on the table for the retail investor should probably stay on the table.

Of course, Lendy couldn’t get any institutions on board.

High returns are always risky an illiquid – P2P and fintech can’t change that.

Factors

In the Economist, Buttonwood looked at factor investing.

There are six main factors:

- Size

- Value

- Momentum

- Yield (perhaps a proxy for value)

- Quality, and

- Low volatility

The classical theory tries to explain them in terms of added risk (which works better for some than for others) but more recently they have been explained in behavioural terms.

- Investors have preferences that lead them to buy one kind of stock rather than another.

There are two drawbacks to the approach:

- Factors become crowded trades once they are well known, which should reduce the available returns, and

- Some factors (particularly momentum) require a lot of trades, and the associated costs wear away between a third and a half of the profits.

I use factor funds in a small way and trend-following (momentum) in a somewhat larger way.

- The modest potential outperformance is welcome, but what I’m really looking for is a less than perfect correlation with the passive funds that make up the largest part of my overall portfolio.

Property

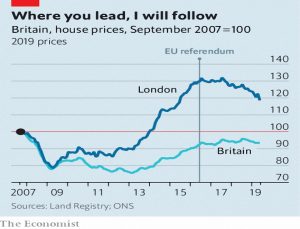

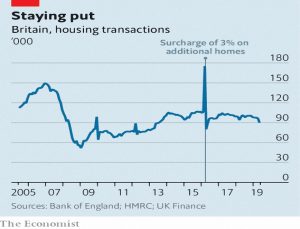

A second article in the newspaper noted that UK house prices are falling.

This also happened in previous recessions:

Falling housing investment accounted for a quarter of the drop in gdp in 2008-09. It played an even bigger role in the recessions of 1975, 1980-81 and 1990-91.

There are a few reasons behind the current slide:

- stamp duty is very high at the top end of the market and on buy-to-let

- foreign buyers (mostly in London) are waiting for Brexit to conclude, and

- interest rates have increased slightly over the past couple of years.

People may now also be waiting for Boris Johnson to cut stamp duty.

The housing market could well get worse before it gets better. Help to Buy, a government lending initiative which has boosted house prices and transactions, will start to be wound down in 2021.

And of course, there may be a no-deal Brexit to cope with in a few months.

St Ives

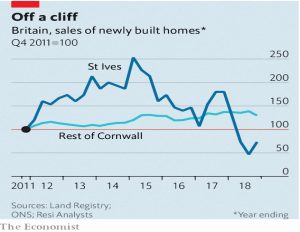

The decision three years ago by the lovely Cornwall town of St Ives (my favourite UK resort) to ban second homeowners from buying new build properties has backfired.

- Sales (and builds) are down and prices (of older properties) are up, two trends not seen in the rest of Cornwall.

St James Place

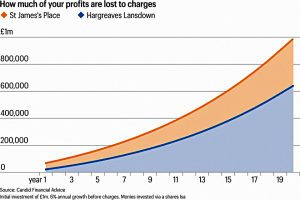

The Woodford scandal seems to have led to a change of tack in the mainstream financial press.

- After beating up Hargreaves Lansdown for their close ties to Woody, they now have it in for St James’ Place’s ridiculously high charges.

In The Times, Ali Hussain wrote that the cost of investing £1M with SJP over 20 years was close to £1M.

The chart assumes 6% growth in a stocks ISA.

- Interestingly, the comparison is with HL, not with a DIY approach using ETFs (which would be far cheaper).

SJP snaffled 45% of the gains over 20 years, whilst HL took 29%.

- SJP has a 5% initial charge and a 0.5% annual advice charge (embedded in the funds).

It’s most popular portfolio costs 1.68% pa.

Pensioner NICs

In FT Adviser, Maria Espadinha reported that the government has (rightly) ruled out making working pensioners pay NICs:

After the state pension age individuals can no longer increase their entitlement to these benefits,”therefore, it is fair that we do not charge them NICs”.

However, there is no such exemption for employers who employ older people, as employer NICs do not determine entitlement to contributory benefits.

Quick links

I have five of them this week, four from Alpha Architect:

- Value investing and Concentration

- Strategies to reduce crash risk in stocks

- Enhancing momentum strategies, and

- Fact, fiction and the size effect.

- Flirting with Models chipped in with Ensemble multi-asset momentum.

Until next time.