Investing under Inflation – Man Group

Today’s post looks at a 2021 paper from Man Group on the Best Strategies for Inflationary Times.

Contents

Investing under inflation

We briefly looked at this paper in 2021, when we considered alternatives to the traditional 60/40 portfolio (which we predicted would not work well when inflation returned and interest rates rose).

At the time, we mainly stole from the abstract:

Unexpected inflation is bad news for traditional assets, such as bonds and equities. Commodities have positive returns during inflation surges but there is considerable variation within the commodity complex.

Among the dynamic strategies, trend-following provides the most reliable protection. Active equity factor strategies also provide some degree of hedging.

Now that inflation is here and the 60/40 has had a terrible few months, I thought it might be worth digging into the paper in more detail.

The paper begins by looking at the absence of inflation since 2007, and the reasons why it might return:

- the unprecedented increase in money creation

- fiscal deficits

- bond market signals (increasing long-term yields)

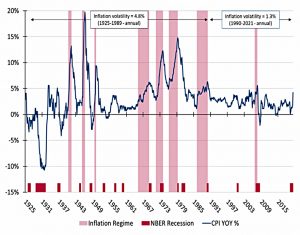

A year later, we are in the thick of inflation, which the paper defines as:

When headline, year-over-year (YoY) inflation is accelerating, and when the level moves to 5% or more.

The paper uses the US CPI basket (which is not universally admired).

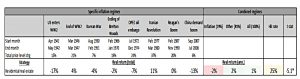

Under this definition, there were eight inflationary regimes since the 1920s, and the current episode would be the ninth.

Performance

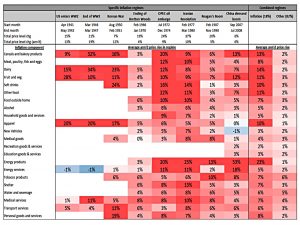

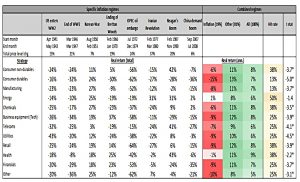

As the abstract described, bonds and stocks do badly, whilst commodities and trend do well.

- Real Estate is better than stocks and bonds, but not great.

Quality and value also have mediocre performance.

Inflation impacts

The next section of the paper looks at the economic mechanisms by which inflation affects asset prices.

One key distinction is between short-term and long-term inflation shocks.

- Bonds and stocks are largely long duration investments and are sensitive to changes in long-term inflation expectations.

Bonds are also impacted by unexpected inflation.

For stocks, inflation implies volatility and uncertainty and potential future economic weakness, impacting the ability of firms to plan ahead.

- In addition, not all firms are able to pass on higher input costs.

There are also tax implications, and higher discount rates to feed into valuation models.

Stocks and bonds

As previously noted, stocks and bonds (and the 60/40 portfolio) do badly.

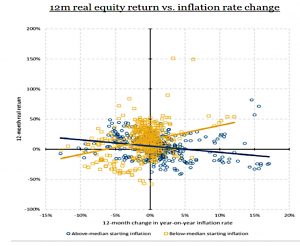

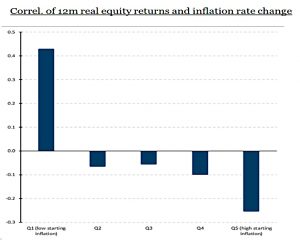

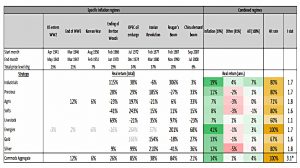

Equities actually benefit from rising inflation if the starting level is below median (risk of deflation), but are hurt by rising inflation if it is above median (increased risk of inflation escalating).

Only in the lowest quintile (starting inflation rate less than 1.0%) is the correlation positive at 0.4. In all other cases, there is a negative relationship between the real equity return and inflation changes, and (monotonically) more so for higher starting levels of inflation.

In contrast:

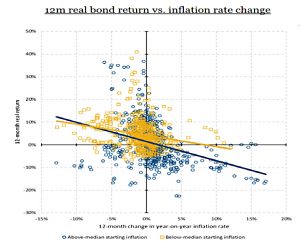

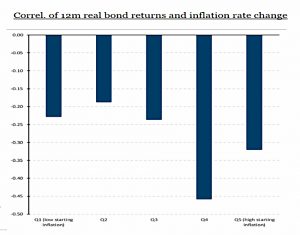

The negative relation between bond returns and inflation changes does not depend much on the starting level of inflation.

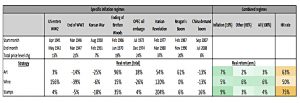

Within stocks sectors, only energy does well, but even this sector underperforms the commodities it produces.

Weak sectors include those with a high exposure to the individual consumer, such as durables (-15%) and retail (-9%). Technology is also -9%. Financials are weak as default risk dominates the benefits of possible rising rates and because there can be a lag between an inflationary regime and central bank tightening.

Within bonds, longer maturities (higher durations) are more sensitive to inflation.

- Corporate bonds perform even worse despite shorter average durations.

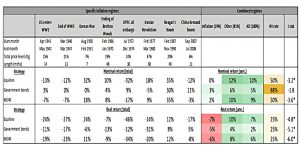

TIPS (linkers) do well under inflation, but no better than in the absence of inflation (as you might expect. Unfortunately, they are now expensive:

The starting TIPS yield in our inflationary regimes was +2.4%, whereas now it is -0.7%. The low yield means that TIPS are a very expensive inflation hedge going forward (investors bear negative returns in non-inflationary times).

Real assets

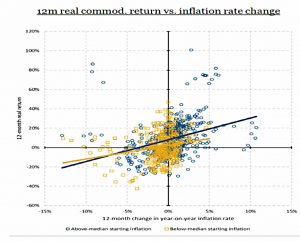

All commodities have positive annualized real returns during inflationary regimes.

They also perform better under inflation than in its absence.

- Energies do best, followed by metals and then food.

The move to EV obviously threatens the performance of fossil fuels in the medium-term, but probably not right now.

- And electrification could boost some metals and rare earths.

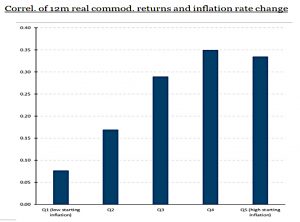

Commodities do best when the starting rate of inflation is already high.

Real Estate underperforms during inflation, but not so badly as stocks and bonds.

The paper also looked at collectables (art, wine and stamps).

Collectibles have lived up to their reputation as a store of value in inflationary times. Real annual returns are positive during inflationary episodes for all three asset groups, with art at +7%, wine at +5%, and stamps +9%.

We notice a possible distinction between art and stamps on the one hand, where performance markedly improves in inflationary periods relative to normal times, and wine, which experiences lower but more consistent returns between normal and inflationary times.

In theory, collectables look useful.

- In practice, there are lots of problems – access, illiquidity, diversification (large trade sizes), high transaction costs, high holding costs and poor tax treatments.

I keep hoping that financial innovation will deliver practical ways to invest in these areas, but it never seems to happen.

Active strategies

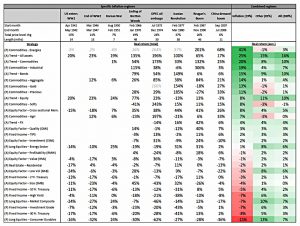

The paper looked at two flavours of active strategies, each of which I would classify as “semi-active” (since they are systematic rather than discretionary).

- These were equity factors (value etc.) and trend-following.

Factors used long-short portfolios and trading costs were estimated at 2% pa.

- Trading costs for trend strategies were assumed to be 0.8% pa.

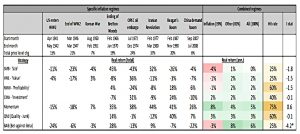

Small caps do badly under inflation.

This fits with intuition. The costs of inflation will have some economies of scale benefit to them.

The profitability and value factors are mild underperformers.

The value performance might be surprisingly weak to some, given that higher-duration growth stocks are often assumed to be adversely sensitive to unexpected inflation as discount rates increase. Value long/short is still much more inflation robust than long-only financial assets.

Momentum performs well but is sensitive to timing issues (when inflation stops and starts).

- Quality also does well, but low beta is weak.

Trend strategies perform well across all asset classes.

Conclusions

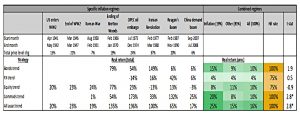

The results are pretty clear – trend and commodities do much better than stocks and bonds under inflationary regimes.

- Real estate and some stock factors are also worth considering, and so would collectables be if access to these was better.

Until next time.