Good Robot? US Robo-Advisors

Today’s post looks at the portfolio construction methods used by a couple of US Robo Advisors.

Contents

Today’s post was inspired by a Reddit thread (( Hat-tip to u/PEEFsmash for his post )) which claimed that Wealthfront and Betterment have “solved portfolio management”.

- Which meant in turn that most people would be better off using robo-advisors that managing their own portfolio.

So I have four objectives today:

- To understand how Wealthfront and Betterment construct portfolios

- To interpret whether this means that they have solved portfolio management

- To decide whether robos are better than DIY investing

- To compare US robos to UK robos

Perfect

What the Redditor meant by perfect was that the portfolios follow academic theory.

- A lot of portfolios claim to do that (including my own).

But there’s more than one way to skin that particular cat, so we’ll dig into what it really means in a moment.

Costs

Even in the US, robo-advisers still carry a fee.

- According to the post, 0.25% pa is now the norm.

That’s less than the UK average, but still not insignificant in the context of a DIY portfolio of ETFs with a weighted average cost in the 0.3% to 0.4% pa range.

- So the US robos will need to have something pretty clever – and hard for a DIY investor to reproduce – for me to be persuaded.

Returns

As is often the case on Reddit, the response to the portfolio centred around returns, in this example, relative to a “3 fund” portfolio.

- Since Reddit has a US bias, this usually means US stocks, international stocks and US bonds.

A single Vanguard fund is also regularly used as the benchmark, and sometimes the S&P 500.

But returns are a red herring:

- Since the 2008 financial crisis (and the response to it) the largest stocks in the largest markets have produced the largest returns.

Using these rulers will give you a false measurement.

- All we have is the past, but it’s better to use long-term hindsight rather than short-term hindsight.

Wealthfront

Wealthfront (WF) has a 34-page White Paper explaining their Investment methodology, which has five steps:

- Identify a diverse set of asset classes

- Select the most appropriate ETFs to represent each asset class

- Apply Modern Portfolio Theory to construct asset allocations that maximize the expected net-of-fee, after-tax real return for each level of portfolio risk

- Determine your risk tolerance to select the allocation that is most appropriate for you

- Monitor and periodically rebalance your portfolio taking advantage of dividend reinvestment

Which all sounds fine.

Assets

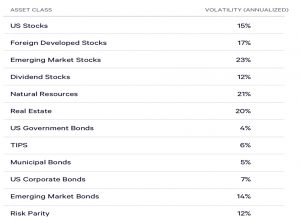

Here’s WF’s asset list.

- As usual with robos, it’s pretty short at 12 assets.

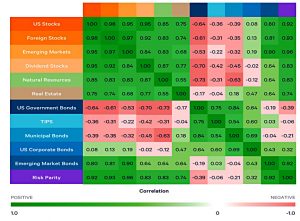

We have four stocks, five bonds and three alternatives, including “risk parity” which to me is a portfolio construction technique rather than an asset class.

- The only other asset not available to UK DIY investors is Municipal bonds, which have tax breaks for US investors but aren’t available over here.

Missing assets include thematic equities, private equity, hedge funds and royalties.

- I initially assumed that commodities and precious metals are included within natural resources, but the notes suggest an energy-only focus.

Natural Resources reflect the prices of energy (e.g., natural gas and crude oil). Natural Resources provide inflation protection and diversification.

Missing factors include momentum, small-cap and low vol.

- I’ve assumed dividend stocks are a proxy for value.

The table also shows returns minus (ETF) fees but before taxes.

- In general, I will assume that UK DIY investors are constructing tax-free portfolios within SIPPs and ISAs.

Risk Parity (RP) is defined here as a dynamic asset allocation strategy:

The strategy targets a fixed level of volatility by adjusting the amount of leverage applied to a portfolio in which the asset class risks have been equalized. The strategy was pioneered by Bridgewater Associates and has historically outperformed traditional stock/bond portfolios with comparable risk.

So rather than apply RP to the whole portfolio, WF appears to run a separate RP portfolio, and allocate to that from within the client portfolios.

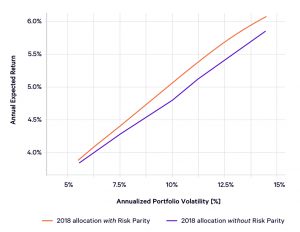

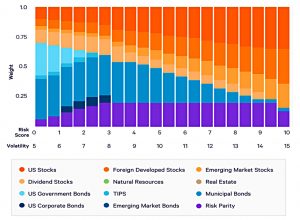

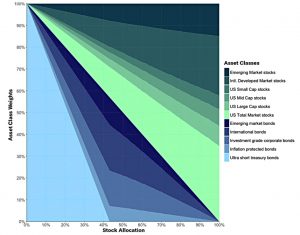

The chart above shows the benefit of adding an RP allocation.

Instruments

WF uses ETFs with an average charge of 0.09%, which is very good.

- On top of that, they charge 0.25% pa, for a total of 0.34% pa, which is good.

Allocations

WF use four inputs to derive their allocations:

- Mean-Variance Optimisation (MVO) from Modern Portfolio Theory (MPT)

- The Black-Litterman model for blending expected returns

- Expected returns from the Capital Asset Pricing Model (CAPM)

- Expected returns from the Wealthfront Capital Markets Model (WFCMM)

The Wealthfront Capital Markets Model (WFCMM) is a multi-factor model with risk premia that can vary over time based on changes in interest rates and valuation ratios. We use the WFCMM to generate forecasts of long-horizon expected returns, which we blend with the predictions of the CAPM using the Black-Litterman model.

There are minimum and maximum constraints for each of the assets within the portfolios:

WF constructs three portfolios (taxable, taxable plus RP and retirement account).

- I’m not sure why there is no retirement plus RP portfolio, but I assume it’s because of US tax law.

The taxable portfolio without RP is used for accounts smaller than $100K (plus RP opt-outs).

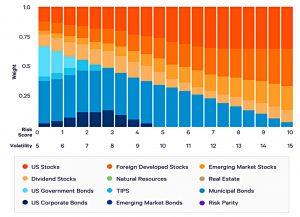

Each portfolio has 20 flavours based on risk settings.

The charts look pretty, but if you look at a particular risk level (say 7, which a lot of DIY investors will be close to), the portfolios are petty simple.

- Adding in RP is nice, but there’s no stand-alone ETF for this, and DIY investors will need to decide for themselves how to incorporate RP beyond their initial asset allocation.

Building the basic WF portfolios is otherwise pretty simple.

Betterment

The Betterment Portfolio Strategy document only runs to 20 pages.

Betterment also uses MPT but adds small-cap (size) and value tilts from the Fama French factor research (so just the three-factor model rather than the five).

They also:

- Estimate forward-looking returns and covariance

- Account for estimation error in the inputs

- Accounting for taxes (in taxable accounts)

Betterment has an investment philosophy:

Betterment uses real-world evidence and systematic decision-making to help increase our customers’ wealth.

And five investing principles for investors:

- Make a personalized plan

- Build in discipline

- Maintain diversification

- Balance cost and value

- Manage taxes

All good stuff once more.

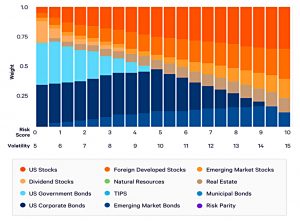

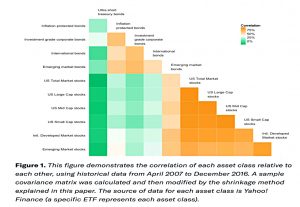

Assets and correlations

Betterment has a similar list of assets to WF (minus RP and dividends, plus small-cap – there’s no sign of value yet) and similar correlations.

Betterment explains why some asset classes are missing:

We have excluded private equity, commodities, and natural resources, since estimates of their market capitalization are unreliable, and there is a lack of data to support their historical performance.

In addition, real estate investment trusts (REITs), are not explicitly included in the portfolio strategy. We include exposure to real estate, but as a sector within equities.

I think they are sticking too close to academic rules here – practitioners would generally include these assets.

Allocations

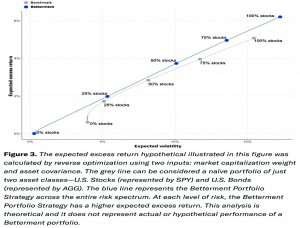

Using CAPM across a wider range of assets than just stocks and bonds improves the Betterment efficient frontier.

Betterment note that:

While CAPM is an elegant theory, it does rely on a number of limiting assumptions: e.g., a one period model, a frictionless and efficient market, and the assumption that all investors are rational mean-variance optimizers.

These are actually pretty difficult assumptions to swallow, but like other models which are necessarily simplifications of reality (ie. “wrong”), the CAPM approach can still be useful.

Betterment also uses Black Litteman to tilt their allocations:

The Betterment Portfolio Strategy is tilted based on the level of confidence we have for our views on size and value. These views are computed from historical data analysis, and our confidence level is a free parameter of the implementation.

They also use Monte Carlo:

By doing an optimization of the portfolio strategy under these simulated market scenarios, we can then average the weights of asset classes in each scenario, which leads to a more robust estimate of the optimal weights.

This secondary optimization analysis alleviates the portfolio construction’s sensitivity to returns estimates and leads to more diversification and expected performance over a broader range of potential market outcomes.

Sounds reasonable.

But as usual, the robo portfolios are pretty boring.

So it would be pretty easy to replicate.

Conclusions

It’s hard to escape the conclusion that these portfolio construction papers are just marketing.

- The portfolios they output are simple and easy to replicate.

And, in general, they contain a high allocation to bonds – given current macroeconomic conditions.

Let’s go back to our objectives:

- We now understand how Wealthfront and Betterment construct portfolios

- I don’t think that they have “solved” portfolio management since the academic theory they use is well understood

- And they are only implementing it in a limited fashion

- For me, even the US robos are inferior to DIY investing

- I can implement a more diversified portfolio at a lower cost for myself

- US robos look slightly more sophisticated than UK robos and are slightly cheaper

Robos as a class continue to disappoint me – with their scale economies, they ought to be able to implement something more sophisticated than I can personally, and at a lower cost.

- Perhaps the real problem is that they wouldn’t be able to market such a product to the unsophisticated investors they target.

Until next time.

1 Response

[…] 7 Circles – Good Robot? US Robo-Advisors Mike has an indepth look at robo-advisors and whether they offer anything different to a typical […]