Weekly Roundup, 30th July 2019

We begin today’s Weekly Roundup in the FT with Jason Butler, who was talking about effective financial habits.

Contents

Good habits

It was a quiet week, as the effect of the summer holidays kicked in.

Jason Butler had six habits that he thought we should adopt:

- Don’t make financial decisions when emotional

- Instead, you should sleep on it.

- Cut out the noise

- And don’t check the value of your portfolio too frequently.

- Just say no

- To add-ons, upgrades and “special” deals.

- All pounds are equal

- It’s surprisingly common for people to treat money differently according to its source (the “house money” or “free money” effect).

- Ignore social media and reality TV.

- This will help you avoid trying to Keep Up with the Joneses.

- Replace a bad habit with a good one.

- This one is a bit trickier – Jason talks about replacing alcohol with non-alcoholic lager and wine, but who would really see that as a replacement?

Central bank equity purchases

Merryn Somerset Webb was worried by a suggestion from BlackRock that the ECB should print money to buy equities.

It’s not a new idea. The Bank of Japan has been buying domestic equities for years: it owns about 75 per cent of the country’s exchange-traded fund market and is a top 10 shareholder in 40 per cent of Japan’s listed companies.

At the moment, the ECB buys bonds, but:

Germany is running out of Bunds, thanks to running a budget surplus, and ECB buying has to be proportional to the size of its constituent countries. So Germany needs to run a deficit to sell Bunds to the ECB or allow the development of eurobonds guaranteed by Germany.

If Germany says no, the ECB might have to look at equities.

But it hasn’t worked (as stimulus) in Japan, and probably wouldn’t in Europe.

- It might push up stock prices, leading to feelgood factor for the minority who already hold them.

It’s also a subtle form of nationalisation, as Merryn points out, and will distort market pricing signals.

- But the bottom line its that it might be a good time to buy European equities.

Economic populism

Buttonwood wrote about economic populism, which he defined as a lack of concern about the potential impacts of budget deficits or inflation.

- This approach is now rare outside of Venezuela.

Most populist politicians prefer orthodox economics (though US Democrats and Corbyn’s Labour are each now flirting with MMT).

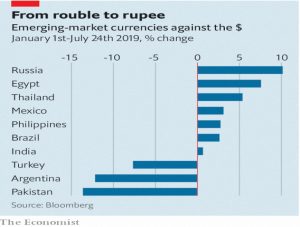

Buttonwood uses FX rates as a proxy for the popularity of a country’s leader:

Countries led by strongmen hostile to orthodox policies have seen their currencies suffer—the inverse of the Putin Principle. Recep Tayyip Erdogan, president of Turkey, is the exemplar.

The contrast between Egypt and Pakistan is also illuminating.

Yield curves

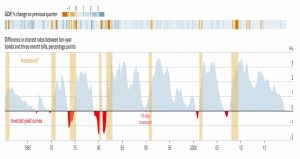

The Economist also wrote about yield curves, explaining how inverted curves happen:

At the short end, when central banks raise rates, the curve flattens and the economy slows. On the long side, when a recession looms, investors expect that central banks will cut rates to soften the blow. That lowers long-term yields, flattening the curve.

And as the chart shows, US inversions almost always signal a recession.

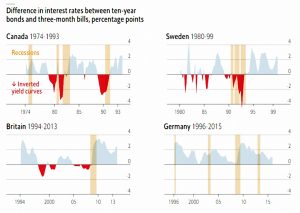

The relationship is not so strong in other countries.

- Given that there have been so few recessions in the US, the apparent relationship could be a statistical fluke.

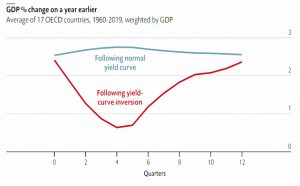

So the newspaper looked at whether flattening curves lead to slowdowns and steepening ones to accelerated growth.

It turns out that this is the case.

Yield curves help predict economic growth across the rich world. For every percentage point that spreads flatten, GDP growth slows about half as much.

Which also means that the US is not a strange outlier.

- And since its curve has flattened by more than a point in the last year, growth should slow from 3% to 2%.

The article also notes that QE may impact the relationship:

Because central banks have bought long-dated bonds in quantitative-easing schemes, they now affect both sides of the yield curve directly. That makes long-term interest rates a less reliable proxy for market expectations.

The price of wine

In the Spectator, Rory Sutherland looked at the price of wine, using a question posed by Nobel prize-winning economist Richard Thaler (of Nudge fame).

- You have a case of claret that you bought for £20 a bottle some years ago – nowadays it sells for £75 a bottle.

If you drink a bottle, how much has it cost you?

Thaler’s options were:

- £0. I already paid for it.

- £20 — what I paid for it.

- £20 plus interest.

- £75, what I could get if I sold the bottle.

- £55. I get to drink a bottle that is worth £75 that I only paid £20 for, so I save money by drinking it.

To a rational economic actor (like me), the answer is obviously £75, since that is how much utility I am giving up by drinking it.

- But only 20% of respondents (readers of a wine auction magazine) got the question right.

The breakdown of answers was 30%, 18%, 7%, 20% and 25% respectively.

Rory has a useful rule for working out whether something is expensive, and it’s one that I use myself:

You should upweight the value of those extravagances which you can enjoy with a great deal of frequency. Beds and bedding are one category where it makes sense to pay over the odds.

He suggests we use the “cost per entertainment hour” unit used to justify the high cost of video games.

- This makes things like big TVs and bigger monitors – and even a flagship smartphone – seem cheap.

Quick links

I have just two for you this week:

- Alpha Architect looked at the financial performance of collectables, and

- Flirting with Models wrote about Timing Luck and Systematic Value.

Until next time.